Vonage 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

F-11 VONAGE ANNUAL REPORT 2014

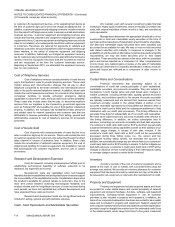

improvements are amortized over their estimated useful life of the

related assets or the life of the lease, whichever is shorter. The cost of

renewals and substantial improvements is capitalized while the cost of

maintenance and repairs is charged to operating expenses as incurred.

Company-owned customer premises equipment is depreciated on a

straight-line basis over three years.

Our network equipment and computer hardware, which

consists of routers, gateways, and servers that enable our telephony

services, is subject to technological risks and rapid market changes due

to new products and services and changing customer demand. These

changes may result in future adjustments to the estimated useful lives

or the carrying value of these assets, or both.

Software Costs

We capitalize certain costs, such as purchased software and

internally developed software that we use for customer acquisition and

customer care automation tools, in accordance with FASB ASC 350-40,

“Internal-Use Software”. Computer software is stated at cost less

accumulated amortization and the estimated useful life is two to five

years.

As previously disclosed, we experienced delays and

incremental costs during the course of the development and

implementation of a new billing and ordering system by Amdocs

Software Systems Limited and Amdocs, Inc. (collectively, "Amdocs")

and the transition of customers to the system. We conducted

discussions with Amdocs to resolve the issues associated with the billing

and ordering system. Based on these discussions, and after our

consideration of the progress made improving our overall IT

infrastructure, the incremental time and costs to develop and implement

the Amdocs system, as well as the expected reduction in capital

expenditures, in June 2012 we and Amdocs determined that terminating

the program was in the best interest of both parties. On July 30, 2012,

we entered into a Settlement Agreement with Amdocs terminating the

related license agreement. As a result, we wrote off our investment in

the system of $25,262, net of settlement amounts to us, in the second

quarter of 2012. This charge is recorded as loss from abandonment of

software assets in the statement of income.

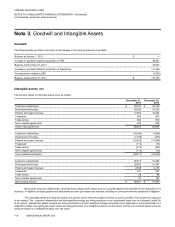

Goodwill and Purchased-Intangible Assets

Goodwill acquired in acquisition of a business is accounted

for based upon the excess fair value of consideration transferred over

the fair value of net assets acquired in the business combination.

Goodwill is tested for impairment on an annual basis on October 1st

and, when specific circumstances dictate, between annual tests. When

impaired, the carrying value of goodwill is written down to fair value. The

goodwill impairment test involves evaluating qualitative information to

determine if it is more than 50% likely that the fair value of a reporting

unit is less than its carrying value in determining if the traditional two-

step goodwill impairment test described below must be applied. The first

step, identifying a potential impairment, compares the fair value of a

reporting unit with its carrying amount, including goodwill. If the carrying

value of the reporting unit exceeds its fair value, the second step would

need to be conducted; otherwise, no further steps are necessary as no

potential impairment exists. The second step, measuring the impairment

loss, compares the implied fair value of the reporting unit goodwill with

the carrying amount of that goodwill. Any excess of the reporting unit

goodwill carrying value over the respective implied fair value is

recognized as an impairment loss. There was no impairment of goodwill

for the year ended December 31, 2014.

Purchased-intangible assets are accounted for based upon

the fair value of assets received. Purchased-intangible assets are

amortized on a straight-line or accelerated basis over the periods of

benefit, ranging from two to ten years. We perform a review of

purchased-intangible assets whenever events or changes in

circumstances indicate that the useful life is shorter than we had

originally estimated or that the carrying amount of assets may not be

recoverable. If such facts and circumstances exist, we assess the

recoverability of purchased-intangible assets by comparing the

projected undiscounted net cash flows associated with the related asset

or group of assets over their remaining lives against their respective

carrying amounts. Impairments, if any, are based on the excess of the

carrying amount over the fair value of those assets. If the useful life of

the asset is shorter than originally estimated, we accelerate the rate of

amortization and amortize the remaining carrying value over the new

shorter useful life. There was no impairment of purchased-intangible

assets identified for the years ended December 31, 2014, 2013, or 2012.

Intangible Assets and Goodwill

Intangible assets acquired in the settlement of litigation or by

direct purchase are accounted for based upon the fair value of assets

received. Goodwill acquired in acquisition of a business is accounted

for based upon the excess fair value of consideration transferred over

the fair value of net assets acquired in the business combinations.

Patents and Patent Licenses

Patent rights acquired in the settlement of litigation or by direct

purchase are accounted for based upon the fair value of assets received.

Long-Lived Assets

We evaluate impairment losses on long-lived assets used in

operations when events and changes in circumstances indicate that the

assets might be impaired. If our review indicates that the carrying value

of an asset will not be recoverable, based on a comparison of the carrying

value of the asset to the undiscounted future cash flows, the impairment

will be measured by comparing the carrying value of the asset to its fair

value. Fair value will be determined based on quoted market values,

discounted cash flows or appraisals. Impairments of property and

equipment are recorded in the statement of income as part of

depreciation expense.

Debt Related Costs

Costs incurred in raising debt are deferred and amortized as

interest expense using the effective interest method over the life of the

debt.

Noncontrolling Interest and Redeemable Noncontrolling

Interest

We consolidate a majority-owned entity where we have the

ability to exercise controlling influence. The ownership interest of the

noncontrolling party is presented as noncontrolling interest in the

Consolidated Balance Sheet as Stockholders' Equity. If we are required

to repurchase the noncontrolling interest at fair value, subject to

adjustment, under a put option or other contractual redemption

requirement, we will report the noncontrolling interest as redeemable in

the Consolidated Balance Sheets between liabilities and equity. We

adjust the redeemable noncontrolling interest to the redemption values

on each balance sheet date with changes recognized as an adjustment

to retained earnings, or in the absence of retained earnings, as an

adjustment to additional paid-in capital when it becomes probable the

noncontrolling interest will become redeemable.

Restricted Cash and Letters of Credit

We had a cash collateralized letter of credit for $3,311 and

$4,306 as of December 31, 2014 and 2013, respectively, related to lease

deposits for our Holmdel offices. In the aggregate, cash reserves and