Audiovox 1997 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Impact of Inflation and Currency Fluctuation

Inflation has not had and is not expected to have a significant

impact on the Company’s financial position or operating results.

However, as the Company expands its operations into Latin America

and the Pacific Rim, the effects of inflation and currency fluctuations

in those areas, if any, could have growing significance to the financial

condition and results of the operations of the Company.

The Company has operations and conducts local business in Asia.

The recent fluctuations in the foreign exchange rates have not materi-

ally impacted the consolidated financial position, results of opera-

tions or liquidity. Management believes that continued fluctuations

will not have a material adverse effect on the Company’s consolidated

financial position, however the impact on the results of operations or

liquidity, particularly our Malaysian subsidiaries, is unknown.

While the prices that the Company pays for the products pur-

chased from its suppliers are principally denominated in United

States dollars, price negotiations depend in part on the relationship

between the foreign currency of the foreign manufacturers and the

United States dollar. This relationship is dependent upon, among

other things, market, trade and political factors.

Seasonality

The Company typically experiences some seasonality.The

Company believes such seasonality could be attributable to increased

demand for its products during the Christmas season, which com-

mences in October, for both wholesale and retail operations.

Year 2000 Date Conversion

Management believes that a significant portion of its computer

systems are year 2000 compliant and is in the process of assessing the

balance of its systems. The Company intends to communicate with

its customers, suppliers, financial institutions and others with which

it does business to ensure that any year 2000 issue will be resolved

timely. This issue affects computer systems that have time-sensitive

programs that may not properly recognize the year 2000. If neces-

sary modifications and conversions by those with which the

Company does business are not completed timely or if all of the

Company’s systems are not year 2000 compliant, the year 2000 issue

may have a material adverse effect on the Company’s consolidated

financial position, results of operations or liquidity.

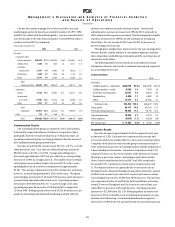

Recent Accounting Pronouncements

The Financial Accounting Standards Board (FASB) has issued

Statement No. 128, “Earnings per Share” (Statement 128), on

December 1, 1997. Under Statement 128, the Company is required to

report basic and diluted earnings per share. It will replace the pre-

sentation of both primary and fully diluted earnings per share.

Statement 128 requires restatement of all prior-period earnings per

share data. The provisions of Statement 128 are effective for financial

statements issued for periods ending after December 15, 1997, includ-

ing interim periods, and earlier application is not permitted. The

provisions of Statement 128 must be implemented no later than fiscal

1998. The Company believes that Statement 128 will not have an

impact on the Company’s financial position, results of operations, or

liquidity, however, the impact on previously reported earnings per

share data is currently unknown.

In June 1997, the FASB issued Statement No. 130, “Reporting

Comprehensive Income”, effective for fiscal years beginning after

December 15, 1997. This Statement requires that all items that are

required to be recognized under accounting standards as compo-

nents of comprehensive income be reported in a financial statement

that is displayed with the same prominence as other financial state-

ments. This Statement further requires that an entity display an

amount representing total comprehensive income for the period in

that financial statement. This Statement also requires that an entity

classify items of other comprehensive income by their nature in a

financial statement. For example, other comprehensive income may

include foreign currency items and unrealized gains and losses on

investments in equity securities. Reclassification of financial state-

ments for earlier periods, provided for comparative purposes, is

required. Based on current accounting standards, this Statement is

not expected to have a material impact on the Company’s consolidat-

ed financial statements. The Company will adopt this accounting

standard effective December 1, 1999, as required.

In June 1997, the FASB issued Statement 131, “Disclosures about

Segments of an Enterprise and Related Information”, effective for fis-

cal years beginning after December 15, 1997. This Statement estab-

lishes standards for reporting information about operating segments

in annual financial statements and requires selected information

about operating segments in interim financial reports issued to

shareholders. It also establishes standards for related disclosures

about products and services, geographic areas and major customers.

Operating segments are defined as components of an enterprise

about which separate financial information is available that is evalu-

ated regularly by the chief operating decision maker in deciding how

to allocate resources and in assessing performance. This Statement

requires reporting segment profit or loss, certain specific revenue and

expense items and segment assets. It also requires reconciliations of

total segment revenues, total segment profit or loss, total segment

assets, and other amounts disclosed for segments to corresponding

amounts reported in the consolidated financial statements.

Restatement of comparative information for earlier periods presented

is required in the initial year of application. Interim information is

not required until the second year of application, at which time com-

parative information is required. The Company has not determined

the impact that the adoption of this new accounting standard will

have on its consolidated financial statements disclosures. The

Company will adopt this accounting standard effective December 1,

1999, as required.

M a n a g e m e n t ’ s D i s c u s s i o n a n d A n a l y s i s o f F i n a n c i a l C o n d i t i o n

a n d R e s u l t s o f O p e r a t i o n s

(continued)

14