Bank of Montreal 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S MESSAGE

Setting High Expectations

The Board of Directors is pleased with BMO’s results and is focused on the year ahead.

J. Robert S. Prichard

Chairman of the Board

Your bank has performed well over the past year. All of

us who are privileged to serve on the Board of Directors are

pleased with the results and confident about what can be

accomplished in the year ahead.

BMO achieved record revenue, record net income and

record earnings per share in 2013. There was an attractive

return of capital to common shareholders – over 60% of

earnings – through the combination of dividends and share

buybacks under the Normal Course Issuer Bid. And our

one-year total

shareholder return – share price appreciation

and dividends

– led the Canadian banks.

The bank’s performance reflects the dedication and

commitment of a talented and motivated team of

employees led by a strong and experienced management

group. In this regard, I want to acknowledge our CEO,

Bill Downe, for his leadership and commitment. His belief

that BMO’s success depends on the success of customers

continues to guide our strategy and is increasingly

embedded in the culture of the bank.

It’s also a pleasure to welcome Frank Techar to his new role

as Chief Operating Officer, assuming overall responsibility

for BMO’s Personal & Commercial and Wealth businesses,

as well as the bank’s retail distribution channels, in both

Canada and the United States. Strengthened operational

capability across all of our businesses is now critical to

future success in our industry as the pace of change

quickens and as regulation continues to intensify. Frank’s

appointment strengthens our capacity to develop industry-

leading, cross-group capabilities that drive customer

experience – at the right pace. Frank brings to his role an

outstanding record of achievement and deep knowledge of

our businesses and the opportunities we have to strengthen

them. Together, Bill and Frank will be a formidable team

leading the bank forward.

We will work closely with Bill and the leadership team in

a shared commitment to redefine and grow the company,

work more efficiently for customers and capitalize on

our scale in Canada, the United States and select markets

worldwide. As we look forward to the year ahead, our

focus will be on execution and performance as we take

advantage of our strong businesses and platforms to

deliver

another year of superior returns.

As your representatives, we will continue to strengthen

our board and the way it works, and we will continue

to work with management in a shared effort to enhance

the diversity of the organization at all levels. The board is

performing well, and I thank my fellow directors for their

many valued contributions to our progress.

Thank you for your confidence in our company during the

past year. I hope you will continue to stand with BMO as

we

enter a new year of achievement

.

J. Robert S. Prichard

CHIEF EXECUTIVE OFFICER’S MESSAGE

Expecting Change

The new climate of heightened expectations is redefining incremental change.

In banking, the impact promises to be dramatic, even disruptive – and, for those

who are ready to take full advantage, highly rewarding.

6 BMO Financial Group 196th Annual Report 2013

William A. Downe

Chief Executive Officer, BMO Financial Group

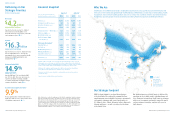

In the fiscal year just completed, BMO Financial Group

posted record net income of $4.2 billion and increased

retained earnings by just under $1.7 billion. We paid

common share dividends of $1.9 billion and repurchased

$675 million of common stock, effectively returning over

60% of earnings to shareholders. And we contributed

$1.7 billion in government levies and taxes.

We completed the final, most significant elements of

the conversion and integration of our 2011 acquisition

of Marshall & Ilsley, capturing cumulative annual run-rate

expense savings approaching $400 million. And we

positioned the bank for future growth in our four core

customer segments: personal banking, commercial banking,

capital markets and wealth management.

Most importantly, we made significant changes in the

leadership structure of the bank to reduce layers of

management and increase the proportion of our workforce

in customer-facing roles. On November 1, 2013, most

senior leaders in Canadian Personal and Commercial

Banking assumed new roles designed to erase old

boundaries and build customer loyalty. Our personal,

commercial and wealth businesses throughout North

America are now united under the leadership of Chief

Operating Officer Frank Techar, who is overseeing a

tightening of operating discipline and the acceleration

of key priorities across the bank.

More broadly, we have initiated longer-term measures

to increase our responsiveness to evolving customer

behaviour in a world where digital media and electronic

commerce compel all companies to respond. The ways that

customers are purchasing and consuming our products

and services are undergoing profound change. It’s

something all of us at BMO identify with – and we’re

investing in capabilities that recognize this shift.

All four operating businesses are moving into 2014 with

clear momentum and a great deal of confidence in our

continued strong performance. We’re well positioned not

only to meet expectations, but to anticipate and surpass

them – which is why we’ve made this the central theme of

our 196th annual report, a comprehensive review of the

past year’s achievements and the decisive steps we’ve

taken to advance BMO’s long-term strategy.

The world is far different from the one we faced a decade

ago. What people expect from a bank – from any business –

is rapidly changing. As customers increasingly rely on mobile

We work every day to help our customers have confidence in their

financial decisions.

BMO Financial Group 196th Annual Report 2013 7