Vonage 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

28 VONAGE ANNUAL REPORT 2014

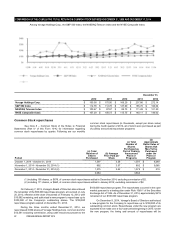

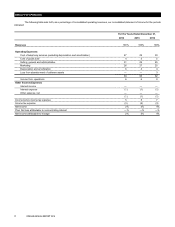

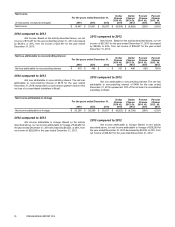

The table below includes key operating data that our management uses to measure the growth and operating performance of our business:

For the Years Ended December 31,

2014 2013 2012

Gross subscriber line additions 661,608 652,852 652,750

Change in net subscriber lines (42,065) 9,392 (15,071)

Subscriber lines (at period end) 2,470,832 2,542,926 2,359,816

Average monthly customer churn 2.6% 2.5% 2.6%

Average monthly operating revenues per line $ 28.89 $28.18 $29.89

Average monthly cost of telephony services per line $ 7.71 $8.07 $9.12

Marketing costs per gross subscriber line addition $ 341.77 $ 347.78 $325.61

Employees (excluding temporary help) (at period end) 1,400 1,243 983

Gross subscriber line additions. Gross subscriber line

additions for a particular period are calculated by taking the net

subscriber line additions during that particular period and adding to that

the number of subscriber lines that terminated during that period. This

number does not include subscriber lines both added and terminated

during the period, where termination occurred within the first 30 days

after activation. The number does include, however, subscriber lines

added during the period that are terminated within 30 days of activation

but after the end of the period.

Change in net subscriber lines. Change in net subscriber lines

for a particular period reflects the number of subscriber lines at the end

of the period, less the number of subscriber lines at the beginning of the

period.

Subscriber lines. Our subscriber lines include, as of a

particular date, all paid subscriber lines from which a customer can make

an outbound telephone call on that date. Our subscriber lines include

fax lines and soft phones but do not include our virtual phone numbers

or toll free numbers, which only allow inbound telephone calls to

customers. Subscriber lines decreased by 42,065, which excludes a

reduction of 78,949 subscriber lines associated with our extensions

product for which we discontinued charging a fee and an increase of

48,920 subscriber lines from Telesphere prior to acquisition, from

2,542,926 as of December 31, 2013 to 2,470,832, as of December 31,

2014.

Average monthly customer churn. Average monthly

customer churn for a particular period is calculated by dividing the

number of customers that terminated during that period by the simple

average number of customers during the period, and dividing the result

by the number of months in the period. The simple average number of

customers during the period is the number of customers on the first day

of the period, plus the number of customers on the last day of the period,

divided by two. Terminations, as used in the calculation of churn

statistics, do not include customers terminated during the period if

termination occurred within the first 30 days after activation. Our average

monthly customer churn increased to 2.6% for 2014 compared to 2.5%

for 2013. The increases were due primarily to the higher early life churn

rate of customers acquired through retail channels without a minimum

service requirement, including assisted selling and community sales

channels, which have increased as a percentage of our total customer

base. Our average monthly customer churn decreased sequentially

from 2.7% for the three months ended September 30, 2014 to 2.5% for

the three months ended December 31, 2014 based in large measure

on our decision to maximize customer value by focusing marketing

spend on higher return channels and away from assisted selling

channels, and was flat compared to the three months ended

December 31, 2013. We monitor churn on a daily basis and use it as

an indicator of the level of customer satisfaction. Other companies may

calculate churn differently, and their churn data may not be directly

comparable to ours. Customers who have been with us for a year or

more tend to have a lower churn rate than customers who have not. In

addition, our customers who are residential international callers

generally churn at a lower rate than residential customers who are

domestic callers. Customers with service period requirements tend to

have a lower churn rate than customers without service period

requirements. Similar trends are seen between customers obtained

through retail sales, which generally do not include service period

requirements, and those obtained through non-retail channels, which

generally do include such service period requirements. In addition,

business customers generally churn at a lower rate than residential

customers. Our churn will fluctuate over time due to economic

conditions, competitive pressures, marketplace perception of our

services, and our ability to provide high quality customer care and

network quality and add future innovative products and services.

Average monthly operating revenues per line. Average

monthly revenue per line for a particular period is calculated by dividing

our total revenue for that period by the simple average number of

subscriber lines for the period, and dividing the result by the number of

months in the period. The simple average number of subscriber lines

for the period is the number of subscriber lines on the first day of the

period, plus the number of subscriber lines on the last day of the period,

divided by two. Our average monthly revenue per line increased slightly

to $28.89 for 2014 compared to $28.18 for 2013. This increase was due

primarily to price increase and higher USF offset by discontinuation of

charging for second extensions.

Average monthly cost of telephony services per line. Average

monthly cost of telephony services per line for a particular period is

calculated by dividing our cost of telephony services for that period by

the simple average number of subscriber lines for the period, and

dividing the result by the number of months in the period. We use the

average monthly cost of telephony services per line to evaluate how

effective we are at managing our costs of providing service. The

Company has reclassified certain personnel and related costs for

network operations and customer care that are attributable to revenue

generating activities from selling, general and administrative expense

to cost of telephony services for all periods presented. Our average

monthly cost of telephony services per line decreased to $7.71 for 2014

compared to $8.07 for 2013, due primarily to the decrease in

international usage costs.

Marketing cost per gross subscriber line addition. Marketing

cost per gross subscriber line addition is calculated by dividing our

marketing expense for a particular period by the number of gross

subscriber line additions during the period. Marketing expense does not

include the cost of certain customer acquisition activities, such as

rebates and promotions, which are accounted for as an offset to

revenues, or customer equipment subsidies, which are accounted for

as cost of goods sold. As a result, it does not represent the full cost to

us of obtaining a new customer. Our marketing cost per gross subscriber

line addition decreased to $341.77 for 2014 from $347.78 in 2013, due

to changes to our retail offers aimed at enhancing customer profitability

and reducing customer churn, which resulted in a softening of gross

subscriber line additions in our consumer business, partially offset by

our investment in VBS.

Employees. Employees represent the number of personnel

that are on our payroll and exclude temporary or outsourced labor.