Vtech 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 VTech Holdings Ltd Annual Report 2013

Management Discussion and Analysis Review of Operations

EUROPE

Group revenue in Europe increased by

7.0% to US$769.9 million. As in North

America, the growth was attributable to

higher revenue of ELPs and CMS in the

region, offsetting lower revenue of TEL

products. Europe was VTech’s second

largest market, accounting for 41.4% of

Group revenue.

Revenue from TEL products declined by

5.5% to US$203.6 million. The decrease

in revenue was primarily due to lower

sales of residential phones, as customers

reduced orders and inventory in view of

the weak economies. This was especially

true in the first half of the financial year,

while improvement was seen in the

second half due to restocking by some

customers. In the calendar year 2012,

VTech maintained its leadership position

as the largest manufacturer of cordless

phones in Western Europe 8.

Despite lower sales of residential phones,

sales of non-residential-phone products

continued to rise. These included baby

monitors, IADs, connected home devices

and hotel phones.

ELPs revenue in Europe was US$331.3

million, up 6.8%, despite being

negatively impacted by a lower average

Euro-US Dollar exchange rate compared

to the last financial year. As in North

America, the children’s educational tablet

Storio 2, Switch & Go Dinos and infant

products, including the new Toot-Toot

Drivers® range, were the growth drivers.

During the financial year 2013, Storio 2

was sold in all VTech’s major markets in

Europe. It was the number one selling

item by retail revenue in the top five

European toy markets in the calendar

year 2012 9. In the same calendar year,

the Kidizoom digital camera also topped

the best selling toy list in Germany 10.

ELPs sales were higher in the UK, France

and Germany while sales in Spain were

lower. In the Benelux countries, sales

grew in Euro terms but declined in US

dollar terms owing to adverse changes in

the exchange rate.

CMS revenue in Europe rose by 21.4%

to US$235.0 million, driven by sales

growth in almost all product categories.

Medical and health products posted

the strongest growth in the region,

buoyed by increased sales to existing

and new customers. Wireless headsets

also delivered robust results, as VTech

benefited from the customer’s new

product launches and consolidation

of suppliers. Switching mode power

supplies and professional audio

equipment demonstrated solid growth,

driven by more orders for solar power

inverters and increased orders from new

German customers respectively. Sales of

industrial products, however, recorded a

decline during the financial year 2013.

8 Source: MZA Ltd, 2013 edition of The Global Telecommunications Market Report

9 & 10 Source: NPD Group, Retail Tracking Service

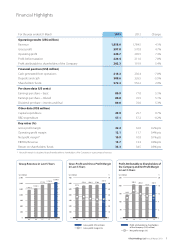

TEL Products

26.5%

US$203.6 million

ELPs

43.0%

US$331.3 million

CMS

30.5%

US$235.0 million

Total: US$769.9 million

Revenue in Europe in Last 5 Years

800

600

400

200

0

US$ million

09 10 11 12 13

570.5 528.9

667.6

719.3

769.9

Revenue in Europe by

Product Line

for the year ended 31 March 2013

vtech.indb 10 13年5月29日 上午3:17