Visa 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

-

237

-

238

-

239

-

240

-

241

-

242

-

243

-

244

-

245

-

246

-

247

-

248

-

249

-

250

-

251

-

252

-

253

-

254

-

255

-

256

-

257

-

258

-

259

-

260

-

261

-

262

-

263

-

264

-

265

-

266

-

267

-

268

-

269

-

270

-

271

-

272

-

273

-

274

-

275

-

276

-

277

-

278

-

279

-

280

-

281

-

282

-

283

-

284

-

285

-

286

-

287

-

288

-

289

-

290

-

291

-

292

-

293

-

294

-

295

-

296

-

297

-

298

-

299

-

300

-

301

-

302

-

303

-

304

-

305

-

306

-

307

-

308

-

309

-

310

-

311

-

312

-

313

-

314

-

315

-

316

-

317

-

318

-

319

-

320

-

321

-

322

-

323

-

324

-

325

-

326

-

327

-

328

-

329

-

330

-

331

-

332

-

333

-

334

-

335

-

336

-

337

-

338

Visa Inc. (V)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 11/21/2008

Filed Period 09/30/2008

Table of contents

-

Page 1

Visa Inc.

(V)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 11/21/2008 Filed Period 09/30/2008

-

Page 2

...using the New York Stock Exchange closing price as of March 31, 2008, the last business day of the registrant's most recently completed second fiscal quarter) was approximately $27.9 billion. There is currently no established public trading market for the registrant's class B common stock, par value...

-

Page 3

... Supplementary Data Item 9 Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Item 9A Controls and Procedures Item 9B Other Information PART III Item 10 Directors, Executive Officers and Corporate Governance Item 11 Executive Compensation Item 12 Security Ownership...

-

Page 4

... reorganization and our initial public offering; projections as to the future trends in the electronic payments industry, as well as our corresponding business strategies and the expected benefits derived from such strategies; statements regarding our relationships with customers and expectations as...

-

Page 5

... card usage and merchant acceptance; we offer a wide range of branded payments product platforms, which our customers use to develop and offer credit, debit, prepaid and cash access programs for cardholders (individuals, businesses and government entities); we provide transaction processing services...

-

Page 6

...provide. Payments volume is the total monetary value of transactions for goods and services purchased with our cards, as reported by our customers. Cash volume generally includes cash access transactions, balance transfers and convenience check transactions associated with our products. Total volume...

-

Page 7

... personal checks, money orders, government checks, travelers cheques, official checks and other paper-based means of transferring value; card-based payments-credit cards, charge cards, debit cards, deferred debit cards, ATM cards, prepaid cards, private label cards and other types of general-purpose...

-

Page 8

...and acquirers, which are the financial institutions that offer Visa network connectivity and payments acceptance services to merchants. In addition, we offer a range of value-added processing services to support our customers' Visa programs and to promote the growth and security of the Visa payments...

-

Page 9

... a later point in time containing additional data required for clearing and settlement.

Authorization A typical Visa transaction begins when the cardholder presents his or her Visa card to a merchant as payment for goods or services. The transaction information is then transmitted electronically to...

-

Page 10

...merchant are located in the same country) in certain other countries, as well as all cross-border transactions, involving products carrying our brands. Domestic transactions that we do not process are generally processed by government-controlled payments networks, our financial institution customers...

-

Page 11

... to Visa transaction data, electronic transfer of substantiating documents and automated management of communications between issuers and acquirers. Value-Added Information Services. We provide our customers with a range of additional information-based business analytics and applications, as well as...

-

Page 12

... merchant clients. Our principal payment platforms enable credit, charge, deferred debit, debit and prepaid payments, as well as cash access, for consumers, businesses and government entities. Our payment platforms are offered under our Visa, Visa Electron, Interlink and PLUS brands. Consumer Credit...

-

Page 13

...processing of checks by taking advantage of Visa's efficient electronic payments processing. Cash Access Our customers can provide global cash access to their cardholders by issuing products accepted at Visa and PLUS branded ATMs. Most Visa and Visa Electron branded cards offer customers cash access...

-

Page 14

... We invest in the development and enhancement of payment product platforms with the goal of increasing the migration of consumer and business spending to electronic payments. We believe that innovation results in more secure and versatile payment program options for customers, merchants and...

-

Page 15

... to our operating rules and interchange rates to enhance the value of our payments network compared to other forms of payment. In the United States, for example, the Visa Small Ticket Payment Service provides a special interchange rate category and No Signature Required programs eliminate the...

-

Page 16

... use of our brands and trademarks, the standards, design and features of payment cards and programs, merchant acquiring activities, including acceptance standards applicable to merchants, use of agents, disputes between members, risk management, guaranteed settlement, customer financial failures and...

-

Page 17

...of interchange rates benefits consumers, merchants, our customers and us by promoting the overall growth of our payments network in competition with other payment card systems and other forms of payment, and creating incentives for innovation, enhanced data quality and security. Interchange fees and...

-

Page 18

... checks), card-based payments (including credit, charge, debit, ATM, prepaid, private-label and other types of general purpose and limited use cards) and other electronic payments (including wire transfers, electronic benefits transfers, automatic clearing house, or ACH, payments and electronic data...

-

Page 19

...competitors, including American Express and Discover, operate closed-loop systems. Closed-loop systems can benefit from direct access to consumer and merchant information, and they tend to have greater control over cardholder service than do operators of open-loop payments networks, like Visa, which...

-

Page 20

... of states have proposed bills that purport to limit interchange fees or merchant discount rates or to prohibit their application to portions of a transaction. In addition, the Merchants Payments Coalition, a coalition of trade associations representing businesses that accept credit and debit cards...

-

Page 21

... to increased costs and decreased payments volume and revenues." We and our customers are subject to regulations related to privacy, data use and security in the jurisdictions in which we do business. For example, in the United States, our customers are subject to the banking regulators' information...

-

Page 22

... rules to address credit and operational risks or new criteria for customer participation and merchant access to our payments system. In addition, outside of the United States, a number of jurisdictions have implemented legal frameworks to regulate their domestic payments systems. For example...

-

Page 23

... issue Visa cards to cardholders, by acquirers, which are the financial institutions that offer Visa network connectivity and payments acceptance services to merchants, in connection with transactions initiated with cards in our payments system. We set default interchange rates in the United States...

-

Page 24

... of states have proposed bills that purport to limit interchange fees or merchant discount rates or to prohibit their application to portions of a transaction. In addition, the Merchants Payments Coalition, a coalition of trade associations representing businesses that accept credit and debit cards...

-

Page 25

... or other forms of payment more attractive. Issuers could also begin to charge higher fees to consumers, thereby making our card programs less desirable and reducing our transaction volumes and profitability. Acquirers could elect to charge higher merchant discount rates to merchants, regardless of...

-

Page 26

...California state law, and ordered Visa U.S.A. and Visa International to require their members to disclose the currency conversion process to cardholders in cardholder agreements, applications, solicitations and monthly billing statements. The judge also ordered unspecified restitution to credit card...

