Vonage 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

34 VONAGE ANNUAL REPORT 2014

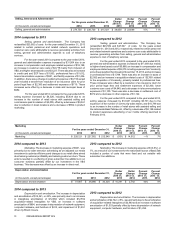

Loss from abandonment of software assets

For the years ended December 31, Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2,012

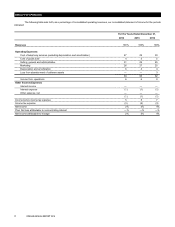

Loss from abandonment of software assets $ — $ — $ 25,262 $ — $ (25.262) —% (100)%

2014 compared to 2013

Loss from abandonment of software assets. None.

2013 compared to 2012

Loss from abandonment of software assets. The loss from

abandonment of software assets of $25,262 in 2012 was due to the

write-off of our investment in the Amdocs system, net of settlement

amounts to the Company, during the second quarter of 2012.

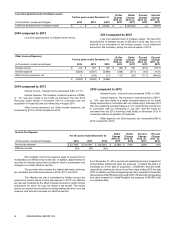

Other Income (Expense)

For the years ended December 31, Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2012

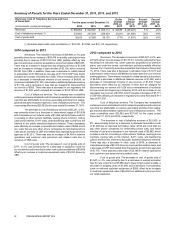

Interest income $ 212 $ 307 $109 $(95) $ 198 (31)% 182 %

Interest expense (6,823) (6,557) (5,986) (266)(571) (4)% (10)%

Other income (expense), net 11 (104)(11)115 (93)111 % (845)%

$ (6,600) $ (6,354) $ (5,888)

2014 compared to 2013

Interest income. Interest income decreased $95, or 31%.

Interest expense. The increase in interest expense of $266,

or 4%, was due mainly to the funds we borrowed from the 2013

Revolving Credit Facility in November 2013 in connection with the

acquisition of Vocalocity and our refinancing in August 2014.

Other income (expense), net. Other income (expense), net

increased by $115 in 2014 compared to 2013.

2013 compared to 2012

Interest income. Interest income increased $198, or 182%.

Interest expense. The increase in interest expense of $571,

or 10%, was due mainly to a higher principal balance on our credit

facility entered into in connection with our refinancing in February 2013

than the remaining principal balance on our credit facility entered into

in connection with our refinancing in July 2011 and the funds we

borrowed from the 2013 revolving credit facility in November 2013 in

connection with the acquisition of Vocalocity.

Other expense, net. Other expense, net increased by $93 in

2013 compared to 2012.

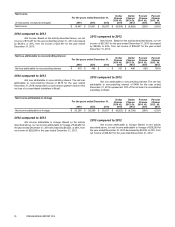

Income Tax Expense

For the years ended December 31, Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2012

Income tax expense $ (21,760) $ (18,194) $ (22,095) $ (3,566) $ 3,901 (20)% 18%

Effective tax rate 53% 39% 38%

We recognize income tax expense equal to pre-tax income

multiplied by our effective income tax rate. In addition, adjustments are

recorded for discrete period items related to stock compensation and

changes to our state effective tax rate.

The provision also includes the federal alternative minimum

tax and state and local income taxes in 2014, 2013, and 2012.

The effective tax rate is calculated by dividing income tax

expense by income before income tax expense. In 2014, our effective

tax rate was impacted by the effect of losses incurred in certain foreign

jurisdictions for which we may not realize a tax benefit. The losses

reduce our pre-tax income without a corresponding reduction in our tax

expense, and therefore increase our effective tax rate.

As of December 31, 2014, we had net operating loss carry forwards for

United States federal and state tax purposes, including the NOLs of

Vocalocity as of the date of acquisition, of $639,981 and $214,238,

respectively, expiring at various times from years ending 2013 through

2033. In addition, we had net operating loss carry forwards for Canadian

tax purposes of $4,458 expiring through 2027. We also had net operating

loss carry forwards for United Kingdom tax purposes of $44,853 with

no expiration date.