Audiovox 1997 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

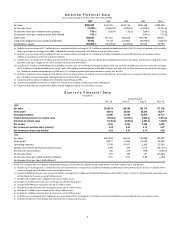

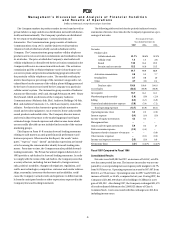

The net sales and percentage of net sales by product line and

marketing group for the fiscal years ended November 30, 1997, 1996

and 1995 are reflected in the following table. Certain reclassifications

have been made to the data for periods prior to fiscal 1996 in order to

conform to fiscal 1997 presentation.

Years Ended November 30,

1997

1996 1995

Net sales:

Communications

Cellular wholesale

$390,230 61.1%

$350,299 58.6% $261,997 52.3%

Cellular retail

6,280 1.0

7,665 1.3 14,177 2.8

Activation

commissions

31,061 4.9

33,102 5.5 38,526 7.7

Residual fees

4,688 0.7

4,828 0.8 4,781 1.0

Other

12,141 1.9

12,785 2.1 11,293 2.3

Total

Communications

444,400 69.5

408,679 68.4 330,774 66.1

Automotive

Sound

91,763 14.4

98,303 16.4 101,757 20.3

Security and

accessories

97,446 15.2

87,234 14.6 67,560 13.5

Other

4,701 0.7

2,879 0.5 649 0.1

Total

Automotive

193,910 30.3

188,416 31.5 169,966 33.9

Other

772 0.1

820 0.1 – –

Total

$639,082 100.0%

$597,915 100.0% $500,740 100.0%

Communication Results

The Communications group is composed of ACC and Quintex,

both wholly-owned subsidiaries of Audiovox Corporation. Since

principally all of the net sales of Quintex are cellular in nature, all

operating results of Quintex are being included in the discussion of

the Communications group’s product line.

Net sales were $444,400, an increase of $35,721, or 8.7%, over the

same period last year. Unit sales of cellular telephones increased

892,000 units, or 43.2%, over 1996. Average unit selling prices

decreased approximately 21.2% but were offset by a corresponding

decrease of 22.9% in average unit cost. The number of new cellular

subscriptions processed by Quintex decreased 9.1%, with a corre-

sponding decrease in activation commissions of approximately

$2,041. The average commission received by Quintex per activation,

however, increased approximately 3.2% from last year. Unit gross

profit margins increased to 11.1% from 9.0% last year, primarily due to

increased unit sales and reduced unit costs. Operating expenses

decreased to $49,582 from $50,710. As a percentage of net sales,

operating expenses decreased to 11.2% during 1997 compared to

12.4% in 1996. Selling expenses decreased $3,203 from last year, pri-

marily in advertising and divisional marketing, partially offset by

increases in commissions and salesmen salaries. General and

administrative expenses increased over 1996 by $572, primarily in

office salaries and temporary personnel. Warehousing and assembly

expenses increased over 1996 by $1,503, primarily in tooling and

direct labor. Pre-tax income for 1997 was $11,582, an increase of

$8,476 compared to last year.

Though gross margins have improved over last year, management

believes that the cellular industry is extremely competitive and that

this competition could affect gross margins and the carrying value of

inventories in the future.

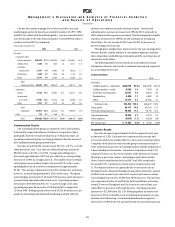

The following table sets forth for the periods indicated certain

statements of income data for the Communications group expressed

as a percentage of net sales:

Communications

1997

1996

Net sales:

Cellular product - wholesale

$390,230 87.8%

$350,299 85.7%

Cellular product - retail

6,280 1.4

7,665 1.9

Activation commissions

31,061 7.0

33,102 8.1

Residual fees

4,688 1.1

4,828 1.2

Other

12,141 2.7

12,785 3.1

Total net sales

444,400 100.0

408,679 100.0

Gross profit

66,117 14.9

60,245 14.7

Total operating expenses

49,582 11.2

50,710 12.4

Operating income

16,535 3.7

9,535 2.3

Other expense

(4,953) (1.1)

(6,429) (1.6)

Pre-tax income

$ 11,582 2.6%

$ 3,106 0.8%

Automotive Results

Net sales increased approximately $5,494 compared to last year,

an increase of 2.9%. Increases were experienced in security and

accessories and were partially offset by a decrease in sound products.

A majority of the increase was from the group’s international opera-

tions, both from an increase in existing business and the formation of

a new subsidiary in Venezuela. Automotive sound decreased 6.7%

compared to last year, due to the transfer of the Heavy Duty Sound

division to a new joint venture. Excluding sound sales from the

Heavy Duty Sound division for fiscal 1997 and 1996, sound sales

decreased 0.6%. Automotive security and accessories increased

11.7% compared to last year, primarily due to increased sales in

Prestige Security, Protector Hardgoods and alarms and video, partial-

ly offset by decreases in net sales of AA security and cruise controls.

Gross margins increased to 20.8% from 18.9% last year. This increase

was experienced in the AV and Private Label sound lines and cruise

control, Protector Hardgoods and AA security accessory lines, par-

tially offset by decreases in Prestige Security. Operating expenses

increased to $27,989 from $25,559. Selling expenses increased over

last year by $1,151, primarily in our international operations, in com-

missions and advertising. General and administrative expenses

increased over 1996 by $1,512, primarily from our international opera-

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s o f F i n a n c i a l C o n d i t i o n

a n d R e s u l t s o f O p e r a t i o n s

(continued)

10