-

Page 27

... based on a federal merchant class action lawsuit that Visa U.S.A. settled in 2003, alleging unlawful "tying" of credit and debit card services, attempted monopolization and other state law competition claims; a case brought by the European Commission against Visa International and Visa Europe...

-

Page 28

... Certain limitations have been placed on our business in recent years as a result of litigation and litigation settlements. For example, as a result of the June 2003 settlement of a U.S. merchant lawsuit against Visa U.S.A., merchants are able to reject Visa consumer debit cards in the United States...

-

Page 29

...

MasterCard-branded debit cards and has repaid to Visa U.S.A. any unearned benefits or financial incentives under its Visa U.S.A. agreement. The settlement service fee bylaw was rescinded as of the effective date of the order. See Note 23-Legal Matters to our consolidated financial statements...

-

Page 30

... the number of payment cards issued, our payments volume and revenues. We and our customers are subject to regulations related to privacy and data use and security in the jurisdictions in which we do business, and we could be adversely affected by these regulations. For example, in the United States...

-

Page 31

... new settlement procedures or other operational rules to address credit and operational risks or new criteria for member participation and merchant access to our payments system. Any of these developments could make it more costly to operate our business. Our framework agreement with Visa Europe...

-

Page 32

... against all forms of payment, including cash, checks and electronic transactions such as wire transfers and automated clearing house payments. In addition, our payment programs compete against the card- based payments systems of our competitors, such as MasterCard, American Express, Discover and...

-

Page 33

...services that permit direct debit of consumer checking accounts or ACH payments, may increase.

Our failure to compete effectively against any of the foregoing competitive threats, could materially and adversely affect our revenues, operating results, prospects for future growth and overall business...

-

Page 34

... with our customers and their relationships with cardholders and merchants to support our programs and services. We do not issue cards, extend credit to cardholders or determine the interest rates (if applicable) or other fees charged to cardholders using cards that carry our brands. Each issuer...

-

Page 35

... increases in interest rates in key countries in which we operate, may adversely affect our financial performance by reducing the number or average purchase amount of transactions involving payment cards carrying our brands. In addition, the current economic environment could lead some customers to...

-

Page 36

...an interruption in service, increased costs or the compromise of data security. Additionally, we rely on service providers for the timely transmission of information across our global data network. If a service provider fails to provide the communications capacity or services we require, as a result...

-

Page 37

... business and the global perception of the Visa brand could be impaired. Visa Europe currently has a regionally controlled processing platform. In June 2006, Visa Europe began operating an authorization system that is separate from ours and Visa Europe plans to begin operating a transaction clearing...

-

Page 38

... change to our governance structure could have a material adverse effect on our business relationships with our customers. Prior to our reorganization in October 2007, a number of Visa's key members had officers who also served on the boards of directors of Visa U.S.A., Visa International, Visa...

-

Page 39

... new brands, payment processing characteristics, products, services, risk management standards, processes for resolving disputes among its members or merchant acceptance profiles that are inconsistent with the operating rules that we apply in the rest of the world. If we want to change a global rule...

-

Page 40

... of the put option would require us to integrate the operations of Visa Europe into our business, which could divert the time and attention of senior management. The fair value of the put option at September 30, 2008 was $346 million. We are required to record any change in the fair value of the put...

-

Page 41

... of our common stock to sell equity securities in the future. As of October 31, 2008, we had 446,503,244 outstanding shares of class A common stock, not including 1,247,719 shares of restricted stock that we granted to certain of our directors and employees. Except for any shares acquired by our...

-

Page 42

...the opinion of our special tax counsel does not apply to the extent that the fair market value of our common stock received by a member of Visa International or by a member of Visa U.S.A. pursuant to the reorganization and the true-up (whether received on the date of closing of the reorganization or...

-

Page 43

... account and are released back to us, the resulting adjustment in the conversion rate of the class B common stock will result in each share of class B common stock then outstanding becoming convertible into an increased number of shares of class A common stock, which in turn will result in dilution...

-

Page 44

...a Visa member, an affiliate of a Visa member or any person that is an operator, member or licensee of any general purpose payment card system that competes with the Company, or any affiliate of such a person. Upon such transfer, each share of class C common stock will convert into one share of class...

-

Page 45

..., no person may own more than 15% of our total outstanding shares on an as-converted basis or more than 15% of any class or series of our common stock, unless our board of directors approves the acquisition of such shares. In addition, except for common stock issued to a member in connection with...

-

Page 46

... of office and processing center space in 30 countries around the world, of which approximately 1.4 million square feet are owned and the remaining 800,000 square feet are leased. Our corporate headquarters is located in the San Francisco Bay Area and consists of four buildings that we own, totaling...

-

Page 47

...Purchases of Equity Securities

Price Range of Common Stock Our Class A common stock commenced trading on the New York Stock Exchange under the symbol "V" on March 19, 2008. The following table sets forth the intra-day high and low sale prices for our class A common stock from March 19, 2008 and for...

-

Page 48

... Plan to our consolidated financial statements included in Item 8 of this report for additional information. In October of 2008, we redeemed 79,748,857 shares of class C (series II) common stock and 35,263,585 shares of our class C (series III) common stock held by Visa Europe for a combined total...

-

Page 49

...report. The table also presents consolidated pro-forma statement of operations data for the year ended September 30, 2007 and consolidated balance sheet data at October 1, 2007 (the date of the business combination discussed below). The selected Visa U.S.A. consolidated statements of operations data...

-

Page 50

...millions except per share data)

Balance Sheet Data (at end of period): Cash and cash equivalents Short-term investment securities, available-for-sale Total current assets Long-term investment securities, available-for-sale Total assets Current portion of long-term debt(3) Current portion of accrued...

-

Page 51

...of our business. Payments volume is the primary basis for service fee revenue. Payments volume is the total monetary value of transactions for goods and services that are purchased with cards bearing our brands. Transactions processed by VisaNet are the primary basis for data processing revenue. The...

-

Page 52

...financial services brand. We provide financial institutions with platforms that encompass consumer credit, debit, prepaid and commercial payments. We facilitate global commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses and government...

-

Page 53

...enhance Visa's brand position as global commerce and information sharing are increasingly conducted over internet and mobile platforms. Money Transfer. Individual and business consumers across the globe transfer money daily to conduct day-to-day business. Our Money Transfer product provides a secure...

-

Page 54

... processed transactions are the basis for data processing fees. Current period service fees are generated from payments volume on Visa-branded cards for goods and services in the preceding quarter, exclusive of PIN-based debit volume. Payments volume and revenues are impacted by changes in currency...

-

Page 55

... Plan to our consolidated financial statements included elsewhere in this report for additional information. The increase in our operating margin during 2008 is primarily attributable to growth in operating revenues resulting from pricing changes and new fees. Impact of Foreign Currency Rates...

