Audiovox 1997 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and transportable cellular telephones is reflective of a desire by con-

sumers for increased flexibility in their use of cellular telephones.

Toward that end, the Company markets an accessory package that

permits its Minivox™ and Minivox Lite® hand-held cellular tele-

phones to be used in an automobile on a hands-free basis and to

draw power from the automobile’s electrical system like an installed

mobile cellular telephone.

Activation commissions decreased by approximately $5,424, or

14.1%, for fiscal 1996 compared to fiscal 1995. This decrease was pri-

marily attributable to fewer new cellular subscriber activations and

partially due to fewer retail outlets operated by the Company. The

number of activation commissions decreased 21.4% compared to fis-

cal 1995. This decrease in commission revenue was offset by a 9.3%

increase in average activation commissions paid to the Company.

Residual revenues on customer usage increased by approximately

$47, or 1.0%, for fiscal 1996, compared to fiscal 1995, due primarily to

the addition of new subscribers to the Company’s cumulative sub-

scriber base, despite a decrease in current year activations. A majori-

ty of the residual income resides with the remaining operating retail

locations.

Net sales of automotive sound equipment decreased by approxi-

mately $2,708, or 2.5%, for fiscal 1996, compared to fiscal 1995. This

decrease was attributable primarily to a decrease in sales of products

sold to mass merchandise chains and auto sound sales to new car

dealers. This decrease was partially offset by increases in sales of

sound products to private label customers. Net sales of automotive

security and accessory products increased approximately $20,418, or

27.9%, for fiscal 1996, compared to fiscal 1995, principally due to

increases in sales of vehicle security products, Protector Hardgoods

and cruise controls. This increase was partially offset by a reduction

in net sales of AA security products.

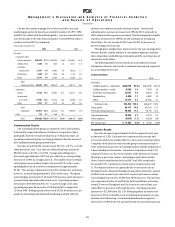

Gross margins increased to 16.1% in fiscal 1996 from 14.1% in fiscal

1995. The 1995 gross margin included a $9,300 charge for inventory

written down to market at August 31, 1995. Cellular gross margins

were 13.2% compared to 9.8% in 1995. Despite a 23.7% decrease in

average unit selling prices, the average gross margin per unit

increased 25.3%. The number of new subscriber activations

decreased 21.4% but was partially offset by a 9.3% increase in average

activation commissions earned by the Company. Residuals increased

1.0% compared to 1995. The Company believes that the cellular mar-

ket will continue to be a highly-competitive and price-sensitive envi-

ronment. Increased price competition related to the Company’s

product could result in downward pressure on the Company’s gross

margins if the Company is unable to obtain competitively priced

product from its suppliers or result in adjustments to the carrying

value of the Company’s inventory.

Automotive sound margins were 19.9%, up from 17.5% in 1995.

Most product lines in the category experienced an increase and there

was a marked increase in the gross margin on international sales.

Automotive accessory margins decreased from 27.9% in 1995 to

24.5% in 1996. This decrease was primarily in the Prestige and cruise

control lines.

Total operating expenses increased approximately $2,837, or

3.5%, compared to 1995. As a percentage to sales, total operating

expenses decreased to 13.9% during 1996 compared to 16.1% for 1995.

Selling expenses increased approximately $5,544, or 16.1%, compared

to 1995. Divisional marketing and advertising increased approximate-

ly $8,256 compared to 1995 in addition to travel and related expenses.

These increases were partially offset by decreases in salesmen’s com-

missions, salesmen’s salaries, payroll taxes and employee benefits.

General and administrative expenses decreased approximately

$3,708 during 1996. The decreases were in occupancy costs, tele-

phone and overseas buying office expenses and were partially offset

by increases in office salaries, travel, payroll taxes, employee benefits

and professional fees.Warehousing, assembly and repair expenses

increased approximately $1,001 compared to1995, predominately in

warehousing expenses and direct labor.

Management fees and related income and equity in income from

joint venture investments increased by approximately $463 for 1996

compared to 1995 as detailed in the following table:

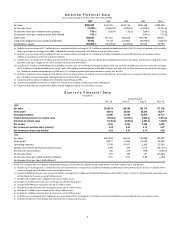

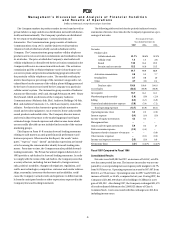

1996 1995

Equity Equity

Management Income Management Income

Fees (Loss) Total Fees (Loss) Total

CellStar – – – – $ 2,151 $ 2,151

ASMC – $ 948 $ 948 – 819 819

G.L.M. $100 – 100 $ 14 – 14

Pacific 22 (334) (312) 186 21 207

TALK – – – – (2,837) (2,837)

Quintex West 18 – 18 – – –

Posse 46 17 63 – – –

$186 $ 631 $ 817 $200 $ 154 $ 354

This increase was primarily due to non-recurring costs recorded

by TALK during 1995, their first full year of operations. This was offset

by the Company owning less than 20% of CellStar for the entire fiscal

year and, therefore, not accounting for the investment on the equity

method. During 1995, the Company owned more than 20% of

CellStar until the third quarter and, therefore, accounted for CellStar

under the equity method until then. Audiovox Pacific has experi-

enced an overall decline in gross margins, as the cellular market in

Australia has experienced the same competitive factors as those in

the United States.

Interest expense and bank charges decreased by $1,214, or 12.5%,

compared to 1995 as a result of a decrease in interest bearing debt.

Other expenses decreased approximately $412 primarily due to the

write-off of fixed assets in the retail group during 1995 which did not

recur in 1996. Costs associated with the issuance of stock warrants for

no monetary consideration to certain holders of the Company’s con-

vertible subordinated debentures also did not recur in 1996.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s o f F i n a n c i a l C o n d i t i o n

a n d R e s u l t s o f O p e r a t i o n s

(continued)

12