Aflac 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

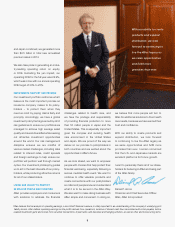

and Japan combined, we generated more

than $2.5 billion in total new annualized

premium sales in 2014.

We also take pride in generating an indus-

try-leading operating return on equity,

or ROE. Excluding the yen impact, our

operating ROE for the full year was 22.9%,

which was in line with our annual operating

ROE target of 20% to 25%.

INVESTMENTS SUPPORT OUR PROMISE

Our investment portfolio reinforces what I

believe is the most important promise an

insurance company makes to its policy-

holders – to protect them when they

need us most by paying claims fairly and

promptly. Accordingly, we have a global

investment policy that is governed by strict

risk guidelines to ensure our portfolios are

managed to achieve high average asset

quality and is well-diversified while seeking

out attractive investment opportunities

around the world. Our risk management

discipline ensures we are mindful of

various market challenges, including risks

related to interest rates, credit spreads

and foreign exchange to help ensure our

portfolio will perform well through market

cycles. Our investment philosophy guides

us to act in the best interests of our policy-

holders, while producing attractive returns

for all of our stakeholders.

LIVING OUR LEGACY TO PROTECT

50 MILLION PEOPLE AND COUNTING

Aflac provides employers and consumers

with solutions to address the financial

challenges related to health care, and

we have the privilege and responsibility

of providing financial protection to more

than 50 million people in Japan and the

United States. This is especially important

given the complex and evolving health

care environment in the United States

and Japan. We are proud of the way we

deliver on our promise to policyholders in

both countries and are excited about the

opportunities in Aflac’s future.

As we look ahead, we want to empower

people with choices that help protect their

financial well-being, especially following a

serious medical health event. We want to

continue to offer valuable products and

create connections with our policyholders

so millions of people know and understand

what it is to be served in the Aflac Way.

We also want to make doing business with

Aflac simple and convenient. In doing so,

we believe that more people will turn to

Aflac for additional solutions to their health

care needs, because we have earned their

trust and confidence.

With our ability to create products and

expand distribution, we look forward

to continuing to live the Aflac legacy as

we seize opportunities and fulfill more

promises than ever. I remain convinced

that the U.S. and Japanese markets are

excellent platforms for future growth.

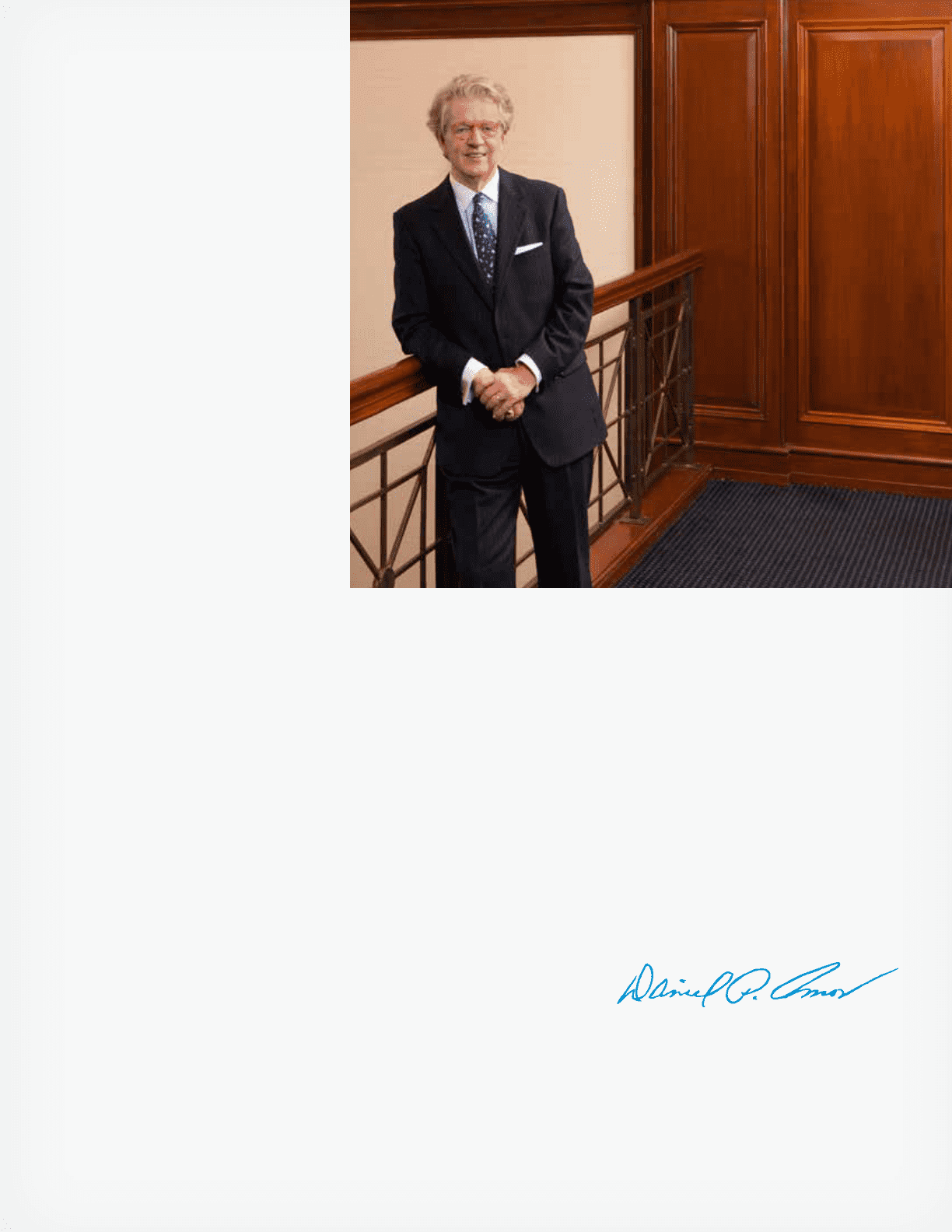

I want to personally thank all of our stake-

holders for believing in Aflac and being part

of the Aflac family.

Daniel P. Amos

Chairman and Chief Executive Officer

Aflac, Aflac Incorporated

With our ability to create

products and expand

distribution, we look

forward to continuing to

live the Aflac legacy as

we seize opportunities

and fulfill more

promises than ever.

*Aflac believes that an analysis of operating earnings, a non-GAAP financial measure, is vitally important to an understanding of the company’s underlying prof-

itability drivers. Aflac defines operating earnings as the profits derived from operations, inclusive of interest cash flows associated with notes payable, before

realized investment gains and losses from securities transactions, impairments, and derivative and hedging activities, as well as other and nonrecurring items.

5