-

Page 56

...74 million in share-based compensation cost during fiscal 2008. Visa Europe put option. We granted Visa Europe the option to cause the sale of Visa Europe to us. We will record any change in the fair market value of this option in our consolidated statement of operations. Changes in the value of the...

-

Page 57

... on payments volumes reported by our customers for the twelve months ended June 30, 2007. These actual and pro forma payments volumes also do not include cash disbursements obtained with Visa-branded cards, balance transfers or convenience checks, which we refer to as cash volume. New service fees...

-

Page 58

... institution customers, merchants and other business partners for various programs designed to build payments volume, increase card issuance and product acceptance and increase Visa-branded transactions. These contracts, which range in term from one to 13 years, provide incentives based on payments...

-

Page 59

... promotion over the terms of the agreements. Visa International Fees Prior to the reorganization, Visa U.S.A. paid fees to Visa International based on payments volumes, exclusive of PIN-based debit volume, for services primarily related to global brand management, global product enhancements...

-

Page 60

...income also includes cash dividends received from other cost and equity method investments. Other non-operating income Other non-operating income relates to the change in fair value of the liability under the framework agreement with Visa Europe. Visa Inc. Fiscal 2008 compared to Visa Inc. Pro Forma...

-

Page 61

... business and leisure travel, in the near term. The following table sets forth the components of our actual and pro forma total operating revenues.

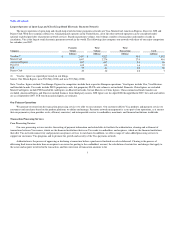

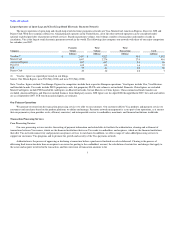

Fiscal Year ended September 30, Visa Inc. 2008 Pro Forma 2007 $ Change % Change

(in millions, except percentages)

Service fees Data processing fees...

-

Page 62

... fees Payments volume on Visa-branded cards for goods and services in the preceding quarter, exclusive of PIN-based debit volume, is the basis for service fees. Payments volume increased $388.3 billion, or 17%, to $2.7 trillion for the twelve months ended June 30, 2008, compared to the prior year...

-

Page 63

...our Cardholder Information Security Program for acquirers whose merchants have not yet met compliance standards. Volume and support incentives The increase in volume and support incentives in the current period was primarily attributable to unusually lower levels of contra revenue recorded in fiscal...

-

Page 64

... actual and pro forma operating expenses.

Fiscal Year ended September 30, Visa Inc. 2008 Pro Forma 2007 % $ Change Change

(in millions, except percentages)

Personnel Network, EDP and communications Advertising, marketing and promotion Professional and consulting fees Depreciation and amortization...

-

Page 65

.... The remainder of the increase primarily reflects an increase in fees for debit processing services related to processing transactions through non-Visa networks. Advertising, marketing and promotion The decrease in advertising, marketing and promotion expense in fiscal 2008 was primarily driven by...

-

Page 66

... II) and class C (series III) common stock which took place in October 2008. Other non-operating income Other non-operating income in fiscal 2008 reflects a change in the fair market value of our liability under the Framework Agreement with Visa Europe due to changes in the LIBOR interest rate. See...

-

Page 67

...$ Change 2008 2007

% Change 2008 2007 vs. 2006

Visa Inc. 2008

Visa U.S.A. 2007

Visa U.S.A. 2006

vs. 2007

vs. 2006 vs. 2007

(in millions, except percentages)

Service fees Data processing fees International transaction fees Other revenues Volume and support incentives Total Operating Revenues...

-

Page 68

... international transactions in April 2008. As noted above, we expect that current worldwide turbulence in the financial and credit markets will moderate discretionary spending, and the rate of cross-border business and leisure travel, in the near term. Other revenues The increase in other revenues...

-

Page 69

... detection product and additional revenues from Visa U.S.A.'s debit processing services related to non-Visa network transactions offset the continued impact of higher volume-based discounts resulting from consolidation and transaction growth among customers. Of the total data processing fees, $122...

-

Page 70

... Year ended September 30, 2008 Visa Inc. 2008 Visa U.S.A. 2007 Visa U.S.A. 2006 vs. 2007 $ Change 2007 vs. 2006 % Change 2008 2007 vs. 2007 vs. 2006

(in millions, except percentages)

Personnel Network, EDP and communications Advertising, marketing and promotion Visa International fees Professional...

-

Page 71

... Extras reward program. These increases were offset by the absence of $67 million of costs incurred during fiscal 2007 to support certain joint promotional campaigns with financial institution customers which did not recur during fiscal 2008. Visa International fees Visa International fees ceased as...

-

Page 72

...

Fees for data processing services related to processing transactions through non-Visa networks would be expected to grow over time as the worldwide migration from paper-based to electronic payments continues. Advertising, marketing and promotion The increase in advertising, marketing and promotion...

-

Page 73

... without receiving future benefits, Visa U.S.A. charged the present value of the total payments to its consolidated statements of operations in fiscal 2006.

Litigation provision Litigation provision increased $2.6 billion reflecting a $1.9 billion provision related to settlement of outstanding...

-

Page 74

... II) and class C (series III) common stock which took place in October 2008. Other non-operating income Other non-operating income in fiscal 2008 reflects a change in the fair market value of our liability under the Framework Agreement with Visa Europe due to changes in the LIBOR interest rate. See...

-

Page 75

...Visa U.S.A.'s 23% for the year ended September 30, 2007. The increase in the effective tax rate is primarily due to tax reserves related to litigation, and the combined effect of the loss of the California special deduction after the IPO, the change in state tax apportionment, and a one-time benefit...

-

Page 76

... benefits related to Visa U.S.A.'s plans to outsource certain data processing and development support functions. Liquidity and Capital Resources Management of Our Liquidity Prior to our reorganization, Visa U.S.A., Visa International and Visa Canada each managed their own short-term and long-term...

-

Page 77

...

September 30, 2008 (Visa Inc.) October 1, 2007 (Visa Inc.) (in millions) September 30, 2007 (Visa U.S.A.)(1)

Cash and cash equivalents Current portion of restricted cash-litigation escrow Short-term investment securities, available-for-sale Total current assets Long-term restricted cash-litigation...

-

Page 78

...-currency transactions in our net settlement balances. This use of cash represents the net of the increases in settlement receivable and increases in settlement payable during fiscal 2008; • • Use of cash reflecting annual compensation benefit payments, offset by accruals for current fiscal year...

-

Page 79

... and due to issuing and acquiring customers, to pay off debt (including litigation settlements), to make planned capital investments in our business, to pay dividends and repurchase our shares at the discretion of the our board of directors, and to invest excess cash in securities that we believe...

-

Page 80

... Guarantee Program for Money Market Funds announced by the United States Treasury on September 29, 2008. The liquidity of our investment portfolio is subject to uncertainties that are difficult to predict. Factors that may impact liquidity include changes to credit ratings of the securities as well...

