iHeartMedia 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of our programming to keep an audience engaged. Finally, we have pioneered mobile applications such as the iheartradio smart phone

application, which allows listeners to use their smart phones to interact directly with stations, talent, including finding titles/artists,

requesting songs and downloading station wallpapers.

Sources of Revenue

Our Radio Broadcasting segment generated 49%, 49% and 50% of our revenue in 2009, 2008 and 2007, respectively. The

primary source of revenue in our Radio Broadcasting segment is the sale of commercial spots on our radio stations for local, regional

and national advertising. Our local advertisers cover a wide range of categories, including consumer services, retailers, entertainment,

health and beauty products, telecommunications, automotive and media. Our contracts with our advertisers generally provide for a

term which extends for less than a one year period. We also generate additional revenues from network compensation, the Internet, air

traffic, events, barter and other miscellaneous transactions. These other sources of revenue supplement our traditional advertising

revenue without increasing on-air-commercial time.

Each radio station’s local sales staff solicits advertising directly from local advertisers or indirectly through advertising

agencies. Our ability to produce commercials that respond to the specific needs of our advertisers helps to build local direct

advertising relationships. Regional advertising sales are also generally realized by our local sales staff. To generate national

advertising sales, we engage one of our units, Katz Media Group, which specializes in soliciting radio advertising sales on a national

level for Clear Channel Radio and other radio companies. National sales representatives such as Katz obtain advertising principally

from advertising agencies located outside the station’s market and receive commissions based on advertising sold (see “Media

Representation”).

Advertising rates are principally based on the length of the spot and how many people in a targeted audience listen to our

stations, as measured by independent ratings services. A station’s format can be important in determining the size and characteristics

of its listening audience, and advertising rates are influenced by the station’s ability to attract and target audiences that advertisers aim

to reach. The size of the market influences rates as well, with larger markets typically receiving higher rates than smaller markets.

Rates are generally highest during morning and evening commuting periods.

Competition

Our stations compete for listeners and advertising revenues directly with other radio stations within their respective

markets, as well as with other advertising media, including satellite radio, broadcast and cable television, print media, outdoor

advertising, direct mail, the Internet and other forms of advertisement. In addition, the radio broadcasting industry is subject to

competition from services that use new media technologies that are being developed or have already been introduced, such as the

Internet and satellite-based digital radio services. Such services reach national and regional audiences with multi-channel, multi-

format, digital radio services.

Radio stations compete for listeners primarily on the basis of program content that appeals to a particular demographic

group. By building a strong brand identity with a targeted listener base consisting of specific demographic groups in each of our

markets, we are able to attract advertisers seeking to reach those listeners.

R

adio Stations

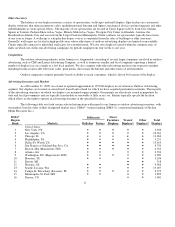

As of December 31, 2009, we owned 260 AM and 634 FM domestic radio stations, of which 149 stations were in the 25

largest U.S. markets. Radio broadcasting is subject to the jurisdiction of the Federal Communications Commission (“FCC”) under the

Communications Act of 1934, as amended (the “Communications Act”). The FCC grants us licenses in order to operate our radio

stations.

3