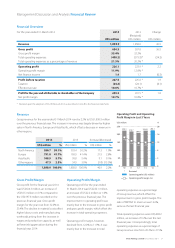

Vtech 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EUROPE

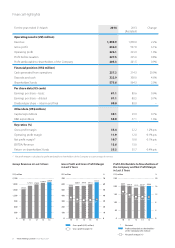

As % of Group RevenueRevenue in Europe in Last 5 Years

Group revenue in Europe was up 2.8% to US$791.8 million in

the financial year 2014, as higher revenue from ELPs and CMS

compensated for lower revenue from TEL products. Europe

remained the second largest market of the Group, representing

41.7% of Group revenue.

ELPs revenue in Europe increased by 16.5% to US$385.8 million,

with sales growth across all major markets, especially France,

from both standalone and platform products. The growth

in standalone products was driven by the Toot-Toot Drivers®

range, infant products, Kidizoom and the Kidi line of products.

During the calendar year 2013, VTech was the number one

market player in the overall Infant Toys category in France, the

UK and Germany7. Furthermore, Toot-Toot Drivers garnered

a number of top industry awards. In France, Its Train Station

was given the “Toy Grand Prix 2013” award in the preschool

toy category by La Revue du Jouet magazine, while in the UK,

it was named “Preschool Toy of the Year” by the Toy Retailers

Association. Toot-Toot Drivers Garage was also ranked among

the top five best-selling infant items by retail value in France,

the UK and Germany8.

In platform products, children’s educational tablets led the

growth. The InnoTab range was updated for the UK market

through the introduction of InnoTab 3 and 3S, while Storio 2

was sold in all VTech’s major European markets. In the calendar

year 2013, Storio was the number one children’s educational

tablet in Europe for the second year in a row9.

7 Source: NPD Group, Retail Tracking Service

8 Source: NPD Group, Retail Tracking Service

9 Source: NPD Group, Retail Tracking Service. Ranking based on total retail sales of

Storio for the combined market of France, the UK, Germany, Spain and Italy

TEL products revenue in Europe decreased by 24.2% to

US$154.3 million. The decline was mainly due to lower sales of

residential phones. This resulted from the decline of the fixed-

line telephones market, a generally weak economy in Europe

and the Group’s decision to focus on higher margin business.

For commercial phones and other telecommunication

products, sales of baby monitors, connected home devices and

hotel phones were higher, offsetting lower sales of integrated

access devices. In January 2014, the Group began initial

shipments of its conference phone and SIP phones to the UK

and France. These new products have been very well received

by both customers and end-users.

CMS revenue in Europe increased by 7.1% to US$251.7 million.

Professional audio equipment, wireless headsets and home

appliances saw higher sales, offsetting lower revenue from

switching mode power supplies and medical and health

products. Professional audio equipment delivered robust

growth, as the Group benefited from new product launches

by existing customers. More orders from new accounts in

Germany also buoyed sales. Wireless headsets posted decent

growth, as VTech gained market share owing to better

service, while good sell-through of the client’s products also

contributed to higher revenue. Sales of home appliances rose

as the new Italian customer increased orders. Switching mode

power supplies and medical and health products, however, saw

sales decline as the switching mode power supplies customer

divested its solar power inverter business, while the product of

the medical and health client did not sell as expected, resulting

in lower orders.

US$ million

10

528.9

11

667.6

12

719.3 769.9 791.8

13 14

0

150

300

600

450

900

750

41.4%

FY2013 FY2014

41.7%

12 VTech Holdings Limited Annual Report 2014

Management Discussion and Analysis Review of Operations