eTrade 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263

|

|

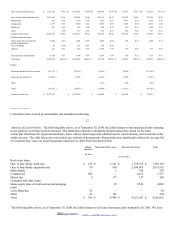

Land — — — 0.01 6 0.03 8 0.08 8 0.21

Lease financing — — 3 0.01 16 0.06 — — — —

Home equity lines of

credit and second

mortgage loans

29 0.10 9 0.05 57 0.64 5 0.16 20 0.41

Other consumer — 0.01 1 0.02 37 0.30 — — — —

Total allowance for loan

losses

$ 10,930 100.00 %

$ 7,161 100.00 %

$ 4,766 100.00 %

$ 3,594 100.00 %

$ 2,957 100.00 %

The above amounts include specific reserves at September 30, 2000, 1999, 1998, 1997 and 1996, totaling $391,000, $406,000,

$449,000, $510,000 and $579,000, respectively, related to non-performing loans.

The following table shows the activity in our allowance for loan losses during the periods indicated.

Years Ended September 30,

2000 1999 1998 1997 1996

(in thousands)

Allowance for loan losses at beginning of period $

7,161 $ 4,715 $ 3,594 $ 2,957 $ 2,311

Charge-offs:

Real estate loans (240 ) (400 ) (463 ) (304 ) (409 )

Other consumer loans (13 ) (56 ) (76 ) — (28 )

Other loans — (2 ) (17 ) — —

Total charge-offs (253 ) (458 ) (556 ) (304 ) (437 )

Recoveries:

Real estate loans 19 38 13 13 148

Other consumer loans — 79 81 7 16

Other loan — 4 5 — —

Total recoveries 19 121 99 20 164

Net charge-offs (234 ) (337 ) (457 ) (284 ) (273 )

Loan loss allowance acquired in the acquisition

with DFC

— — 724 — —

Additions charged to operations 4,003 2,783 905 921 919

Allowance for loan losses at end of period $

10,930 $ 7,161 $ 4,766 $ 3,594 $ 2,957

Mortgage-Backed Securities

We maintain a significant portfolio of mortgage-backed securities, primarily in the following forms:

privately insured mortgage pass through securities;

17

Government National Mortgage Association (‘Ginnie Mae’ ’ ) participation certificates;

Federal National Home Loan Mortgage Corporation (‘Fannie Mae’ ’ ) participation certificates;

Federal Home Loan Mortgage Corporation (‘Freddie Mac’ ’ ) participation certificates; and

securities issued by other non-agency organizations.

Principal and interest on Ginnie Mae certificates are guaranteed by the full faith and credit of the United States government. Fannie

Mae and Freddie Mac certificates are each guaranteed by their respective agencies. Mortgage-backed securities generally entitle us to

receive a pro rata portion of the cash flows from an identified pool of mortgages. We also invest in collateralized mortgage obligations

(‘CMOs’ ’ ). CMOs are securities issued by special purpose entities generally collateralized by pools of mortgage-backed securities.

The cash flows from these pools are segmented and paid in accordance with a predetermined priority to various classes of securities

issued by the entity. Our CMOs are senior tranches collateralized by federal agency securities or whole loans. Over 99% of our CMO

portfolio is comprised of securities with a triple ‘A’ ’ rating. Although our CMO portfolio has maturity periods similar to our

2002. EDGAR Online, Inc.