-

Page 81

... Federal Funds Rate plus 0.5% or the Bank of America prime rate; (2) Eurocurrency Advance, which will bear interest at a rate equal to LIBOR (as adjusted for applicable reserve requirements) plus an applicable cost adjustment and an applicable margin of 0.11% to 0.30% based on our credit rating; or...

-

Page 82

... credit and debit transactions and the timing of payments settlement between financial institution customers with settlement currencies other than the U.S. dollar. These settlement receivables and payables generally remain outstanding for one to two business days, consistent with standard market...

-

Page 83

... class C common stock will share ratably on an as-converted basis in such future dividends. Visa Europe put-call option agreement. We have granted Visa Europe a put option which, if exercised, will require us to purchase all of the outstanding shares of capital stock of Visa Europe from its members...

-

Page 84

... 2009. Upon completion, we will migrate our current east coast data center to this new facility. The new data center is intended to support our technology objectives related to reliability, scalability, security and new product development. At September 30, 2008, we had incurred total costs of $264...

-

Page 85

... as required by United Kingdom property law under the existing lease. In the event of a default by VESI, Visa International is obligated to make lease payments. The base rent commitment is £8 million each year or $14 million in U.S. dollars (based on the September 30, 2008 exchange rate). VESI...

-

Page 86

... programs designed to build sales volume and increase payment product acceptance. These agreements, which range in term from one to 13 years, provide card issuance, marketing and program support based on specific performance requirements. Payments under these agreements will be offset by revenues...

-

Page 87

... agreements with Visa Europe, a holder of our class C common stock, which allow each entity to provide services to the other at negotiated fees, including the allocation of costs for office premises which are shared by us and Visa Europe. For fiscal 2008, total operating revenues and operating...

-

Page 88

...

Revenue Recognition-Volume and Support Incentives We enter into incentive agreements with financial institution customers, merchants and other business partners to build payments volume and to increase product acceptance. Certain volume and support incentives are based on performance targets...

-

Page 89

..., 2008, it does not represent the actual purchase price that we may be required to pay if the option was exercised, which would likely be significantly in excess of this amount. Fair Value-Goodwill and Intangibles The purchase method of accounting for business combinations and associated impairment...

-

Page 90

... of a number of factors, including the competitive environment, market share, customer history and macroeconomic factors. We determined that our brand and customer relationships intangible assets have indefinite lives, based on our significant market share, history of strong revenue and cash...

-

Page 91

... of FASB Statement No. tax benefits of $317 million and $857 million, 109" required us to inventory, evaluate and measure all uncertain tax respectively, associated with the settlement of the positions taken or to be taken on tax returns, and to record liabilities for American Express litigation and...

-

Page 92

... 2008, we elected the fair value option for certain investment securities which are held in connection with employee compensation plans. These securities will be reported as trading securities with changes in fair value recorded as other income (expense) on our consolidated statements of operations...

-

Page 93

... 03-6-1 requires companies to treat unvested share-based payment awards that have non-forfeitable rights to dividend or dividend equivalents as a separate class of securities in calculating earnings per share. FSP EITF 03-6-1 is effective for fiscal years beginning after December 15, 2008; earlier...

-

Page 94

... the timing of rate setting for settlement with customers relative to the timing of market trades for balancing currency positions. The foreign currency exchange risk in settlement activities is limited through daily operating procedures, including the utilization of Visa settlement systems and our...

-

Page 95

... point increase or decrease in rates would have impacted the fair value of these notes by approximately $2 million at September 30, 2008. Equity Price Risk We own equity securities which are selected to offset obligations in connection with our long-term incentive and deferred compensation plans...

-

Page 96

...the value of pension plan assets could result in increases to our pension liability and a reduction to stockholders' equity due to an increase in the underfunded status of the plan, increases in pension expense due to a decline in the expected rate of return on plan assets, and increases in required...

-

Page 97

... Data VISA INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Page

VISA INC. As of September 30, 2008 and 2007 and for the years ended September 30, 2008, 2007 and 2006 Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations...

-

Page 98

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was...

-

Page 99

... statements of operations, changes in stockholders' equity, comprehensive income, and cash flows for each of the years in the two-year period ended September 30, 2007 are those of Visa U.S.A, the accounting acquirer in the reorganization. /s/ KPMG LLP San Francisco, California November 17, 2008...

-

Page 100

... BALANCE SHEETS

September 30, 2008 September 30, 2007(1)

(in millions, except share data)

Assets Cash and cash equivalents Restricted cash-litigation escrow Investment securities, available-for-sale Settlement receivable Accounts receivable Customer collateral Current portion of volume and support...

-

Page 101

..., except share and par value data)

Temporary Equity and Minority Interest Class C (series II) common stock, $0.0001 par value, 218,582,801 shares authorized, 79,748,857 shares issued and outstanding $ at September 30, 2008, net of subscription receivable Minority interest Total temporary equity...

-

Page 102

...

VISA INC. CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended September 30, 2008 2007(1) (in millions except per share data) 2006(1)

Operating Revenues Service fees Data processing fees International transaction fees Other revenues Volume and support incentives Total operating revenues...

-

Page 103

... of Contents

VISA INC. CONSOLIDATED STATEMENTS OF OPERATIONS-(Continued)

For the Year Ended September 30, 2008 2007(1) (in millions except per share data) 2006(1)

Basic weighted average shares outstanding (Note 17)(2) Class A common stock Class B common stock Class C (series I) common stock Class...

-

Page 104

Table of Contents

VISA INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

Common Stock Class C (series III Additional Treasury Accumulated Class C Class C and Paid in Income Class A Class B (series I) (series II) series IV) Capital Stock (Deficit) Balance as of September 30, 2005(1) ...

-

Page 105

... Class A common stock Class B common stock Class C (series I, III, IV) common stock Class C (series II) common stock Impact of cash dividend declaration on class C (series II) common stock (Note 16) Special IPO dividends received from cost-method investees (Note 16) Balance as of September 30, 2008...

-

Page 106

...

VISA INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the Years Ended September 30, 2008 2007(1) (in millions) 2006(1)

Net income (loss) Other comprehensive (loss) income, net of tax: Investment securities, available-for-sale Net unrealized (loss) gain Income tax effect Reclassification...

-

Page 107

...intangibles, investments, debt issuance costs and accretion of member deposits Share-based compensation (Note 18) Fair value adjustment for liability under the framework agreement (Note 4) Interest earned on litigation escrow, net of tax Net recognized loss (gain) on investment securities, including...

-

Page 108

...payments on capital lease obligations Net cash provided by (used in) financing activities Effect of exchange rate changes on cash and cash equivalents Increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Disclosure...

-

Page 109

..., prepaid and commercial payments. VisaNet, a secure, centralized, global processing platform, enables Visa Inc. to provide financial institutions and merchants with a wide range of product platforms, transaction processing and related value-added services. The Company does not issue cards, set fees...

-

Page 110

...of operations of the Company beginning October 1, 2007. Initial Public Offering In March 2008, the Company completed its initial public offering (the "IPO"), issuing 446,600,000 shares of class A common stock at an IPO price of $44 per share. The Company closed the transaction on March 25, 2008. The...

