Vtech 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

VTech Holdings Ltd Annual Report 2013

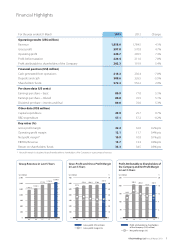

Liquidity and Financial

Resources

Shareholders’ funds as at 31 March 2013

were US$572.3 million, an increase of

2.9% from US$556.2 million in the last

financial year. Shareholders’ funds per

share increased by 2.7% from US$2.23 to

US$2.29.

The Group had no borrowings as at

31 March 2012 and 31 March 2013.

The Group’s financial resources remain

strong. As at 31 March 2013, deposits

and cash reduced from US$326.5 million

to US$308.6 million, a decrease of 5.5%

compared with the last financial year-

end-date. It was mainly due to the

increase in working capital compared

with the same period last year. The

Group has adequate liquidity to meet

its current and future working capital

requirements.

Analysis of Cash Flow from Operations

2013

US$ million

2012

US$ million

Change

US$ million

Operatingprofit 224.7 209.5 15.2

Depreciation and amortisation 29.3 27.5 1.8

EBITDA 254.0 237.0 17.0

Gain on disposal of tangible assets (0.1) (0.1) –

Working capital change (39.6) (6.5) (33.1)

Cash generated from operations 214.3 230.4 (16.1)

The Group’s cash generated from operations for the year ended 31 March 2013 was

US$214.3 million, as compared to US$230.4 million in the same period last year. The

change was mainly attributable to the increase in EBITDA, which offset the increase in

working capital investment.

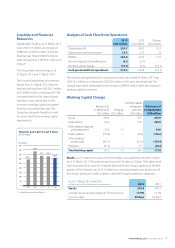

Working Capital Change

Balance as at

31 March 2012

US$ million

Hedging

US$ million

Working capital

change per

cash flow

US$ million

Balance as at

31 March 2013

US$ million

Stocks 239.2 –37.7 276.9

Trade debtors 210.6 –14.3 224.9

Otherdebtors,deposits

and prepayment 33.6 1.0 –34.6

Trade creditors (173.8) –(2.4) (176.2)

Othercreditors

and accruals (141.1) –(13.3) (154.4)

Provisions (31.5) –3.3 (28.2)

Total working capital 137.0 1.0 39.6 177.6

Stocks as of 31 March 2013 were US$276.9 million, increased from US$239.2 million

as of 31 March 2012. The turnover days rose from 82 days to 90 days. The higher stock

level was primarily to cater for increased demand for the Group’s products in the first

quarter of the financial year 2014. Furthermore, we had arranged early production of

the Group’s products in order to better utilise the Group’s production capacities.

As at 31 March 2013 and 2012

All figures are in US$ million unless stated otherwise 2013 2012

Stocks 276.9 239.2

Average stocks as a percentage of Group revenue 13.9% 13.1%

Turnover days 90 days 82 days

450

400

350

300

250

200

150

100

50

0

US$ million

09 10 11 12 13

292.1*

* Include currency-linked deposits

382.6

333.1 326.5

308.6

Deposits and Cash in Last 5 Years

(As at 31 March)

vtech.indb 7 13年5月29日 上午3:17