Vonage 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

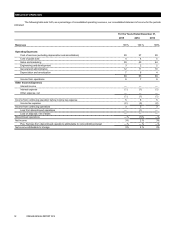

31 VONAGE ANNUAL REPORT 2015

>The cost of leasing from other companies the telephone

numbers that we provide to our customers. We lease these

telephone numbers on a monthly basis.

>The cost of co-locating our regional data connection point

equipment in third-party facilities owned by other companies,

Internet service providers or collocation facility providers.

>The cost of providing local number portability, which allows

customers to move their existing telephone numbers from

another provider to our service. Only regulated

telecommunications providers have access to the centralized

number databases that facilitate this process. Because we

are not a regulated telecommunications provider, we must

pay other telecommunications providers to process our local

number portability requests.

>The cost of complying with FCC regulations regarding VoIP

emergency services, which require us to provide enhanced

emergency dialing capabilities to transmit 911 calls for our

customers.

>Taxes that we pay on our purchase of telecommunications

services from our suppliers or imposed by government

agencies such as Federal USF and related fees.

> License fees for use of third party intellectual property.

> The personnel and related expenses of certain network

operations and technical support employees and contractors.

Cost of goods sold. Cost of goods sold primarily consists of

costs that we incur when a customer first subscribes to our service.

These costs include:

>The cost of the equipment that we provide to consumer

customers who subscribe to our service through our direct

sales channel in excess of activation fees when an activation

fee is collected. Business customers' purchased equipment

is recorded on a net basis. The remaining cost of customer

equipment is deferred up to the activation fee collected and

amortized over the estimated average customer life.

>The cost of the equipment that we sell directly to retailers.

>The cost of shipping and handling for customer equipment,

together with the installation manual, that we ship to

customers.

>The cost of certain products or services that we give

customers as promotions.

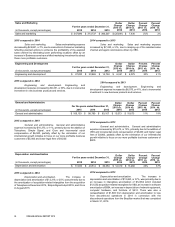

Sales and marketing expense. Sales and marketing expense

includes:

>Advertising costs, which comprise a majority of our sales and

marketing expense and include online, television, direct mail,

alternative media, promotions, sponsorships, and inbound

and outbound telemarketing.

>Creative and production costs.

>The costs to serve and track our online advertising.

>Certain amounts we pay to retailers for activation

commissions.

>The cost associated with our customer referral program.

>The personnel and related expenses of sales and marketing

employees and contractors.

>Transaction fees paid to credit card, debit card, and ECP

companies and other third party billers such as iTunes, which

may include a per transaction charge in addition to a percent

of billings charge.

>The cost of customer support and collections.

>Systems and information technology support.

Engineering and development expense. Engineering and

development expense includes:

>The personnel and related expenses of developers

responsible for new products and software engineers

maintaining and enhancing existing products.

General and administrative expense. General and

administrative expense includes:

>Personnel and related costs for executive, legal, finance, and

human resources employees and contractors.

>Share-based expense related to share-based awards to

employees, directors, and consultants.

>Rent and related expenses.

>Professional fees for legal, accounting, tax, public relations,

lobbying, and development activities.

>Acquisition related transaction and integration costs.

>Litigation settlements.

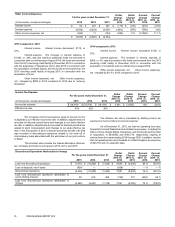

Depreciation and amortization expenses. Depreciation and

amortization expenses include:

>Depreciation of our network equipment, furniture and fixtures,

and employee computer equipment.

>Depreciation of Company-owned equipment in use at

customer premises.

>Amortization of leasehold improvements and purchased and

developed software.

>Amortization of intangible assets (developed technology,

customer relationships, non-compete agreements, patents,

trademarks and trade names).

>Loss on disposal or impairment of property and equipment.

Loss from abandonment of software assets. Loss from

abandonment of software assets include:

>Impairment of investment in software assets.

OTHER INCOME (EXPENSE)

Other Income (Expense) includes:

>Interest income on cash and cash equivalents.

>Interest expense on notes payable, patent litigation

judgments and settlements, and capital leases.

>Amortization of debt related costs.

>Accretion of notes.

>Realized and unrealized gains (losses) on foreign currency.

>Gain (loss) on extinguishment of notes.

>Realized gains (losses) on sale of marketable securities.