Vonage 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-20 VONAGE ANNUAL REPORT 2015

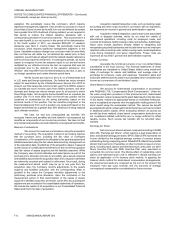

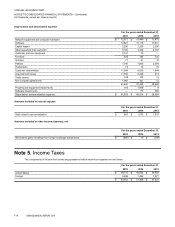

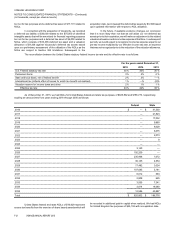

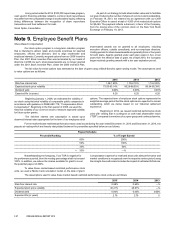

The components of the income tax expense are as follows:

For the years ended December 31,

2015 2014 2013

Current:

Federal $ (1,846) $ (1,452) $ (907)

Foreign (1,667) (376)(155)

State and local taxes (956)(803)(337)

$ (4,469) $ (2,631) $ (1,399)

Deferred:

Federal $ (11,289) $ (15,239) $ (14,954)

Foreign (1,088) (2,985)(1,603)

State and local taxes (1,572) (904)(238)

$ (13,949) $ (19,128) $ (16,795)

$ (18,418) $ (21,759) $ (18,194)

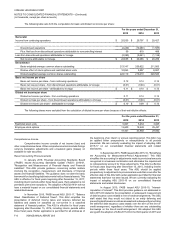

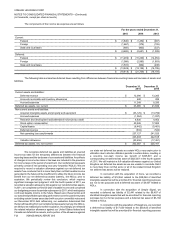

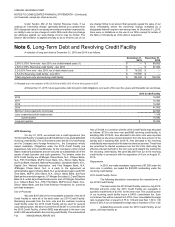

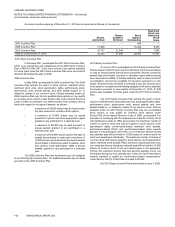

The following table summarizes deferred taxes resulting from differences between financial accounting basis and tax basis of assets and

liabilities.

December 31,

2015 December 31,

2014

Current assets and liabilities:

Deferred revenue $ 12,096 $13,265

Accounts receivable and inventory allowances 640 289

Accrued expenses 11,249 8,295

Deferred tax assets, net, current $ 23,985 $21,849

Non-current assets and liabilities:

Acquired intangible assets and property and equipment $ (33,129) $ (13,799)

Accrued expenses (1,054)(1,937)

Research and development and alternative minimum tax credit 6,630 4,952

Stock option compensation 20,545 17,802

Capital leases (6,442)(5,401)

Deferred revenue (634)(524)

Net operating loss carryforwards 237,127 241,525

223,043 242,618

Valuation allowance (20,456) (17,451)

Deferred tax assets, net, non-current $ 202,587 $225,167

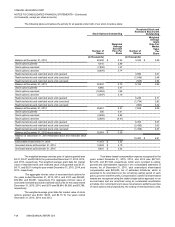

We recognize deferred tax assets and liabilities at enacted

income tax rates for the temporary differences between the financial

reporting bases and the tax bases of our assets and liabilities. Any effects

of changes in income tax rates or tax laws are included in the provision

for income taxes in the period of enactment. Our net deferred tax assets

primarily consist of net operating loss carry forwards (“NOLs”). We are

required to record a valuation allowance against our net deferred tax

assets if we conclude that it is more likely than not that taxable income

generated in the future will be insufficient to utilize the future income tax

benefit from our net deferred tax assets (namely, the NOLs), prior to

expiration. We periodically review this conclusion, which requires

significant management judgment. Until the fourth quarter of 2011, we

recorded a valuation allowance fully against our net deferred tax assets.

In 2011, we completed our first full year of taxable income and completed

our budgetary process for periods subsequent to 2011, which anticipates

continued taxable income in the future. Based upon these factors and

our sustained profitable operating performance over the past three years

excluding certain losses associated with our prior convertible notes and

our December 2010 debt refinancing, our evaluation determined that

the benefit resulting from our net deferred tax assets (namely, the NOLs),

are likely to be realized prior to their expiration. Accordingly, we released

the related valuation allowance against our United States federal and

Canada net deferred tax assets, and a portion of the allowance against

our state net deferred tax assets as certain NOLs may expire prior to

utilization due to shorter utilization periods in certain states, resulting in

a one-time non-cash income tax benefit of $325,601 and a

corresponding net deferred tax asset of $325,601 in the fourth quarter

of 2011. We still maintain a full valuation allowance against our United

Kingdom net deferred tax assets as we are unable to conclude that it

is more likely than not that some or all of the related United Kingdom

net deferred tax assets will be realized.

In connection with the acquisition of iCore, we recorded a

deferred tax liability of $12,944 related to the $38,064 of identified

intangible assets that will be amortized for financial reporting purposes

but not for tax purposes and a deferred tax asset of $4,457 related to

NOLs.

In connection with the acquisition of Simple Signal, we

recorded a deferred tax liability of $2,441 related to the $6,407 of

identified intangible assets that will be amortized for financial reporting

purposes but not for tax purposes and a deferred tax asset of $3,182

related to NOLs.

In connection with the acquisition of Telesphere, we recorded

a deferred tax liability of $17,050 related to the $50,925 of identified

intangible assets that will be amortized for financial reporting purposes