eTrade 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263

|

|

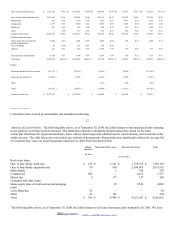

Commercial 657 664 372 568 1,217

Land — — 316 — —

Home equity lines of credit and

second mortgage loans

— 21 255 — 54

Other — 60 205 — —

Total 12,048 8,340 8,875 10,927 10,250

TDRs — — — 425 435

Total of non-accrual loans and

TDRs

12,048 8,340 8,875 11,352 10,685

REO: One- to four-family 850 539 1,460 681 1,300

Valuation allowance for REO — — — — (65 )

Total REO, net 850 539 1,460 681 1,235

Total non-performing assets, net $ 12,898 $ 8,879 $ 10,335 $ 12,033 $ 11,920

Total non-performing assets, net,

as a percentage of total bank

assets

0.14 %

0.21 %

0.45 %

1.09 %

1.84 %

Total loss allowance as a

percentage of total non-

performing loans, net

90.72 %

85.86 %

53.70 %

31.66 %

27.67 %

During fiscal 2000, our non-performing assets increased by $4.0 million, or 45.3%, to $12.9 million at September 30, 2000 from $8.9

million at September 30, 1999. As a matter of policy, we actively monitor our non-performing assets.

During fiscal 2000 and 1999, if our non-accruing loans had been performing in accordance with their terms, we would have recorded

interest income of approximately $845,000 and $550,000, respectively. However, none of the interest income disclosed was

recognized as income during the periods.

Special Mention Loans . In certain situations, a borrower’ s past credit history may lead to doubt regarding the borrower’ s ability to

repay under the loan’ s contractual terms, whether or not the loan is delinquent. Such loans, classified as “special mention” loans,

continue to accrue interest and remain as a component of the loans receivable balance. These loans represented $148,000 of the total

loan portfolio at September 30, 2000, and are actively monitored.

15

Allowance for Loan Losses. As an investor in mortgage loans, we recognize that we will experience occasional credit losses. We

believe the risk of credit loss varies with, among other things, the following:

type of loan;

creditworthiness of the borrower over the term of the loan;

general economic conditions; and

in the case of a secured loan, the quality of the security for the loan.

Our policy is to maintain an adequate allowance for loan losses based on, among other things, the following:

our historical loan loss experience;

regular reviews of delinquencies and loan portfolio quality;

the industry’ s historical loan loss experience for similar asset types; and

evaluation of economic conditions.

We increase our allowance for loan losses when we estimate that losses have been incurred by charging provisions for probable loan

losses against income. Charge-offs reduce the allowance when losses are confirmed.

2002. EDGAR Online, Inc.