Audiovox 1997 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

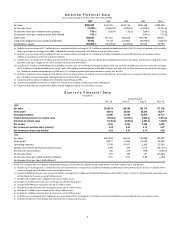

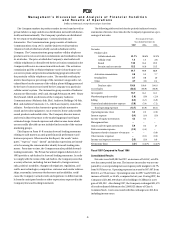

Quarter Ended

Feb. 28 May 31 Aug. 31 Nov. 30

1997

Net sales $166,614 148,195 153,124

171,149

Gross profit 28,002 25,055 25,634 28,071

Operating expenses 23,486 21,243 20,606 21,732

Income before provision for income taxes 15,328 (a) 14,032 (c) 5,565 (e) 8,517(g)

Provision for income taxes 11,125 (b) 5,678 (d) 2,467 (f) 3,150(h)

Net income 4,203 8,354 3,098 5,367

Net income per common share (primary) 0.24 0.43 0.16 0.27

Net income per share (fully diluted) 0.23 0.42 0.16 0.26

1996

Net sales $122,493 141,194 142,828 191,400

Gross profit 19,877 21,586 24,639 30,286

Operating expenses 17,519 19,347 2,091 25,536

Income (loss) before provision for income taxes 1,091 426 1,575 (23,727)(i)

Provision for income taxes 612 276 808 4,138 (j)

Net income (loss) 479 150 767 (27,865)

Net income (loss) per common share (primary) 0.05 0.02 0.08 (2.83)

Net income (loss) per share (fully diluted) – – – –

NOTE: The Company does not compute fully diluted earnings per share when the addition of potentially dilutive securities would result in anti-dilution.

(a) Includes a pre-tax charge of $12.7 million for costs associated with the exchange of $21.5 million of subordinated debentures into 2,860,925 shares of Class A Common Stock

and a pre-tax gain of $23.8 million on the sale of CellStar shares.

(b) Includes $158,000 for income taxes associated with the exchange of $21.5 million of subordinated debentures into 2,860,925 shares of Class A Common Stock and income taxes

of $9.0 million for the gain on sale of CellStar shares.

(c) Includes $10.2 million of pre-tax gain on the sale of CellStar shares.

(d) Includes $3.9 million of income taxes on the gain on sale of CellStar shares

(e) Includes $303,000 of pre-tax gain on the sale of CellStar shares

(f) Includes $115,000 of income taxes on the gain on the sale of CellStar shares

(g) Includes $3.2 million of pre-tax gain on the sale of CellStar shares

(h) Includes $1.2 million of income taxes on the gain on sale of CellStar shares

(i) Includes a pre-tax charge of $26.3 million for costs associated with the exchange of $41.3 million of subordinated debentures into 6,806,580 shares of common stock.

(j) Includes tax expense of $2.9 million associated with the exchange of debentures.

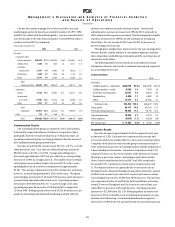

1997

1996 1995 1994 1993

Net sales

$639,082

$597,915 $500,740 $486,448 $389,038

Net income (loss)

21,022

(a) (26,469)(b) (11,883)(c) 26,028(e) 12,224(g)

Net income (loss) per common share, primary

1.09

(a) (2.82)(b) (1.31)(c) 2.86(e) 1.35(g)

Net income (loss) per common share, fully diluted

1.05

(a) – – 2.20(e) 1.25(g)

Total assets

289,827

265,545 308,428 239,098 169,671

Long-term obligations, less current installments

38,996

70,413 142,802 110,698 (f) 13,610(h)

Stockholders’ equity

187,892

(d) 131,499(d) 114,595(d) 92,034 65,793

(a) Includes a pre-tax charge of $12.7 million for costs associated with the exchange of $21.5 million of subordinated debentures into 2,860,925 shares of common stock in additio

to tax expense on the exchange of $158,000. Additionally, includes a net gain of $23.2 million on sale of CellStar shares.

(b) Includes a pre-tax charge of $26.3 million for costs associated with the exchange of $41.3 million of subordinated debentures into 6,806,580 shares of common stock in

addition to tax expense on the exchange of $2.9 million.

(c) Includes a pre-tax charge of $2.9 million associated with the issuance of warrants, a pre-tax charge of $11.8 million for inventory write-downs and the down-sizing of the retail

operations and a pre-tax gain on the sale of an equity investment of $8.4 million.

(d) Includes a $12.2 million unrealized gain on marketable securities, net, a $773,000 unrealized gain on equity collar, net, and a $20.8 million increase as a result of the exchange

of $21.5 million of subordinated debentures in 1997 and a $10.3 million unrealized gain on marketable securities, net, and a $34.4 million increase as a result of the exchange o

$41.3 million of subordinated debentures in 1996 and a $31.7 million unrealized gain on marketable securities, net, for 1995.

(e) Includes a cumulative effect change of ($178,000) or ($0.02) per share, primary, and ($0.01) per share, fully diluted. Also includes a pre-tax gain on sale of an equity investmen

of $27.8 million and a gain on public offering of equity investment of $10.6 million.

(f) Long-term debt includes the addition of a $65 million bond offering in 1994.

(g) Includes an extraordinary item of $2.2 million or $0.24 per share, primary, and $0.22 per share, fully diluted.

(h) Long-term debt does not include $38.8 million of bank obligations which were classified as current.

S e l e c t e d F i n a n c i a l D a t a

Years ended November 30, 1997, 1996, 1995, 1994 and 1993

Q u a r t e r l y F i n a n c i a l D a t a

(unaudited)

2