-

Page 111

...year from the balance sheet date are considered noncurrent assets. The Company classifies its debt and marketable equity securities as available-for-sale to meet investment objectives such as liquidity management and to promote business and strategic objectives. These securities are recorded at cost...

-

Page 112

... influencing the investment, expectations of the entity's cash flows and capital needs, and the viability of its business model. Settlement receivable and payable-The Company operates systems for clearing and settling customer payment transactions. Net settlements are generally cleared within one...

-

Page 113

... values as reported on the Company's consolidated balance sheets. Customer collateral-The Company holds cash deposits and other noncash assets from certain customers in order to ensure their performance of settlement obligations arising from credit, debit and travelers cheque product clearings...

-

Page 114

... to signing or renewing long-term contracts in instances where the Company receives a performance commitment, from the customer, to generate a substantial portion of its credit or debit card payments volume on Visa branded products for an agreed upon period of time. Incentives are accrued based on...

-

Page 115

... payments by customers with respect to their card programs carrying marks of the Visa brand. Service fees are based principally upon spending on Visa-branded cards for goods and services as reported on financial institution customers' quarterly operating certificates. Current quarter service fees...

-

Page 116

...Other revenues include fees earned from Visa Europe in connection with the Visa Europe Framework Agreement (see Note 4-Visa Europe), optional card enhancements, such as extended cardholder protection and concierge services, cardholder services and other services provided to customers. Other revenues...

-

Page 117

... the present value of its future benefit obligations. The discount rate is based on matching the duration of a pool of high quality corporate bonds to the expected benefit payment stream. To determine the expected long-term rate of return on pension plan assets, the Company considers the current and...

-

Page 118

... rate and the value at current market rates, and generally reflects the estimated amounts that the Company would receive or pay to terminate the contracts at the reporting date based on broker quotes for the same or similar instruments. Share-based compensation-The Company accounts for share-based...

-

Page 119

... and upon adoption on October 1, 2008 will elect the fair value option for certain equity securities and report them as trading assets with changes in fair value recorded in other income (expense) on the consolidated statement of operations. See Note-6 Investments. The adoption of SFAS 159 is...

-

Page 120

... and in exchange for the interests held in Visa U.S.A., Visa International, Visa Canada and Inovant, the Company authorized and issued to Visa Europe and the financial institution member groups of the participating regions the following shares of common stock (in whole numbers):

Shares Issued in the...

-

Page 121

... 4-Visa Europe for more information related to the Visa Europe put option and the liability under framework agreement. Visa Inc. Common Stock Issued in Exchange for the Acquired Regions

$ 16,785 346 132 17,263 1,150 $ 18,413

The value of the purchase consideration conveyed to each of the member...

-

Page 122

... Shares. Visa Inc. Common Stock Issued to Visa Europe Visa Europe remained a separate entity owned and governed by its European member banks. Under the terms of the reorganization, Visa Europe exchanged its membership interest in Visa International and Inovant for a put-call option agreement...

-

Page 123

... closing date of March 31, 2008 and the applicable three-month London Interbank Offered Rate ("LIBOR") rate at September 30, 2007 of 5.23%. See Note 4-Visa Europe for more information related to the liability under the framework agreement. Fair Value of Assets Acquired and Liabilities Assumed Total...

-

Page 124

... Non-current liabilities Pension and post-retirement benefits Long-term debt Intangible assets Tradename Customer relationships Visa Europe franchise right Goodwill Net assets acquired The following table reflects activity related to goodwill from September 30, 2007 to September 30, 2008:

$

1,733...

-

Page 125

... data) Fiscal 2007

Operating Revenues Service fees Data processing fees International transaction fees Other revenues Volume and support incentives Total operating revenues Operating Expenses Personnel Network, EDP and communications Advertising, marketing and promotion Professional and consulting...

-

Page 126

... basis into shares of class C (series II) common stock. On March 19, 2008, the Company issued 51,844,393 additional shares of class C (series II) stock at a price of $44 per share in exchange for a subscription receivable from Visa Europe. This issuance and subscription receivable were recorded as...

-

Page 127

.... As a result, in accordance with Emerging Issues Task Force ("EITF") Topic D-98, "Classification and Measurement of Redeemable Securities," in March 2008, the Company reclassified all outstanding shares of the class C (series II) common stock at its then fair value of $1.125 billion to temporary or...

-

Page 128

...and that applicable to Visa Europe on a stand alone basis at the time of exercise and the estimated growth of Visa Europe's sustainable net operating income. These key inputs are unobservable. The Company determined that the call option contained in the put-call option agreement has nominal value at...

-

Page 129

... with changes in fair value reflected in Visa Inc.'s consolidated statement of operations under the guidelines of SFAS 133. During the year ended September 30, 2008, the Company made adjustments to its liability under the framework agreement as follows:

Fiscal 2008 (in millions)

Balance at...

-

Page 130

... clearing and settlement system services within Visa Europe's region. In addition, the parties share foreign exchange revenues related to currency conversion for transactions involving European cardholders as well as other cross-border transactions that take place in Visa Europe's region until Visa...

-

Page 131

... approximately 0.71 shares of class A common stock for each share of class B common stock. The escrow funds are held in money market investments with the income earned, less the applicable taxes, classified as short term and long term restricted cash on the Company's consolidated balance sheet. The...

-

Page 132

...applicable taxes Balance at September 30 (1) See Note 23-Legal Matters for additional information about the American Express settlement.

$

$

- 3,000 (1,085) 13 1,928

The Company, at the request of the litigation committee, may conduct additional sales of class A common stock in order to increase...

-

Page 133

... Contents

VISA INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) September 30, 2008 (in millions, except as noted) Note 6-Investments Available-for-Sale Investments Available-for-sale investment securities, which are recorded at fair value, consist of debt securities issued by governments...

-

Page 134

... rate securities at September 30, 2008 was $13 million. Other Investments At September 30, 2008, investments accounted for under the cost and equity methods totaled $592 million, of which $565 million were acquired in the reorganization from Visa International and were recorded at their fair value...

-

Page 135

...

- 205 40 - 26 271

September 30, 2008 (in millions)

September 30, 2007

Other investments Long-term prepaid expenses Other Total

$

$

592 $ 29 13 634 $

4 41 46 91

The money market investment represents the estimated fair value of the Company's investment in the Reserve Primary Fund (the "fund...

-

Page 136

...defendant banks as part of the American Express settlement agreement (see Note 23-Legal Matters). The balance was received from the co-defendant banks, and paid to American Express in March of 2008. The Company acquired a significant portion of its other investments portfolio from Visa International...

-

Page 137

... the value of the Visa brand utilized in Canada and the unincorporated regions of Visa International. Visa Europe franchise right represents the value of the right to franchise the use of the Visa brand, use of Visa technology and access to the overall Visa network in the Visa Europe region...

