United Healthcare 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

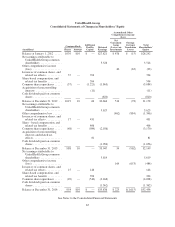

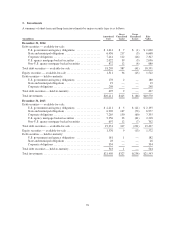

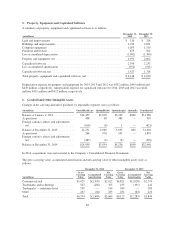

Redeemable Noncontrolling Interests

Noncontrolling interests in the Company’s subsidiaries whose redemption is outside the control of the Company

are classified as temporary equity. The redeemable noncontrolling interests are primarily related to non-public

shareholders of Amil. The following table provides details of the Company’s redeemable noncontrolling interests

activity for the years ended December 31, 2014 and 2013:

(in millions) 2014 2013

Redeemable noncontrolling interests, beginning of period ............................. $1,175 $ 2,121

Net earnings ................................................................. — 48

Acquisitions ................................................................. 203 360

Redemptions ................................................................ — (1,417)

Distributions ................................................................. (40) —

Fair value and other adjustments ................................................. 50 63

Redeemable noncontrolling interests, end of period .................................. $1,388 $ 1,175

During 2013, the Company increased its ownership of Amil to 90% by acquiring all of Amil’s remaining

publicly-traded shares.

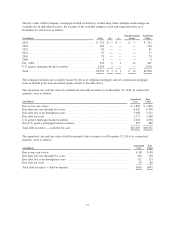

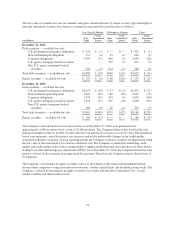

Share-Based Compensation

The Company recognizes compensation expense for share-based awards, including stock options, stock-settled

stock appreciation rights (SARs) and restricted stock and restricted stock units (collectively, restricted shares), on

a straight-line basis over the related service period (generally the vesting period) of the award, or to an

employee’s eligible retirement date under the award agreement, if earlier. Restricted shares vest ratably;

primarily over three to four years and compensation expense related to restricted shares is based on the share

price on date of grant. Stock options and SARs vest ratably over four to six years and may be exercised up to 10

years from the date of grant. Compensation expense related to stock options and SARs is based on the fair value

at date of grant, which is estimated on the date of grant using a binomial option-pricing model. Under the

Company’s Employee Stock Purchase Plan (ESPP) eligible employees are allowed to purchase the Company’s

stock at a discounted price, which is 85% of the lower market price of the Company’s common stock at the

beginning or at the end of the six-month purchase period. Share-based compensation expense for all programs is

recognized in operating costs in the Company’s Consolidated Statements of Operations.

Net Earnings Per Common Share

The Company computes basic net earnings per common share by dividing net earnings by the weighted-average

number of common shares outstanding during the period. The Company determines diluted net earnings per

common share using the weighted-average number of common shares outstanding during the period, adjusted for

potentially dilutive shares associated with stock options, SARs, restricted shares and the ESPP, (collectively,

common stock equivalents) using the treasury stock method. The treasury stock method assumes a hypothetical

issuance of shares to settle the share-based awards, with the assumed proceeds used to purchase common stock at

the average market price for the period. Assumed proceeds include the amount the employee must pay upon

exercise, any unrecognized compensation cost and any related excess tax benefit. The difference between the

number of shares assumed issued and number of shares assumed purchased represents the dilutive shares.

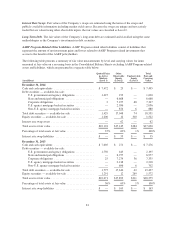

Industry Tax

Health Reform Legislation includes an annual, nondeductible insurance industry tax (Industry Tax) to be levied

proportionally across the insurance industry for risk-based health insurance products that began on January 1,

2014.

74