American Home Shield 2015 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2015 American Home Shield annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 Adjusted EBITDA means net income (loss) before: income (loss) from

discontinued operations, net of income taxes; provision (benet) for income

taxes; loss on extinguishment of debt; interest expense; depreciation

and amortization expense; 401(k) Plan corrective contribution; non-cash

impairment of software and other related costs; non-cash impairment of

property and equipment; non-cash stock based compensation expense;

restructuring charges; gain on sale of Merry Maids branches; management

and consulting fees; consulting agreement termination fees; and other non-

operating expenses. For a reconciliation of Adjusted EBITDA to net income

(loss), see “Item 6. Selected Financial Data” in our Annual Report on Form

10-K included in this annual report to stockholders.

2 Adjusted EBITDA margin means Adjusted EBITDA as a percentage of revenue.

3 Adjusted Net Income means income from continuing operations before:

amortization expense; 401(k) Plan corrective contribution; impairment of

software and other related costs; consulting agreement termination fees;

restructuring charges; gain on sale of Merry Maids branches; management

and consulting fees; loss on extinguishment of debt; other expense; and

the tax impact of all the aforementioned adjustments. For a reconciliation

of Adjusted Net Income to income from continuing operations, see page 16.

4 Based on Adjusted Net Income and weighted average diluted shares

outstanding of 136.6 million in 2015 and 113.8 million in 2014.

5 Free Cash Flow means (i) net cash provided from operating activities from

continuing operations before: call premium paid on retirement of debt;

premium received on issuance of debt; cash paid for consulting agreement

termination fees; and excess tax benets from stock-based compensation;

(ii) less property additions. For a reconciliation of net cash provided from

operating activities from continuing operations to Free Cash Flow, see “Item

6. Selected Financial Data” in our Annual Report on Form 10-K included in

this annual report to stockholders.

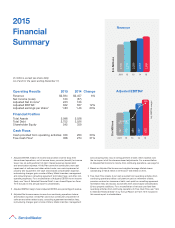

Operating Results 2015 2014 Change

Revenue $2,594 $2,457 6%

Net Income (Loss) 160 (57)

Adjusted Net Income3 245 166

Adjusted EBITDA1 622 557 12%

Adjusted earnings per share4 1.80 1.46 23%

Financial Position

Total Assets 5,098 5,028

Total Debt 2,752 3,026

Shareholder Equity 545 359

Cash Flows

Cash provided from operating activities 336 253 33%

Free Cash Flow5 358 274 31%

(In millions, except per-share data)

As of and for the years ending December 31,

2,594

2,105

151413122011

2,214

2,293

2,457

$ in Millions

Revenue

Adjusted EBITDA¹

557

622

397

413

450

19% 19%

20%

23%

24%

$ in Millions

Adj. EBITDA margin2

151413122011

2015

Financial

Summary