Audiovox 1997 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

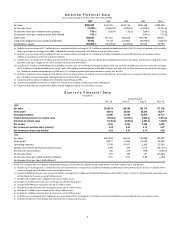

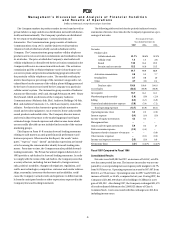

Our balance sheet is stronger than it has ever been.

Financial highlights of the year include a 6.9% increase in net sales

over last year and a drop in accounts receivable days on hand from 71

in 1996 to 59 in 1997. Cash collections were up 13.2% over 1996 and

working capital has increased 13.3% from last year.

In Ja nu a ry 1997, we completed an exc hange of $21.5 million of

Audiovox subordinated debentures for 2,860,925 shares of Class A

Common Stock. This was in addition to the exchange made in late fis-

cal 1996. The combined exchanges will save the Company $3.9 million

in annual interest expense. Stockholders’ equity has increased $56.4

million from November 30, 1996.

An Interview with Charles M. Stoehr,

Senior Vice President and Chief Financial Officer

audiovox corporation

Q U E S T I O N :

1997 saw significant changes to the Company’s balance sheet.

Can you elaborate?

A N S W E R :

The liquidity provided by the 865,000

shares of CellStar common stock that

the Company still holds will be reserved

for future strategic planning initiatives.

In fiscal 1997, the Comp a ny sold

1,835,000 sha res of its holdings of

CellStar common stock for net cash pro-

ceeds of $45.9 million and a net gain of $23.2 million.

Q U E S T I O N :

What is the Company’s position on CellStar shares?

A N S W E R :

We just completed the successful installation of a

new system that will resolve the year 2000 issue and give the Company

global MIS control. With this system, we can transmit and process

data from any of our worldwide locations and translate the local lan-

guage. The system will also give us fulfillment capability that provides

for advanced inventory management from the time we receive prod-

uct from our suppliers to the time we ship to our customers. We expect

to use the fulfillment capability extensively in our wireless subsidiary.

Q U E S T I O N :

Can you outline the changes the Company is making to its

Management Information Systems?

A N S W E R :

I believe that we are on solid ground

and well positioned for growth. The

bond conversion, sale of CellStar shares

and earnings results give us the balance

sheet strength to position the Company

to support future strategic growth ini-

t i at i v es in both of our ma rk et i n g

g ro up s. Both our Com mu n ic at i ons and Automot i ve gro ups wi l l

require capital as they develop the new technologies necessary to

expand in their respective markets.

Q U E S T I O N :

Overall how do you see the Company’s financial position?

A N S W E R :

Net Sales

($ in millions)

Stockholders’ Equity

($ in millions)

Net Income (Loss)

From Operations

($ in millions)

8