Vonage 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

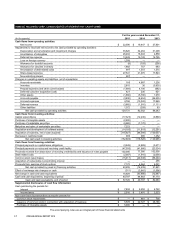

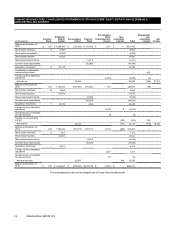

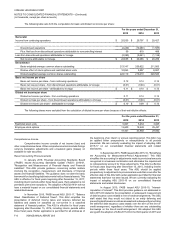

(In thousands, except per share amounts)

F-12 VONAGE ANNUAL REPORT 2015

expiration. We periodically review this conclusion, which requires

significant management judgment. If we are able to conclude in a future

period that a future income tax benefit from our net deferred tax assets

has a greater than 50% likelihood of being realized, we are required in

that period to reduce the related valuation allowance with a

corresponding decrease in income tax expense. This would result in a

non-cash benefit to our net income in the period of the determination.

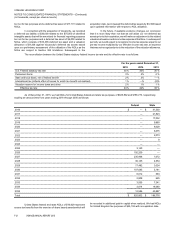

In the fourth quarter of 2011, we released $325,601 of valuation

allowance (see Note 5. Income Taxes). We periodically review this

conclusion, which requires significant management judgment. In the

future, if available evidence changes our conclusion that it is more likely

than not that we will utilize our net deferred tax assets prior to their

expiration, we will make an adjustment to the related valuation allowance

and income tax expense at that time. In subsequent periods, we would

expect to recognize income tax expense equal to our pre-tax income

multiplied by our effective income tax rate, an expense that was not

recognized prior to the reduction of the valuation allowance. Our

effective rate may differ from the federal statutory rate due, in part, to

our foreign operations and certain discrete period items.

We file income tax returns in the U.S. on a federal basis and

in U.S. state and foreign jurisdictions. Our federal tax return remains

subject to examination by the Internal Revenue Service from 2010 to

present, our New Jersey tax returns remain open from 2008 to present,

our Canada tax return remains open from 2009 to present, and other

domestic and foreign tax returns remain open for all periods to which

those filings relate. We recognize the tax benefit from an uncertain tax

position only if it is more likely than not that the tax position will be

sustained on examination by the taxing authorities, based on the

technical merits of the position. The tax benefits recognized in the

financial statements from such a position are measured based on the

largest benefit that has a greater than 50% likelihood of being realized

upon ultimate resolution.

We have not had any unrecognized tax benefits. We

recognize interest and penalties accrued related to unrecognized tax

benefits as components of our income tax provision. We have not had

any interest and penalties accrued related to unrecognized tax benefits.

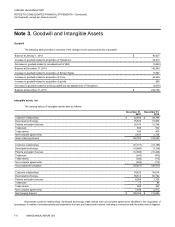

Business Combinations

We account for business combinations using the acquisition

method of accounting. The acquisition method of accounting requires

that the purchase price, including the fair value of contingent

consideration, of the acquisition be allocated to the assets acquired and

liabilities assumed using the fair values determined by management as

of the acquisition date. Goodwill as of the acquisition date is measured

as the excess of consideration transferred over the net of the acquisition

date fair values of assets acquired and the liabilities assumed. While

the Company uses its best estimates and assumptions as part of the

purchase price allocation process to accurately value assets acquired

and liabilities assumed at the acquisition date, the Company’s estimates

are inherently uncertain and subject to refinement. As a result, during

the measurement period, which may be up to one year from the

acquisition date, the Company records adjustments to the assets

acquired and liabilities assumed, with the corresponding offset to

goodwill to the extent the Company identifies adjustments to the

preliminary purchase price allocation. Upon the conclusion of the

measurement period or final determination of the values of assets

acquired or liabilities assumed, whichever comes first, any subsequent

adjustments are recorded to the consolidated statements of operations.

We include the results of all acquisitions in our Consolidated Financial

Statements from the date of acquisition.

Acquisition related transaction costs, such as banking, legal,

accounting and other costs incurred in connection with an acquisition,

are expensed as incurred in general and administrative expense.

Acquisition related integration costs include costs associated

with exit or disposal activities, which do not meet the criteria of

discontinued operations, including costs for employee, lease, and

contract terminations, facility closing or other exit activities. Additionally,

these costs include expenses directly related to integrating and

reorganizing acquired businesses and include items such as employee

retention costs, recruiting costs, certain moving costs, certain duplicative

costs during integration and asset impairments. These costs are

expensed as incurred in general and administrative expense.

Foreign Currency

Generally, the functional currency of our non-United States

subsidiaries is the local currency. The financial statements of these

subsidiaries are translated to United States dollars using month-end

rates of exchange for assets and liabilities, and average rates of

exchange for revenues, costs, and expenses. Translation gains and

losses are deferred and recorded in accumulated other comprehensive

income as a component of stockholders’ equity.

Share-Based Compensation

We account for share-based compensation in accordance

with FASB ASC 718, “Compensation-Stock Compensation”. Under the

fair value recognition provisions of this pronouncement, share-based

compensation cost is measured at the grant date based on the fair value

of the award, reduced as appropriate based on estimated forfeitures,

and is recognized as expense over the applicable vesting period of the

stock award using the accelerated method. The excess tax benefit

associated with stock compensation deductions have not been recorded

in additional paid-in capital. When evaluating whether an excess tax

benefit has been realized, share based compensation deductions are

not considered realized until NOLs are no longer sufficient to offset

taxable income. Such excess tax benefits will be recorded when

realized.

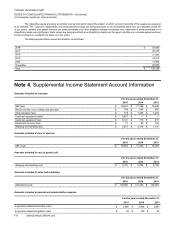

Earnings per Share

Net income per share has been computed according to FASB

ASC 260, “Earnings per Share”, which requires a dual presentation of

basic and diluted earnings per share (“EPS”). Basic EPS represents net

income divided by the weighted average number of common shares

outstanding during a reporting period. Diluted EPS reflects the potential

dilution that could occur if securities or other contracts to issue common

stock, including stock options and restricted stock units under our 2001

Stock Incentive Plan and 2006 Incentive Plan were exercised or

converted into common stock. The dilutive effect of outstanding, stock

options and restricted stock units is reflected in diluted earnings per

share by application of the treasury stock method. In applying the

treasury stock method for stock-based compensation arrangements,

the assumed proceeds are computed as the sum of the amount the

employee must pay upon exercise and the amounts of average

unrecognized compensation cost attributed to future services.