Vtech 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 VTech Holdings Ltd Annual Report 2011

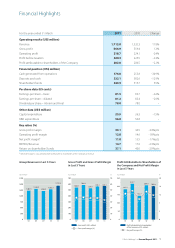

Operating Profit and Operating

Profit Margin in Last 5 Years

US$ million %

50

0

250

4

100 8

150 12

200 16

0

20

07

Operating profit (US$ million)

194.0

08

228.9

09

154.3

10

224.1

11

218.7

13.3

14.7

10.7

14.6

12.8

Operating profit margin (%)

Dividend per Share in Last 5 Years

* Include a special dividend of US30.0 cents per ordinary share

US cents

20

40

60

80

0

100

07

80.0*

08

63.0

09

53.0

10

78.0

11

78.0

US cents

20

40

60

80

0

100

Earnings per Share in Last 5 Years

07

76.6

08

89.4

09

58.5

10

83.7

11

81.5

US$ million

10

20

30

40

50

60

0

70

Group R&D Expenditure

in Last 5 Years

07

45.2

08

51.3

09

56.9

10

56.8

11

56.8

Management Discussion and Analysis

Operating Profit/Margin

The operating profit for the year

ended 31 March 2011 was US$218.7

million, a decrease of US$5.4 million

or 2.4% over the previous financial

year. The operating profit margin also

dropped from 14.6% in the previous

financial year to 12.8% during the

financial year. The ratio of EBITDA to

revenue in the financial year 2011

was 14.7% against 17.0% recorded

in the previous financial year.

The decrease partly reflected the

decrease in gross profit margin and

higher selling and distribution costs.

Selling and distribution costs rose by

16.5% from US$207.3 million in the

previous financial year to US$241.6

million in the financial year 2011. The

increase was mainly attributable to

increased spending on advertising

and promotional activities by the

Group and higher royalty payments

to licensors for the use of popular

cartoon characters for certain

ELPs during the financial year. As a

percentage of Group revenue, selling

and distribution costs increased from

13.5% in the previous financial year

to 14.1% in the financial year 2011.

Administrative and other operating

expenses fell from US$71.2 million

in the previous financial year to

US$49.8 million in the financial year

2011. This was mainly attributable

to lower legal and professional costs

during the financial year. With better

foreign exchange risk management,

the net exchange gain arising from

the Group’s global operations in

the ordinary course of business was

US$1.8 million in the financial year

2011. This contrasted with the minimal

exchange loss recorded in previous

financial year. Administrative and other

operating expenses as a percentage of

Group revenue decreased from 4.6%

in the previous financial year to 2.9%

during the financial year.

During the financial year 2011,

the research and development

expense was US$56.8 million, the

same as the previous financial year.

Research and development expense

as a percentage of Group revenue

decreased from 3.7% in the previous

financial year to 3.3% in the financial

year 2011.

Profit attributable

to shareholders and

Dividends

The profit attributable to

shareholders of the Company for

the year ended 31 March 2011 was

US$202.0 million, a decrease of

US$4.5 million as compared to the

previous financial year.

Basic earnings per share for the

year ended 31 March 2011 were

US81.5 cents as compared to

US83.7 cents in the previous financial

year. During the financial year, the

Group declared and paid an interim

dividend of US16.0 cents per share,

which aggregated to US$39.7 million.

The Directors have proposed a

final dividend of US62.0 cents per

share, which will aggregate to

US$153.9 million.