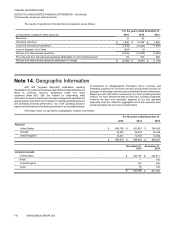

Vonage 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-40 VONAGE ANNUAL REPORT 2015

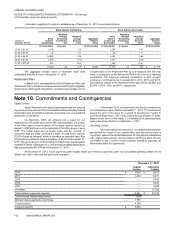

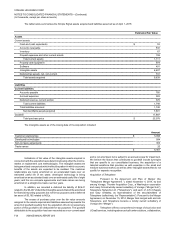

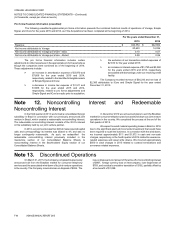

Pro forma financial information (unaudited)

The following unaudited supplemental pro forma information presents the combined historical results of operations of Vonage, Simple

Signal, and iCore for the years 2015 and 2014, as if the Acquisitions had been completed at the beginning of 2014.

For the years ended December 31,

2015 2014

Revenue $ 943,554 $ 942,882

Net income attributable to Vonage 20,653 14,036

Net income attributable to Vonage per share - basic 0.10 0.07

Net income attributable to Vonage per share - diluted 0.09 0.06

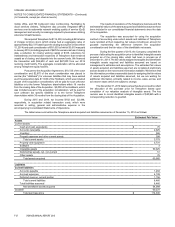

The pro forma financial information includes certain

adjustments to reflect expenses in the appropriate pro forma periods as

though the companies were combined as of the beginning of 2014.

These adjustments include:

>an increase in amortization expense of $3,970 and

$7,666 for the year ended 2015 and 2014,

respectively, related to the identified intangible assets

of Simple Signal and iCore;

>a decrease in income tax expense of $1,511 and

$1,888 for the year ended 2015 and 2014,

respectively, related to pro forma adjustments and

Simple Signal and iCore's results prior to acquisition;

>the exclusion of our transaction-related expenses of

$2,610 for the year ended 2015;

>an increase in interest expense of $1,790 and $3,060

for the years ended 2015 and 2014, respectively

associated with borrowings under our revolving credit

facility.

The Company recorded revenue of $34,243 and net loss of

$2,385 attributable to iCore and Simple Signal for the year ended

December 31, 2015.

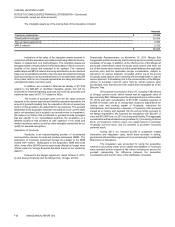

Note 12. Noncontrolling Interest and Redeemable

Noncontrolling Interest

In the third quarter of 2013, we formed a consolidated foreign

subsidiary in Brazil in connection with our previously announced joint

venture in Brazil, which created a redeemable noncontrolling interest.

The redeemable noncontrolling interest consists of the 30.0% interest

in this subsidiary held by our joint venture partner.

In 2014, our joint venture partner did not make required capital

calls and correspondingly its interest was diluted to 4% and was no

longer contingently redeemable. As such, we reclassified the

redeemable noncontrolling interest previously included in the

mezzanine section of our Consolidated Balance Sheets to

noncontrolling interest in the Stockholders' Equity section of our

Consolidated Balance Sheets.

In December 2014 we announced plans to exit the Brazilian

market for consumer telephony services and wind down our joint venture

operations in the country. We completed the process at the end of the

first quarter of 2015.

We expect to avoid material operating losses in Brazil in 2016

due to the significant planned incremental investment that would have

been required to scale the business. In connection with the wind down,

we incurred approximately $111 and $1,972 in cash and non-cash

charges, respectively, in the fourth quarter of 2014 related to severance-

related expenses and asset write downs. We incurred approximately

$500 in cash charges in 2015 related to contract terminations and

severance-related expenses.

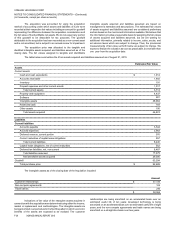

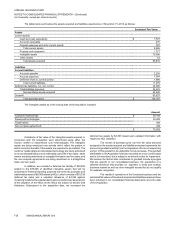

Note 13. Discontinued Operations

On March 31, 2015, the Company completed its previously

announced exit from the Brazilian market for consumer telephony

services and the associated wind down of its joint venture operations

in the country. The Company incurred a loss on disposal of $824. The

loss on disposal is comprised of the write-off of noncontrolling interest

of $907, foreign currency loss on intercompany loan forgiveness of

$783, and residual cumulative translation of $192, partially offset by

a tax benefit of $1,058.