iHeartMedia 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R

adio Networks

In addition to radio stations, our Radio Broadcasting segment includes Premiere Radio Networks, a national radio network

that produces, distributes or represents more than 90 syndicated radio programs and services for more than 5,000 radio station

affiliates. Our broad distribution platform enables us to attract and retain top programming talent. Some of our more popular radio

personalities include Rush Limbaugh, Sean Hannity, Steve Harvey, Ryan Seacrest and Glenn Beck. We believe recruiting and

retaining top talent is an important component of the success of our radio networks.

We also own various sports, news and agriculture networks serving Alabama, California, Colorado, Florida, Georgia,

Iowa, Kentucky, Missouri, Ohio, Oklahoma, Pennsylvania, Tennessee and Virginia.

I

nternational Radio Investments

We own a 50% equity interest in the Australian Radio Network, which has broadcasting operations on Australia and New

Zealand and which we account for under the equity method of accounting. We owned an equity interest in Grupo ACIR

Comunicaciones (“Grupo ACIR”), the owner of radio stations in Mexico, which we sold in 2009.

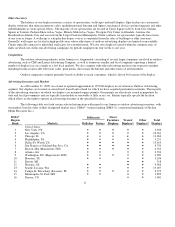

Americas Outdoor Advertising

Our Americas Outdoor Advertising segment includes our operations in the United States, Canada and Latin America, with

approximately 91% of our 2009 revenue in this segment derived from the United States. We own or operate approximately 195,000

displays in our Americas segment and have operations in 49 of the 50 largest markets in the United States, including all of the 20

largest markets. For the year ended December 31, 2009, Americas Outdoor Advertising represented 22% of our consolidated net

revenue.

Our outdoor assets consist of billboards, street furniture and transit displays, airport displays, mall displays, and wallscapes

and other spectaculars, which we own or operate under lease management agreements. Our outdoor advertising business is focused on

urban markets with dense populations.

Strategy

We believe outdoor advertising has attractive industry fundamentals, including a broad audience reach and a highly cost

effective media for advertisers as measured by cost per thousand persons reached compared to other traditional media. Our Americas

strategy focuses on our competitive strengths to position the Company through the following strategies:

Promote Overall Outdoor Media Spending. Outdoor advertising represented 3% of total dollars spent on advertising in the

United States in 2008. Our strategy is to drive growth in outdoor advertising’s share of total media spending and leverage such growth

with our national scale and local reach. We are focusing on developing and implementing better and improved outdoor audience

delivery measurement systems to provide advertisers with tools to determine how effectively their message is reaching the desired

audience. As a result of the implementation of strategies above, we believe advertisers will shift their budgets towards the outdoor

advertising medium.

Significant Cost Reductions and Capital Discipline. To address the softness in advertising demand resulting from the

global economic downturn, we have taken steps to reduce our fixed costs. In the fourth quarter of 2008, CCMH commenced a

restructuring plan to reduce our cost base through renegotiations of lease agreements, workforce reductions, elimination of

overlapping functions and other cost savings initiatives. In order to achieve these cost savings, we incurred a total of $17.4 million in

costs in 2008 and 2009. We estimate the benefit of the restructuring program was an approximate $50.5 million aggregate reduction

to fixed operating expenses in 2009 and that the benefit of these initiatives will be fully realized in 2010.

5

(2) Included in the total are stations that were placed in a trust in order to bring the merger into compliance with the FCC’s

media ownership rules. We have divested certain stations in the past and will continue to divest these stations as required.