-

Page 138

... Europe put option-(See Note 4-Visa Europe) Accrued income taxes-(See Note 22-Income Taxes) Employee benefits Other Total Note 11-Debt The Company had outstanding debt as follows:

$

$

346 122 99 46 613 $

- - 80 45 125

September 30 , 2008

September 30, 2007

(in millions)

4.64% Senior secured...

-

Page 139

...based on credit ratings for similar notes. 2002 Senior Secured Notes In December 2002, Visa U.S.A. issued $200 million in series A and B senior secured notes with maturity dates of five and ten years. The notes are collateralized by the Company's Colorado facility, which consists of two data centers...

-

Page 140

... general corporate purposes. This program allows the Company to issue up to $500 million of unsecured debt securities, with maturities up to 270 days from the date of issuance and at interest rates generally extended to companies with comparable credit ratings. At September 30, 2008, the Company had...

-

Page 141

... up the commercial paper program and for general corporate purposes. Loans under the five-year facility may be in the form of: (1) Base Rate Advance, which will bear interest at a rate equal to the higher of the Federal Funds Rate plus 0.5% or the Bank of America prime rate; (2) Eurocurrency Advance...

-

Page 142

... service (credit)/cost Total Adoption of New Accounting Standard

$ $

43 (43) -

$ $

6 (4) 2

At September 30, 2007, the Company adopted the provisions of Statement of Financial Accounting Standard No. 158 (SFAS 158), Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans...

-

Page 143

... Service cost Interest cost Plan amendments Actuarial (gain)/loss Settlements Benefit payments Effect of change in measurement date Benefit obligation-end of year Accumulated benefit obligation Change in Plan Assets: Fair value of plan assets-beginning of year Actual return on plan assets Company...

-

Page 144

... (in millions)

Pension Benefits

Actuarial (gain)/loss Prior service (credit)/cost Total

$ $

13 (8) 5

$ $

- (3) (3)

The benefit obligation and fair value of plan assets for pension and postretirement plans with obligations in excess of plan assets at September 30, 2008 and 2007 are as follows...

-

Page 145

... Benefits Fiscal 2008 2007 2006 2008 (in millions) 2007 2006 Postretirement Benefits

Service cost Interest cost Expected return on assets Amortization of: Prior service (credit)/cost Actuarial loss Net periodic pension cost Curtailment (gain)/loss Settlement (gain)/loss Total net benefit cost Visa...

-

Page 146

...as follows:

Fiscal 2008 2007 2006

Discount rate for benefit obligation Pension Postretirement Net periodic benefit cost Pension Postretirement Expected long-term rate of return on plan assets Rate of increase in compensation levels for: Benefit obligation Net periodic benefit cost

6.75% 6.24% 6.00...

-

Page 147

... the expected average future working lifetime of the current employees, which is currently nine years. The assumed annual rate of future increases in per capita cost of health benefits for the other postretirement benefits plan was 9% in fiscal 2008. The rate is assumed to decrease to 5% by 2016 and...

-

Page 148

... funded status of $2 million. Other Benefits The Company participates in a defined contribution plan, which covers substantially all of its employees and Visa International employees residing in the United States. Personnel costs included $33 million, $26 million and $24 million in fiscal 2008, 2007...

-

Page 149

... cards, travelers cheques, deposit access products, point-of-sale check service drivers and other instruments processed in accordance with the operating regulations. This indemnification creates settlement risk for the Company due to the difference in timing between the date of a payment transaction...

-

Page 150

... to changes in foreign exchange rates. At September 30, 2008, all derivative instruments outstanding have maturities of less than 4 months. Visa U.S.A. did not have material transactions in foreign currencies or any material derivative instruments outstanding at September 30, 2007. The Company does...

-

Page 151

... statement of operations during fiscal 2009 due to the recognition in earnings of the hedged forecasted transactions. The Company excludes time value for effectiveness testing and measurement purposes. The excluded time value is reported immediately in earnings. For fiscal 2008, the amount recorded...

-

Page 152

... Credit Risk Revenue by geographic market is primarily based on the location of the issuing bank. Certain revenues, primarily international service fees, are shared by geographic locations based upon the location of the merchant involved in the transaction. Visa does not maintain or measure revenues...

-

Page 153

...the Company. Class C (series I) issued and outstanding shares are net of 525,443 shares issued which were returned to the Company in a special IPO dividend from a cost method investee. These shares are included in treasury stock on the Company's consolidated balance sheets at September 30, 2008. See...

-

Page 154

... stock at a price of $44 per share in exchange for a subscription receivable from Visa Europe. This issuance and subscription receivable were recorded as offsetting entries in temporary equity on the Company's consolidated balance sheet at September 30, 2008. Initial Public Offering In March 2008...

-

Page 155

... (series II) common stock in October 2008. The redemption price of $1.146 billion was adjusted for dividends paid and related interest, par value of related shares redeemed, and the return to Visa Europe of the class C (series II) common stock subscription receivable outstanding, resulting in a cash...

-

Page 156

...549,587) -

As Converted Post October 2008 Redemptions 447,746,261 175,367,482 151,596,308 - - - 774,710,051

All voting and dividend payment rights are based on the number of shares held multiplied by the applicable conversion rate in effect on the record date, as discussed below. Subsequent to the...

-

Page 157

... The sales prices in the other recent transactions reflected a discount from the closing price of the Company's class A common stock on the date of these transactions reflecting the conversion and transfer restrictions on class C (series I) common stock, discussed below. These special cash and stock...

-

Page 158

... the number of shares of class B or C common stock held multiplied by the applicable conversion rate in effect on the record date. Dividends Declared On June 11, 2008, the Company's board of directors declared a dividend in the aggregate amount of $0.105 per share of class A common stock (determined...

-

Page 159

... to this class of common stock is limited to accretion recorded on the carrying value of these securities through redemption of these shares on October 10, 2008 at the contractual redemption value of $1.146 billion, adjusted for dividends and certain other adjustments. See Note 4-Visa Europe for...

-

Page 160

... to have occurred, for the purpose of presenting earnings per share, on March 19, 2008, the date the Company's shares commenced trading on the New York Stock Exchange: a) b) The issuance of 446,600,000 shares of class A common stock in connection with the Company's IPO, The reclassification of all...

-

Page 161

... to class B common stock reflects its conversion ratio during that period of 0.71 shares of class A common stock for each share of class B common stock. On an as-converted basis and for the purpose of calculating net income allocated, the weighted average number of class B common shares outstanding...

-

Page 162

... of 525,443 shares, representing a stock dividend received on August 1, which is included in treasury stock on the Company's September 30, 2008 consolidated balance sheets. Total weighted average shares also reflect 112,100 additional class C (series I) shares issued on August 15, 2008. See Note 16...

-

Page 163

... into shares of class A common stock and class C (series III) redemption shares are not convertible into shares of class A common stock subsequent to the IPO. Certain members of our board of directors, who are also employees of our financial institution customers, received restricted stock awards...

