Vtech 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2VTech Holdings Ltd Annual Report 2013

Letter to Shareholders

Our Business

There were a number of key developments in our business

during the financial year 2013 that demonstrate how we have

been responding to market opportunities. These will have a

positive impact on the Group’s longer-term growth prospects.

The Group’s product mix and sales mix have been evolving.

In the financial year 2013, electronic learning products (ELPs)

grew to become our largest product line, representing 39.3% of

Group revenue. The Group’s sales via e-tailers and our websites

are expanding rapidly. Sales of the download content from our

app store, Learning Lodge TM, increased fivefold in the financial

year 2013, albeit from a low base.

In telecommunication (TEL) products, sales of non-residential-

phone products increased in the financial year 2013 despite

lower sales of residential phones, rising to approximately 12%

of total TEL products revenue, from approximately 8% in the

financial year 2012. These products consist of baby monitors,

integrated access devices (IADs), small to medium sized

business (SMB) phones, connected home TM devices, cordless

headsets and hotel phones.

OurELPsperformedwellinthefinancialyear2013.Despitethe

decline of the toy market in the US and Europe, ELPs revenue

grew by 11.3% as compared with the last financial year. In

the calendar year 2012, we became the largest infant toy

manufacturer in our main European markets 1. Furthermore,

Storio® 2 was the number one selling item by retail value in

the top five European toy markets 2. This demonstrates our

excellence in product development, and our ability to build a

strong brand presence.

The financial year 2013 marked the eleventh straight year of

sales growth at our contract manufacturing services (CMS).

It shows the soundness of our strategy to focus on medium-

sized companies that are leaders in their industries. With its

strong reputation and expertise in certain product categories,

CMS once again outperformed the global EMS (electronic

manufacturing services) market as we continued to add new

customers and expand geographically. A notable success was

achieving double-digit sales growth in Europe despite the

economic difficulties on the continent.

1 Source: NPD Group, Retail Tracking Service. Ranking based on total retail sales in the Infant Toys category, for the combined market of UK, France, Germany and Spain

2 Source: NPD Group, Retail Tracking Service

Results and Dividend

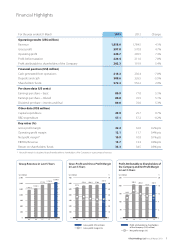

Group revenue for the year ended 31 March 2013 increased by

4.1% to US$1,858.0 million. The growth was driven by higher

revenue in North America, Europe and Asia Pacific, which offset

lowerrevenueinOtherRegions.

Profit attributable to shareholders of the Company rose by 5.4%

to US$202.3 million, with the Group’s net profit margin largely

consistent with that of the last financial year. Basic earnings per

share increased by 5.1% to US80.9 cents, compared to US77.0

cents in the last financial year.

The Board of Directors (the Board) has proposed a final dividend

of US64.0 cents per ordinary share. Together with the interim

dividend of US16.0 cents per ordinary share, this will result in

a full-year dividend of US80.0 cents per ordinary share, against

US76.0 cents per ordinary share in the last financial year, an

increase of 5.3%.

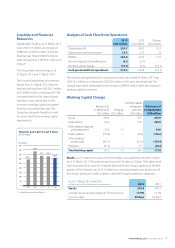

Costs and Operations

In the financial year 2013, the Group benefited from lower cost

of materials due to sluggish global demand. However, this was

offset by higher labour costs and manufacturing overheads

in China, as recruitment and retention of workers became

more challenging. During the financial year, we not only raised

workers’ compensation and benefits, but also increased our

investment in improving their working and living environment.

VTech delivered solid results in the

financial year 2013, reporting record

revenue and profit growth despite a

challenging economic environment.

This performance demonstrates the

fundamental strength of the Group,

which has the ability to grow sales and

increase its market leadership despite

a difficult market environment.

Dear Shareholders,

vtech.indb 2 13年5月29日 上午3:16