Audiovox 1997 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

During the fourth quarter of 1996, the Company exchanged

$41,252 of its 6 1/4% subordinated debentures for 6,806,580 shares of

Class A Common Stock. This exchange resulted in a charge to earn-

ings of approximately $26,318 before income taxes. This charge

includes the loss on the exchange and the write-off of the remaining

debt issuance costs associated with the original issue of the deben-

tures.

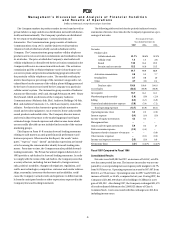

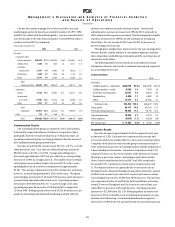

Liquidity and Capital Resources

The Company’s cash position at November 30, 1997 was approxi-

mately $2,905 below the November 30, 1996 level. Operating activi-

ties used approximately $36,899, primarily from increases in inven-

tory and prepaid expenses and other assets, and a decrease in

accounts payable, accrued expenses and other current liabilities.

These events were partially offset by a decrease in accounts receiv-

able and an increase in income taxes payable. Investing activities

provided approximately $37,695, composed primarily of $45,937

from the sale of investment securities, partially offset by the purchase

of property, plant and equipment of $3,986 and purchase of equity

investments of $4,706. Financing activities used approximately

$3,458, principally from the repayment of borrowings under line of

credit agreements.

On February 9, 1996, the Company’s 10.8% Series AA and 11.0%

Series BB Convertible Debentures matured. The Company paid

$4,362 to holders on that date.The remaining $1,100 was converted

into 206,046 shares of Common Stock. On November 25, 1996, the

Company concluded an exchange of $41,252 of its 6 1/4% subordi-

nated debentures for 6,806,580 shares of the Company’s Class A

Common Stock. Accounting charges to earnings for this transaction

were $29,206, including income taxes on the gain of the exchange of

the bonds. As a result of the exchange, stockholders’ equity was

increased by $34,426.

On October 1, 1996, business formally conducted by the

Company’s cellular division was continued in a newly-formed, whol-

ly-owned subsidiary called Audiovox Communications Corp.

Capitalization of this company was accomplished by exchanging the

assets of the former division, less their respective liabilities, for all of

the common stock.

On May 5, 1995, the Company entered into the Second Amended

and Restated Credit Agreement (the Credit Agreement) which super-

seded the first amendment in its entirety. During 1997 and 1996, the

Credit Agreement was amended ten times providing for various

changes to the terms. The terms as of November 30, 1997 are sum-

marized below.

Under the Credit Agreement, the Company may obtain credit

through direct borrowings and letters of credit. The obligations of the

Company under the Credit Agreement continue to be guaranteed by

certain of the Company’s subsidiar ies and are secured by accounts

receivable and inventory of the Company and those subsidiaries.

The obligations were secured at November 30, 1996 by a pledge

agreement entered into by the Company for 2,125,000 shares of

CellStar Common Stock and 100 shares of ACC. Subsequent to

November 30, 1996, the shares of CellStar Common Stock were

released from the Pledge Agreement. Availability of credit under the

Credit Agreement is a maximum aggregate amount of $95,000, sub-

ject to certain conditions, and is based upon a formula taking into

account the amount and quality of its accounts receivable and inven-

tory. The Credit Agreement expires on February 28, 2000.

The Credit Agreement contains several covenants requiring,

among other things, minimum levels of pre-tax income and mini-

mum levels of net worth as follows: Pre-tax income of $4,000 per

annum; pre-tax income of $1,500 for the two consecutive fiscal quar-

ters ending May 31, 1997, 1998 and 1999; pre-tax income of $2,500 for

the two consecutive fiscal quarters ending November 30, 1997, 1998

and 1999; the Company cannot have pre-tax losses of more than

$1,000 in any quarter; and the Company cannot have pre-tax losses

in any two consecutive quarters. In addition, the Company must

maintain a minimum level of total net worth of $170,000. The Credit

Agreement provides for adjustments to the covenants in the event of

certain specified non-operating transaction. Additionally, the agree-

ment includes restrictions and limitations on payments of dividends,

stock repurchases and capital expenditures. During 1997, the

Company received amendments and waivers to allow the Company

to make stock repurchases and enter into the equity collar.

Subsequent to year end, the Company received a waiver which

allowed for the delay in issuance of its financial statements.

The Company granted to an investor in CellStar, in connection

with the CellStar initial public offering, two options to purchase up to

an aggregate of 1,750,000 shares of CellStar Common Stock owned by

the Company, 1,500,000 of which was exercised in full on June 1, 1995

at an exercise price of $11.50 per share. As a result, the Company

recorded a gain, before provision for income taxes, of $8,435. This

reduced the Company’s ownership in CellStar below 20% and, as

such, the Company will no longer account for CellStar under the

equity method of accounting. Subsequent to November 30, 1996, the

remaining 250,000 shares under the remaining option expired. The

remaining 2,375,000 CellStar shares owned by the Company will be

accounted for as an investment in marketable equity securities.

During 1997, the Company sold 1,835,000 shares of its CellStar shares

for a gain of $23,232, net of income tax. The Company continues to

hold 865,000 shares of CellStar common stock. Based upon the clos-

ing market price of CellStar on November 30, 1997, the unrealized

gain in equity is $12,194, net of deferred taxes.

The Company believes that it has sufficient liquidity to satisfy its

anticipated working capital and capital expenditure needs through

November 30, 1998 and for the reasonable foreseeable future.