Vonage 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-13 VONAGE ANNUAL REPORT 2015

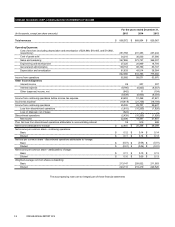

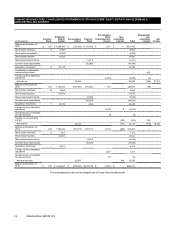

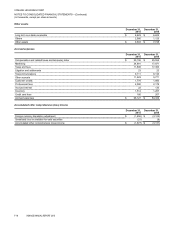

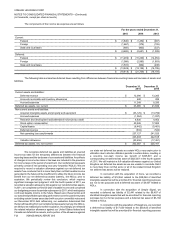

The following table sets forth the computation for basic and diluted net income per share:

For the years ended December 31,

2015 2014 2013

Numerator

Income from continuing operations $ 25,035 $29,707 $29,427

Discontinued operations (2,439) (10,260) (1,626)

Plus: Net loss from discontinued operations attributable to noncontrolling interest 59 819 488

Loss from discontinued operations attributable to Vonage (2,380) (9,441)(1,138)

Net income attributable to Vonage $22,655 $20,266 $28,289

Denominator

Basic weighted average common shares outstanding 213,147 209,822 211,563

Dilutive effect of stock options and restricted stock units 10,963 9,597 8,957

Diluted weighted average common shares outstanding 224,110 219,419 220,520

Basic net income per share

Basic net income per share - from continuing operations 0.12 0.14 0.14

Basic net loss per share - from discontinued operations attributable to Vonage (0.01)(0.04)(0.01)

Basic net income per share - attributable to Vonage $ 0.11 $0.10 $0.13

Diluted net income per share

Diluted net income per share - from continuing operations 0.11 0.14 0.13

Diluted net loss per share - from discontinued operations attributable to Vonage (0.01)(0.04)(0.01)

Diluted net income per share - attributable to Vonage $ 0.10 $0.09 $0.13

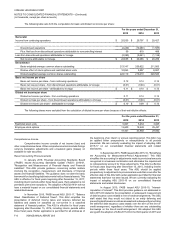

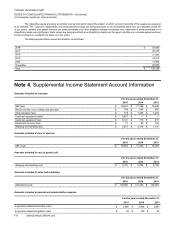

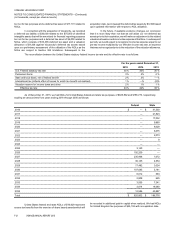

The following shares were excluded from the calculation of diluted income per share because of their anti-dilutive effects:

For the years ended December 31,

2015 2014 2013

Restricted stock units 5,827 5,454 3,625

Employee stock options 13,600 18,428 25,437

19,427 23,882 29,062

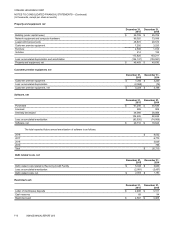

Comprehensive Income

Comprehensive income consists of net income (loss) and

other comprehensive items. Other comprehensive items include foreign

currency translation adjustments and unrealized gains (losses) on

available for sale securities.

Recent Accounting Pronouncements

In January 2016, Financial Accounting Standards Board

(“FASB”) issued Accounting Standards Update ("ASU") 2016-01,

"Recognition and Measurement of Financial Assets and Financial

Liabilities". This ASU provide guidance concerning certain matters

involving the recognition, measurement, and disclosure of financial

assets and financial liabilities. The guidance does not alter the basic

framework for classifying debt instruments held as financial assets. This

ASU is effective for fiscal years beginning after December 15, 2017,

including interim periods within those fiscal years. Early adoption is not

permitted, with some exceptions. The adoption of ASU 2016-01 will not

have a material impact on our consolidated financial statements and

related disclosures.

In November 2015, FASB issued ASU 2015-17, "Balance

Sheet Classification of Deferred Taxes". This ASU simplifies the

presentation of deferred income taxes and requires deferred tax

liabilities and assets be classified as non-current in a classified

statement of financial position. This ASU is effective for fiscal years

beginning after December 15, 2016, including interim periods within

those fiscal years. Earlier application is permitted for all entities as of

the beginning of an interim or annual reporting period. This ASU may

be applied either prospectively or retrospectively to all periods

presented. We are currently evaluating the impact of adopting ASU

2015-17 on our consolidated financial statements and related

disclosures.

In September 2015, FASB issued ASU 2015-16, "Simplifying

the Accounting for Measurement-Period Adjustments". This ASU

simplifies the accounting for adjustments made to provisional amounts

recognized in a business combination and eliminates the requirement

to retrospectively account for those adjustments. This ASU is effective

for fiscal years beginning after December 15, 2015, including interim

periods within those fiscal years. This ASU should be applied

prospectively to adjustments to provisional amounts that occur after the

effective date of this ASU with earlier application permitted for financial

statements that have not been issued. We are currently evaluating the

impact of adopting ASU 2015-16 on our consolidated financial

statements and related disclosures.

In August 2015, FASB issued ASU 2015-15, "Interest-

Imputation of Interest". This ASU provides guidance not addressed in

ASU 2015-03 related to the presentation or subsequent measurement

of debt issuance costs related to line-of-credit arrangements. The SEC

staff stated that they would not object to an entity deferring and

presenting debt issuance costs as an asset and subsequently amortizing

the deferred debt issuance costs ratably over the term of the line-of-

credit arrangement, regardless of whether there are any outstanding

borrowings on the line-of-credit arrangement. We adopted this ASU

along with the adoption of ASU 2015-03 in the third quarter of 2015 and