Audiovox 1997 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tions, in occupancy, office expenses and bad debt expense.

Warehousing and assembly expenses decreased from 1996 by $233,

primarily from the transfer of Heavy Duty Sound business to the new

joint venture. Pre-tax income for 1997 was $8,002, an increase of

$2,303 compared to last year. Without the transfer of the Heavy Duty

Sound business, pre-tax income increased $2,796 compared to 1996.

The Company believes that the Automotive group has an expand-

ing market with a certain level of volatility related to both domestic

and international new car sales. Also, certain of its products are sub-

ject to price fluctuations which could affect the carrying value of

inventories and gross margins in the future.

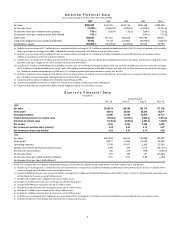

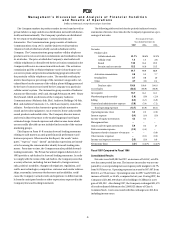

The following table sets forth for the periods indicated certain

statements of income data for the Automotive group expressed as a

percentage of net sales:

Automotive

1997

1996

Net sales:

Sound

$ 91,763 47.3%

$ 98,303 52.2%

Security and accessories

97,446 50.3

87,234 46.3

Other

4,701 2.4

2,879 1.5

Total net sales

193,910 100.0

188,416 100.0

Gross profit

40,326 20.8

35,622 18.9

Total operating expenses

27,989 14.4

25,559 13.6

Operating income

12,337 6.4

10,063 5.3

Other expense

(4,335) (2.2)

(4,364) (2.3)

Pre-tax income

$ 8,002 4.1%

$ 5,699 3.0%

Other Income and Expense

Interest expense and bank charges decreased by $5,938 for 1997

compared to 1996. This was due to reduced interest bearing debt and

the decrease in interest bearing subordinated debentures which were

exchanged for shares of common stock.

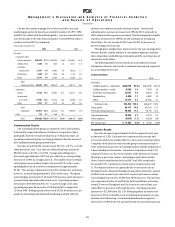

Management fees and equity in income from joint venture invest-

ments increased by approximately $651 for 1997 compared to 1996 as

detailed in the following table:

1997 1996

Equity

Equity

Management Income

Management Income

Fees (Loss) Total

Fees (Loss) Total

ASA

– $1,857 $1,857

– – –

ASMC

– – –

– $ 948 $ 948

G.L.M.

$ 12 – 12

$100 – 100

Pacific

– (685) (685)

22 (334) (312)

Quintex West

– – –

18 – 18

Posse

97 187 284

46 17 63

$109 $1,359 $1,468

$186 $ 631 $ 817

Audiovox Pacific has experienced an overall decline in gross mar-

gins, as the cellular market in Australia has experienced the same

competitive factors as those in the United States.

During January 1997, the Company completed an exchange of

$21,479 of its subordinated debentures for 2,860,925 shares of Class A

Common Stock (Exchange). As a result of the Exchange, a charge of

$12,686 was recorded. The charge to earnings represents (i) the dif-

ference in the fair market value of the shares issued in the Exchange

and the fair market value of the shares that would have been issued

under the terms of the original conversion feature plus (ii) a write-off

of the debt issuance costs associated with the subordinated deben-

tures plus (iii) expenses associated with the Exchange offer. The

Exchange resulted in taxable income due to the difference in the face

value of the bonds converted and the fair market value of the shares

issued and, as such, a current tax expense of $158 was recorded. An

increase in paid in capital was reflected for the face value of the

bonds converted, plus the difference in the fair market value of the

shares issued in the Exchange and the fair market value of the shares

that would have been issued under the terms of the original conver-

sion feature for a total of $33,592.

During 1997, the Company sold a total of 1,835,000 shares of

CellStar for net proceeds of $45,937 and a net gain of $23,232.

Provision for Income Taxes

Income taxes are provided for at a blended federal and state rate

of 41% for profits from normal business operations. During 1997, the

Company had several non-operating events which had tax provisions

calculated at specific rates, determined by the nature of the transac-

tion. The tax treatment for the debt conversion expense of $12,686,

which lowered income before provision for income taxes, did not

reduce taxable income as it is a non-deductible item. Instead of

recording a tax recovery of $5,201, which would lower the provision

for income taxes, the Company actually recorded a tax expense of

$158. This and other various tax treatments resulted in an effective

tax rate of 51.6% for 1997.

Fiscal 1996 Compared to Fiscal 1995

Net sales increased by approximately $97,175, or 19.4% for fiscal

1996, compared to fiscal 1995. This result was primarily attributable

to increases in net sales from the cellular division of approximately

$76,413, or 23.9%, automotive security and accessory equipment of

approximately $20,418, or 27.9% and other products, primarily home

stereo systems of $3,052. These increases were partially offset by a

decrease in automotive sound equipment of approximately $2,708, or

2.5%.

The improvement in net sales of cellular telephone products was

primarily attributable to an increase in unit sales. Net sales of cellular

products increased by approximately 857,000 units, or 70.9%, com-

pared to fiscal 1995, primarily resulting from an increase in sales of

hand-held portable cellular telephones and transportable cellular

telephones, partially offset by a decline in sales of installed mobile

cellular telephones. The average unit selling price declined approxi-

mately 23.7% vs. 1995 as production efficiencies and market compe-

tition continues to reduce unit selling prices. The Company believes

that the shift from installed mobile cellular telephones to hand-held

11