Vonage 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

33 VONAGE ANNUAL REPORT 2014

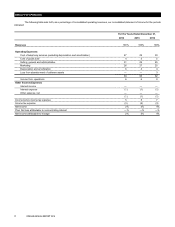

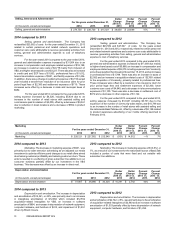

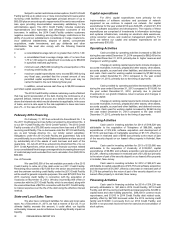

Selling, General and Administrative

For the years ended December 31,

Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2012

Selling, general and administrative $ 274,750 $ 238,720 $ 215,021 $ 36,030 $23,699 15% 11%

2014 compared to 2013

Selling, general and administrative. The Company has

reclassified $23,582 of costs for the year ended December 31, 2013

related to certain personnel and related network operations and

customer care costs attributable to revenue generating activities from

selling, general and administrative expense to cost of telephony

services.

For the year ended 2014 compared to the year ended 2013,

general and administrative expense increased by $31,504 due to an

increase in compensation and employee related expense of $18,198,

an increase in customer care costs of $2,778 mainly from inclusion of

VBS, and higher share based cost of $3,227. There was also an increase

in credit card and ECP fees of $1,063, professional fees of $1,612,

telecommunications expense of $551, and facility expense of $1,426.

In addition, there was a change in settlement expense of $3,150 as last

year included a benefit from resolution of an insurance claim for prior

period legal fees of $2,300 and settlement expenses of $715. These

increases were offset by a decrease in state and municipal taxes of

$682.

For the year ended 2014 compared to the year ended 2013,

selling expense increased by $4,526, including $5,434 due to an

increase in the number of retail stores with assisted selling and

commissions paid to retailers of $3,005, offset by a decrease of $3,361

due to reduction in kiosk locations and a decrease of $552 in product

marketing.

2013 compared to 2012

Selling, general and administrative. The Company has

reclassified $23,582 and $27,347 of costs for the years ended

December 31, 2013 and 2012, respectively, related to certain personnel

and related network operations and customer care costs attributable to

revenue generating activities from selling, general and administrative

expense to cost of telephony services.

For the year ended 2013 compared to the year ended 2012,

general and administrative expense increased by $11,058 due mainly

to higher share based cost of $5,868, an increase in compensation and

employee related expense of $9,273 including expense from Vocalocity

since the acquisition that closed on November 15, 2013, and an increase

in professional fees of $1,798. There was also an increase in taxes of

$2,082 and an increase in acquisition related costs of $2,768 related

to the acquisition of Vocalocity, primarily related to professional fees.

These increases were offset by a resolution of an insurance claim for

prior period legal fees and settlement expenses of $2,300, lower

customer care costs of $4,949, and a decrease in telecommunications

expenses of $1,100. There was also a decrease in settlement cost of

$972 and a decrease in other expense of $1,122.

For the year ended 2013 compared to the year ended 2012,

selling expense increased by $12,641 including $3,701 due to the

expansion of the number of community sales teams, and $10,749 due

to an increase in the number of retail stores with assisted selling and

the nationwide BasicTalk launch, offset by a decrease of $2,158 related

to product awareness advertising of our mobile offering launched in

February 2012.

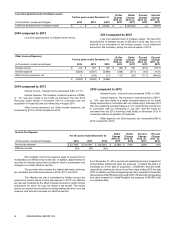

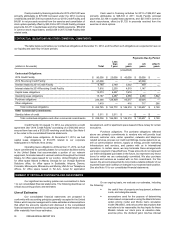

Marketing

For the years ended December 31,

Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2012

Marketing $ 226,121 $ 227,052 $ 212,540 $ (931) $ 14,512 —% 7%

2014 compared to 2013

Marketing. The decrease in marketing expense of $931, was

primarily due to lower television advertising as we adjusted our media

investment to optimize efficiency and changes to our retail offers aimed

at enhancing customer profitability and reducing customer churn. These

actions resulted in a softening of gross subscriber line additions in our

consumer business partially offset by our investment in the VBS

business. This decrease was offset by an increase in direct mail.

2013 compared to 2012

Marketing. The increase in marketing expense of $14,512, or

7%, as a result of our investment for the nationwide launch of BasicTalk

included a portion of costs that were fixed and not variable with

subscriber line additions.

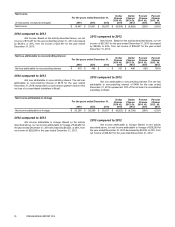

Depreciation and Amortization

For the years ended December 31, Dollar

Change

2014 vs.

2013

Dollar

Change

2013 vs.

2012

Percent

Change

2014 vs.

2013

Percent

Change

2013 vs.

2012

(in thousands, except percentages) 2014 2013 2012

Depreciation and amortization $51,407 $36,066 $33,324 $15,341 $2,742 43% 8%

2014 compared to 2013

Depreciation and amortization. The increase in depreciation

and amortization of $15,341, or 43%, was primarily due to an increase

in intangibles amortization of $12,084 which included $12,552

acquisition-related intangibles for VBS, an increase in software

amortization of $894, an increase in depreciation of network equipment,

computer hardware, and furniture of $412, and impairment of $1,951

driven by Brazil closure.

2013 compared to 2012

Depreciation and amortization. The increase in depreciation

and amortization of $2,742, or 8%, was primarily due to the amortization

of acquisition-related intangibles of $2,483 and an increase in software

amortization of $1,553 partially offset by lower depreciation of network

equipment, computer hardware, and furniture of $1,295.