-

Page 164

... outstanding excluded stock options to purchase 14,698 shares of common stock for the year ended September 30, 2008. These amounts were excluded because the options' exercise prices were greater than the average market price of our common stock for the periods presented, and therefore, their effect...

-

Page 165

... of 525,443 shares, representing a stock dividend received on August 1, which is included in Treasury Stock on the Company's September 30, 2008 consolidated balance sheets. Total weighted average shares also reflect 112,100 additional class C (series I) shares issued on August 15, 2008. See Note 16...

-

Page 166

...-pricing model, including the period applicable for the risk-free rate of return and expected volatility. The risk-free rate of return assumption is based upon the zero coupon U.S. treasury bond rate over the expected term of the Company's options. As the Company did not have publicly traded stock...

-

Page 167

... data and employee attrition rates. The following table summarizes the Company's option activity for the year ended September 30, 2008:

Weighted Average Remaining Contractual Term (in years)

Options

WeightedAverage Exercise Price Per Share

Aggregate Exercise Price

Aggregate Intrinsic Value...

-

Page 168

...per share. The additional RSA awards issued in May 2008 and August 2008 were valued using the closing price of class A common stock as listed on the New York Stock Exchange on the date of grant or $82.75 and $73.60, respectively. The following table summarizes the Company's RSA activity for the year...

-

Page 169

...,925 3,852 48,221,892

For the year end

September 30, 2 (in millions)

Options RSAs RSUs Total

$

$

The Company recorded its share-based compensation in Personnel on its consolidated statements of operations for the year ended September 30, 2008. The Company did not capitalize any portion of its...

-

Page 170

... addition to fixed payments included in the above table, certain sponsorship agreements require the Company to undertake marketing, promotional or other activities up to stated monetary values to support events which the Company is sponsoring. The stated monetary value of these activities typically...

-

Page 171

... thirteen years, provide card issuance, marketing and program support based on specific performance requirements. These agreements are designed to encourage customer business and to increase overall Visa-branded payment volume, thereby reducing unit transaction processing costs and increasing brand...

-

Page 172

... agreements with Visa Europe which allow each entity to provide services to the other at negotiated fees, including the allocation of costs for office premises which are shared by the Company and Visa Europe. For fiscal 2008, total operating revenues and operating expenses related to Visa Europe...

-

Page 173

... non-U.S. customers. Income tax expense for the years ended September 30, 2008, 2007 and 2006 consists of:

2008 2007 (in millions) 2006

Current: U.S. federal State and local Non-U.S. Total current taxes Deferred: U.S. federal State and local Non-U.S. Total deferred taxes Total income tax (benefit...

-

Page 174

...No. 141. Included in accrued litigation on the Company's consolidated balance sheet at September 30, 2008 is approximately $3 billion associated with the American Express settlement, the Discover litigation and other matters. For tax purposes, the deduction related to these matters is deferred until...

-

Page 175

... income tax rate for the year ended September 30, 2008 differs from that of 2007 primarily due to the tax reserves related to litigation, and the combined effect of the loss of the California special deduction after the Company's IPO, the change in state tax apportionment, and a one-time tax benefit...

-

Page 176

... prior years Increases of unrecognized tax benefits related to current year Decreases of unrecognized tax benefits related to settlements Reductions to unrecognized tax benefits related to lapsing statute of limitations Ending balance at September 30, 2008 $ 320 8 126 (46) (1) 407

$

In connection...

-

Page 177

... and $16 million were received in cash as a tax refund. The Company believes that unrecognized tax benefits will not significantly increase or decrease within the next 12 months. The Company is subject to examination by the Internal Revenue Service and various state and foreign tax authorities...

-

Page 178

...714 185 (2) 75 (231) 3,682

Visa Inc. consolidated the initial payment to American Express (see discussion below) on behalf of the five co-defendant banks. The Company recorded a corresponding receivable in prepaid and other current assets on the Company's consolidated balance sheets at September 30...

-

Page 179

... motion to dismiss Discover's claims based upon effects in an alleged debit market. Visa U.S.A. and Visa International answered the amended complaint on November 30, 2005. Fact discovery is complete. At a hearing on April 25, 2007, the District Court set a trial date of September 9, 2008. The court...

-

Page 180

... ordered Visa U.S.A., Visa International, MasterCard and Discover to confer and stipulate to terms for non-binding mediation of this dispute. The mediation was completed in June 2008 and failed to result in a settlement with either Visa or MasterCard. The district court issued a scheduling order...

-

Page 181

... purpose card network services and an alleged market for debit card network services. Visa Inc., Visa U.S.A. and Visa International entered into a settlement agreement with American Express that became effective on November 9, 2007. Under the settlement agreement, American Express will receive...

-

Page 182

.... No new claims were added to the complaint. Defendants filed a motion for summary judgment on the remaining causes of action on November 7, 2008. No trial date has been set. The Interchange Litigation Kendall. On October 8, 2004, a purported class action lawsuit was filed by a group of merchants in...

-

Page 183

... of court to file a Second Consolidated Amended Class Action Complaint. Among other things, this complaint would: (i) add new claims for damages and injunctive relief against Visa and the bank defendants regarding interchange fees for Visa online/PIN debit cards; (ii) add new claims for damages and...

-

Page 184

... noted) interchange fees for Visa's credit, offline debit, and online/PIN debit cards; (iii) eliminate claims for damages relating to the so-called "no-surcharge" rule and "anti-steering" rules; and (iv) eliminate claims for damages based on the alleged tie of network processing services and payment...

-

Page 185

... its ruling on an antitrust standing issue. On April 27, 2007, Visa U.S.A. and the State of West Virginia reached an agreement in principle to settle all claims against Visa U.S.A. A loss provision was recorded in Visa U.S.A.'s consolidated statements of operations in connection with this settlement...

-

Page 186

... American Express or Discover brands. MasterCard contended that the settlement service fee violated the final judgment in the DOJ litigation by effectively prohibiting Visa U.S.A. members from issuing MasterCard debit cards. On August 18, 2005, the court issued an order appointing a special master...

-

Page 187

... In 2000, a "representative" action was filed in California state court against Visa U.S.A. and Visa International in connection with an asserted 1% currency conversion "fee" assessed on member financial institutions by the payment card networks on transactions involving the purchase of goods or 186

-

Page 188

... and Visa International agreed that for five years they would separately identify or itemize any fees added to transactions because they occurred in a foreign country or involved a foreign currency and would require U.S. issuing members to disclose certain changes, if any, to exchange rate practices...

-

Page 189

... a foreign payment transaction between February 10, 1996 and November 8, 2006, the Settlement Damages Class. The court also approved, for settlement purposes only, the "Settlement Injunctive Class," which contains all persons who held a U.S. issued Visa- or MasterCard-branded credit or debit card or...

-

Page 190

... merchant class action was filed in California state court against Visa U.S.A., Visa International, MasterCard, Merrick Bank and CardSystems Solutions, Inc. The complaint stems from a data-security breach at CardSystems, a payment card processor that handled Visa and other payment brand transactions...

