Vonage 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-34 VONAGE ANNUAL REPORT 2015

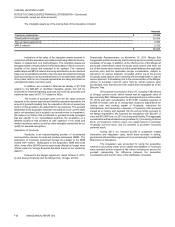

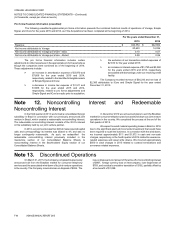

The acquisition was accounted for using the acquisition

method of accounting under which assets and liabilities of iCore were

recorded at their respective fair values including an amount for goodwill

representing the difference between the acquisition consideration and

the fair value of the identifiable net assets. We do not expect any portion

of this goodwill to be deductible for tax purposes. The goodwill

attributable to the acquisition has been recorded as a non-current asset

and is not amortized, but is subject to an annual review for impairment.

The acquisition price was allocated to the tangible and

identified intangible assets acquired and liabilities assumed as of the

closing date. The fair values assigned to tangible and identifiable

intangible assets acquired and liabilities assumed are based on

management’s estimates and assumptions. The estimated fair values

of assets acquired and liabilities assumed are considered preliminary

and are based on the most recent information available. We believe that

the information provides a reasonable basis for assigning the fair values

of assets acquired and liabilities assumed, but we are waiting for

additional information, primarily related to income, sales, excise, and

ad valorem taxes which are subject to change. Thus, the provisional

measurements of fair value set forth below are subject to change. We

expect to finalize the valuation as soon as practicable, but not later than

one year from the acquisition date.

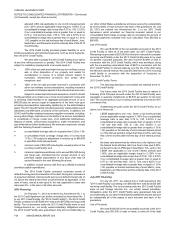

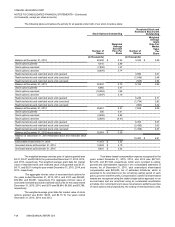

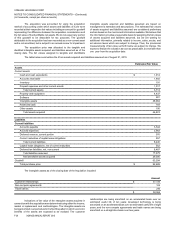

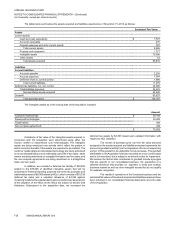

The table below summarizes the iCore assets acquired and liabilities assumed as of August 31, 2015:

Estimated Fair Value

Assets

Current assets:

Cash and cash equivalents $ 1,014

Accounts receivable 1,492

Inventory 191

Prepaid expenses and other current assets 1,017

Total current assets 3,714

Property and equipment 4,437

Software 281

Intangible assets 38,064

Restricted cash 183

Other assets 195

Total assets acquired 46,874

Liabilities

Current liabilities:

Accounts payable 3,344

Accrued expenses 3,963

Deferred revenue, current portion 576

Current maturities of capital lease obligations 557

Total current liabilities 8,440

Capital lease obligations, net of current maturities 552

Deferred tax liabilities, net, non-current 8,487

Total liabilities assumed 17,479

Net identifiable assets acquired 29,395

Goodwill 63,294

Total purchase price $ 92,689

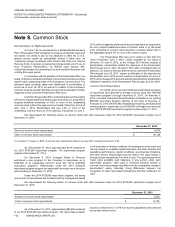

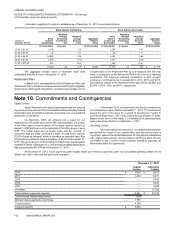

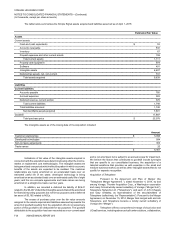

The intangible assets as of the closing date of the Acquisition included:

Amount

Customer relationships $ 37,720

Non-compete agreements 104

Trade names 240

$38,064

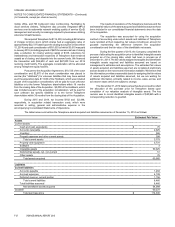

Indications of fair value of the intangible assets acquired in

connection with the acquisition were determined using either the income,

market or replacement cost methodologies. The intangible assets are

being amortized over periods which reflect the pattern in which economic

benefits of the assets are expected to be realized. The customer

relationships are being amortized on an accelerated basis over an

estimated useful life of ten years; developed technology is being

amortized on an accelerated basis over an estimated useful life of eight

years; and the non-compete agreements and trade names are being

amortized on a straight-line basis over two years.