Access America 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Mondial Assistance Annual Report 2008 35

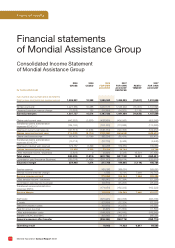

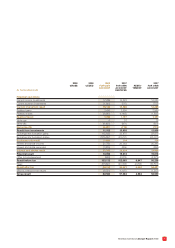

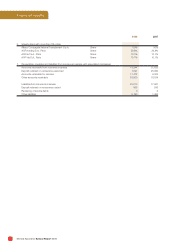

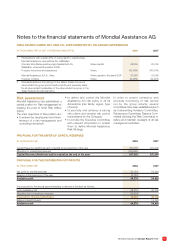

Exchange rates of principal currencies

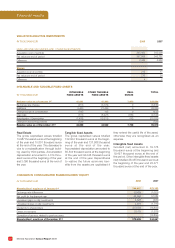

BALANCE SHEET YEAR END RATE

(AGAINST 1 EURO) 2008 2007

Australia (AUD) 2.0274 1.6757

Japan (JPY) 126.1400 164.9300

Brazil (BRL) 3.2436 2.6217

United Kingdom (GBP) 0.9525 0.7334

Switzerland (CHF) 1.485 1.6547

USA (USD) 1.3917 1.4721

INCOME STATEMENT AVERAGE RATE

(AGAINST 1 EURO) 2008 2007

Australia (AUD) 1.7432 1.6351

Japan (JPY) 152.3492 161.247

Brazil (BRL) 2.67854 2.6648

United Kingdom (GBP) 0.79705 0.6846

Switzerland (CHF) 1.58694 1.6427

USA (USD) 1.47109 1.3705

Consolidation scope

The consolidated fi nancial statements

of Mondial Assistance Group comprise

the annual accounts of Mondial

Assis tance AG and subsidiaries, which

are prepared in accordance with the

accoun ting and valuation principles of the

Mondial Assistance Group. Consoli-

dated subsidiaries are listed further in

the notes to the consolidated fi nancial

statements.

In 2008, the following companies

were founded: Neoasistencia Manot-

eras S.L. (Spain), Mondial Assistance

Sigorta Aracilik Hizmetleri Ltd Sirketi

(Turkey) and Atencion Integral a la

Dependencia S.L. (Spain). The first

two were consolidated in the Mondial

Assistance Group; whereas the last

one is a joint venture held at 50% and

is accounted for according the Equity

method.

In 2008, one Italian company Mondial

Contact Center Italia S.r.l. was acquired

and has been consolidated into Mondial

Assistance Group.

Finally, the Spanish subsidiary Mondial

Assistance Seguros y Reaseguros de

Riesgos Diversos was closed, and

replaced by a new branch: Elvia Travel

Insurance Spain.

Consolidation principles

Subsidiaries have been recorded accor-

ding to the full consolidation method

when subject to the majority control of

the Mondial Assistance Group.

All intra-group transactions and balances

have been eliminated.

Interests in joint ventures are recognised

by including the accounts using the

equity consolidation basis.

Equity investments in which the Mondial

Assistance Group owns at least 20%

of the voting rights are accounted

for using the equity method, except

for investments in which the Mondial

Assistance Group is not able to exercise

signifi cant infl uence, in which case the

cost method is used.

Participations in which the company

owns less than 20% are accounted for

under the cost method.

The equity and net income attributable

to minority shareholders’ interests are

disclosed separately in the balance sheet

and income statement respectively.

The purchase method of accounting is

used for acquired businesses, including

entities under common control of

Mondial Assistance AG’s ultimate holding

company. Companies acquired or

disposed of during the year are included

in the consolidated fi nancial statements

from the date of acquisition or to the

date of disposal respectively.

Foreign currency

translation

The Group’s reporting currency is the

euro (€). The functional currency for each

Group company is the currency of the

environment where the enterprise carries

on its activities. Assets and liabilities are

translated at the closing rate on the balance

sheet date. Expenses and income are

translated at the annual average rate from

the functional currency into the reporting

currency. Translation differences between

the functional currency and reporting

currency, including those arising in the

process of equity consolidation, are taken

to shareholders’ equity without affecting

earnings. Translation differences between

the transaction currency and functional

currency are reported in earnings.

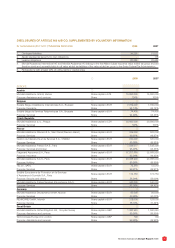

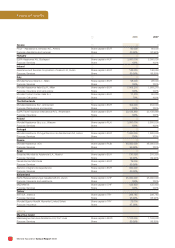

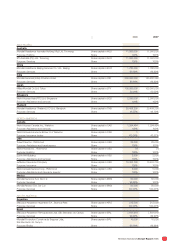

Notes to the consolidated fi nancial statements

of Mondial Assistance Group