Vonage 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-21 VONAGE ANNUAL REPORT 2014

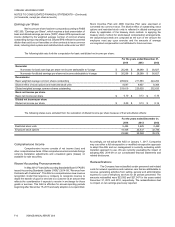

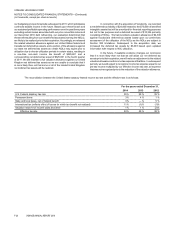

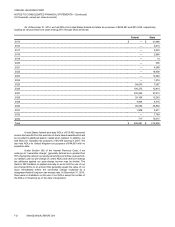

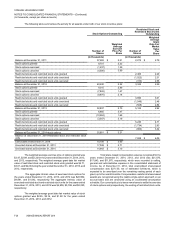

As of December 31, 2014, we had NOLs for United States federal and state tax purposes of $639,981 and $214,238, respectively,

expiring at various times from years ending 2015 through 2033 as follows:

Federal State

2015 $ — $ 21,668

2016 — 6,015

2017 — 2,433

2018 — 2,866

2019 — 14

2020 — 356

2021 — 4,388

2022 — 18,408

2023 — 12,448

2024 — 1,374

2025 84,670 7,087

2026 190,275 12,914

2027 232,525 37,213

2028 29,166 13,253

2029 4,664 4,516

2030 96,056 45,830

2031 1,908 5,371

2032 — 7,769

2033 717 10,315

Total $ 639,981 $214,238

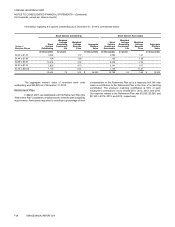

United States federal and state NOLs of $15,482 represent

excess tax benefits from the exercise of share based awards which will

be recorded in additional paid-in capital when realized. In addition, we

had NOLs for Canadian tax purposes of $4,458 expiring in 2027. We

also had NOLs for United Kingdom tax purposes of $44,853 with no

expiration date.

Under Section 382 of the Internal Revenue Code, if we

undergo an “ownership change” (generally defined as a greater than

50% change (by value) in our equity ownership over a three-year period),

our ability to use our pre-change of control NOLs and other pre-change

tax attributes against our post-change income may be limited. The

Section 382 limitation is applied annually so as to limit the use of our

pre-change NOLs to an amount that generally equals the value of our

stock immediately before the ownership change multiplied by a

designated federal long-term tax-exempt rate. At December 31, 2014,

there were no limitations on the use of our NOLs except for certain of

the NOLs of Vocalocity as of the date of acquisition.