Vtech 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VTech Holdings Ltd Annual Report 2011 3

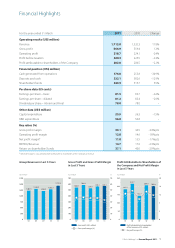

Basic earnings per share consequently decreased by

2.6% to US81.5 cents, compared to US83.7 cents in the

financial year 2010. The Board of Directors (the Board) has

proposed a final dividend of US62.0 cents per ordinary

share. Together with the interim dividend of US16.0 cents

per ordinary share, this gives a total dividend for the

year of US78.0 cents per ordinary share, the same as the

previous financial year.

Segment Results

In North America, which remains our largest market,

higher sales of ELPs and CMS offset lower revenue from

TEL products. For ELPs, sales of our platform products

recorded strong growth during the financial year, driven

by the successful launch of MobiGo® and V.Reader®.

Standalone products also delivered good sales increases,

as our infant and pre-school products sold well. CMS

posted the strongest growth in North America, as

the economy recovered and we gained additional

business from existing customers due to our customer

focused approach.

All three product lines recorded revenue growth in

Europe, despite the economic uncertainties in some

countries. Sales of TEL products were boosted by

increasing sales to existing customers. Standalone

products, particularly the infant category and the Kidi

line, led the growth in ELPs. CMS grew across all key

product categories, as we secured more business from

existing customers.

The Group continued to expand in Asia Pacific and other

regions, mainly through increasing sales in Australia,

Japan, Latin America and the Middle East. Our TEL

products have made good inroads into the Asia Pacific

market, where we increased our market share in Australia

and ramped up orders for a Japanese customer. ELP sales

grew modestly in this region during the financial year,

led by Latin America and the Middle East. Our CMS sales

also rose in Asia Pacific, driven by an increase in sales of

medical equipment.

Outlook

The global economy is continuing its recovery, but

the situation is fragile. Unemployment is high in most

developed countries and the oil price remains elevated,

which threatens to undermine consumer sentiment.

We are nonetheless planning for top line growth in

the financial year 2012. Our product innovations,

market leadership and growing reputation in the EMS

industry position us well to achieve sales growth across

our markets.

Profitability, however, is difficult to gauge as we expect to

face stronger headwind from rising costs. Cost of materials

may rise further as commodity prices remain high and

volatile. The disruption of the Japanese supply chain

may also lead to a tightening of the supply of certain

components, which may result in price escalation. Wages

in China are forecast to rise further, while the appreciation

of the Renminbi is likely to continue.

We will continue to exercise tight cost control and

improve our productivity, striving to minimise margin

impacts. Programmes are in place to speed up the

automation of our processes and re-engineer our

products for lower cost. In addition, we have taken

appropriate actions to pass on certain cost increases to

our customers. With our product innovations, efficient

operations and economies of scale, we will remain

competitive in our markets.

North America

Even though the US cordless phone market is maturing,

our goal is to deliver overall growth for TEL products in

North America in the financial year 2012.

To achieve this, we will introduce feature-rich products at

competitive prices to maintain our market lead in the US

corded and cordless consumer phone market. Our new

products include enhanced features, such as push-to-talk

“walkie-talkie” capability for immediate communication

throughout the house and HD audio for the clearest

call experience. We have also revamped our successful

Bluetooth® line of products that allow consumers to

connect their cellular phones to our cordless phones.

Tech’s Hot Growth Companies 2010

VTech was ranked 8th on Bloomberg

Businessweek’s 2010 list of “Tech’s Hot

Growth Companies”. Most importantly, the

Group is the only Hong Kong company to

make the list.