-

Page 191

... and document requests, which focus on PIN debit and Visa's No Signature Required program. On July 1, 2008, the Division notified Visa U.S.A. that the rule change announced by Visa U.S.A. regarding the routing of PINless debit transactions addressed the concerns that led the Division to...

-

Page 192

... Hill Country Custom Cycles, filed a putative class action lawsuit against Visa Inc., several banks, and a processor in U.S. District Court for the Central District of California on June 4, 2008. The plaintiff alleges that, due to fluctuations in currency conversion rates, a transaction disputed by...

-

Page 193

... the California Business & Professions Code §§ 17200 et seq. Visa International filed its answer to the Second Amended Complaint and related counterclaims on April 23, 2007. Discovery in this matter is currently ongoing and is scheduled to be completed on May 12, 2008. A patent claims construction...

-

Page 194

... in principle to settle the dispute in January 2008. On May 16, 2008, Visa U.S.A. and Visa International filed a Motion to Enforce the Settlement Agreement against all parties to the agreement, including the inventor. Briefing is now complete. If the settlement agreement is enforced, the amount of...

-

Page 195

... 7,171,370 ("Funds Distribution System Connected with Point of Sale Transactions"). Visa U.S.A. filed a Motion to Dismiss, or in the Alternative for a More Definite Statement, based on the plaintiff's failure to identify which products or services offered by Visa U.S.A. purportedly infringe which of...

-

Page 196

...their class B shares to shares of class A common stock, reducing the total number of diluted class A shares outstanding for purposes of calculating EPS. See Note 5-Retrospective Responsibility Plan. On November 14, 2008 the Company filed a definitive proxy with the Securities and Exchange Commission...

-

Page 197

... share using the two-class method under the guideline of SFAS No. 128 to reflect the different rights of each class and series of outstanding common stock. Historical balances for periods prior to October 1, 2007 represent balances for Visa U.S.A. Inc., deemed the accounting acquirer in the business...

-

Page 198

... of disclosure controls and procedures (as defined in the Rules 13a-15(e) and 15(d)-15(e) under the Securities Exchange Act of 1935, as amended (the "Exchange Act")) that is designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized...

-

Page 199

... the closing of our proposed initial public offering and October 5, 2008, the quarterly base fee will be reduced by an amount equal to the product of the following: (i) our net proposed initial public offering price per share; (ii) the number of class C (series III) shares held by Visa Europe that...

-

Page 200

... clearing and settlement system services within Visa Europe's region. In addition, the parties share foreign exchange revenues related to currency conversion for transactions involving European cardholders as well as other cross-border transactions that take place in Visa Europe's region until Visa...

-

Page 201

... average rate of decline in the number of ATMs outside of Visa Europe's region that accept Visa-branded general purpose payment product cards for the processing of credit and debit transactions; and

•

Visa Europe has failed to deliver and implement a remediation plan within six months after the...

-

Page 202

... Mr. Saunders served as Chairman and Chief Executive Officer of Fleet Credit Card Services at FleetBoston Financial Corporation. Mr. Saunders served as a member of the board of directors of Visa U.S.A. from October 2002 to February 2007 and Visa International from October 2005 to February 2007, when...

-

Page 203

... markets, banking and transaction services business of Citigroup Inc. In this capacity, he was responsible for finance, operations and technology for CMB. Prior to this role, he served in positions of increasing responsibility with Salomon Smith Barney and its predecessor companies for 22 years...

-

Page 204

... of the Bank from February 1997 to April 2008. He also currently serves as Chairman of the board of directors of our affiliate, Visa Jordan Card Services Limited Co.; and as a director of Salam International Investment Limited, a Middle East conglomerate with diversified operations in technology...

-

Page 205

... of the Global Markets Institute from November 2004 to January 2007 and as a member of the management committee from February 2002 to January 2007. She currently serves on the board of directors of the American International Group, Inc., a global insurance and financial services company, and the...

-

Page 206

... 2007 and a director of Visa International from April 2007 to October 2007. Mr. McKay was also the Executive Vice President of Personal Financial Services at Royal Bank of Canada from October 2006 to April 2008. Prior to this role, he served in positions of increasing responsibility since joining...

-

Page 207

... the Exchange Act requires our directors and officers, and persons who beneficially own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in ownership of our common stock and our other equity securities with the SEC. Based solely on our review of...

-

Page 208

... waiver on our website or by filing a report on Form 8-K. A copy of the Codes is attached hereto as Exhibit 14.1 and is available on our website at http://www.visa.com. Material Changes to the Procedures by which Security Holders May Recommend Changes to the Company's Board of Directors Until March...

-

Page 209

..., however, that the term of our class I directors elected at the first annual meeting held after the closing date of our restructuring shall, in any event, expire on the day of the annual meeting of the Company held in the calendar year 2011. Nominating and Corporate Governance Committee We have...

-

Page 210

...annual compensation of the CEO and other executive officers, including salary, bonus, stock options and other benefits; (4) reviewing and recommending to the full board the compensation of our directors; and (5) monitoring the Company's incentive and equity-based compensation plans. The compensation...

-

Page 211

... an annual review of our total compensation program with respect to executive compensation. This review reports on the aggregate level of our executive compensation, as well as the combination of elements used to compensate our executive officers. This review is based on public information and...

-

Page 212

... for purposes of compensation determinations made for the 2008 fiscal year are:

Financial Services Processing Technology Business Services

Equivalent-Sized Peers

American Express Capital One HSBC North America PNC Financial Wells Fargo Bank of America Citigroup JPMorgan Chase

ADP Discover...

-

Page 213

... Payments Upon Termination and Change in Control." Executive Compensation Components The principal components of compensation of our executive officers are base salary; annual incentive plan; long-term incentive compensation; retirement and other benefits; perquisites and other personal benefits...

-

Page 214

... to continue the process of restructuring Visa Inc.; (2) to develop and execute Visa Inc.'s global corporate strategy; and (3) to develop and implement requisite policies, controls, governance procedures and processes appropriate for a world class organization. Following the end of fiscal 2008, 213

-

Page 215

... public offering; (2) delivery of the finance-related synergy savings committed to in the fiscal 2008 budget; (3) creation of a global integrated finance organization with clear accountabilities for reporting and pricing/incentive processes, practices and controls; and (4) establishment of effective...

-

Page 216

... incentive plan is intended to promote our long-term success and increase stockholder value by attracting, motivating and retaining our non-employee directors, officers, employees and consultants. To achieve this purpose, the equity incentive plan allows the flexibility to award stock options, stock...

-

Page 217

... the fourth business day after we publicly announce earnings. For all newly issued option awards, the exercise price of the option award will be the closing price on the date of the grant. Stock Ownership Guidelines. In February 2008, the compensation committee established stock ownership guidelines...

-

Page 218

.... Additionally, we have instituted stock ownership guidelines for our non-employee directors. See "-Director Compensation." Retirement and Other Benefits Our benefits programs are designed to be competitive, cost-effective and compliant with local regulations. We generally target the median of the...

-