United Healthcare 2014 Annual Report Download - page 41

Download and view the complete annual report

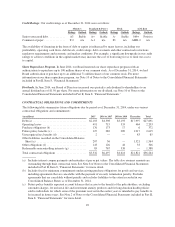

Please find page 41 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.program; and a permanent risk adjustment program. The Reinsurance Program is a temporary program that will

be funded on a per capita basis from all commercial lines of business including insured and self-funded

arrangements. The total three year amount of $25 billion for the Reinsurance Program will be allocated as

follows: $20 billion (2014 - $10 billion, 2015 - $6 billion, 2016 - $4 billion) subject to increases based on state

decisions, to fund the reinsurance pool and $5 billion (2014 and 2015 - $2 billion, 2016 - $1 billion) to fund the

U.S. Treasury. While funding for the Reinsurance Program will come from all commercial lines of business, only

market reform compliant individual businesses will be eligible for reinsurance recoveries.

For detail on the Industry Tax and Premium Stabilization Programs, see Note 2 of Notes to the Consolidated

Financial Statements included in Part II, Item 8, “Financial Statements.”

Exchanges and Coverage Expansion. Across markets, we and our competitors are adapting product, network

and marketing strategies to anticipate new or expanding distribution channels including public exchanges, private

exchanges and off exchange purchasing. Effective in 2014, states have either created their own public exchange,

entered a partnership exchange or relied on the federally facilitated exchange for individuals and small

employers. The exchanges have created new market dynamics that have impacted and could further impact our

existing businesses, depending on the ultimate member migration patterns for each market. In 2014, commercial

fully insured membership expanded industry-wide with more than 7 million consumers served through the

individual public exchanges alone. Self-insured enrollment remained relatively stable, but there has been an

increased interest in post-reform alternatives such as private exchange solutions. Our level of participation in

public exchanges is determined on a state-by-state basis. Each state is evaluated based on factors such as growth

opportunities, our current local presence, our competitive positioning, our ability to honor our commitments to

our local customers and consumers, and the regulatory environment. In 2014, we participated in 13 state public

exchanges, including four individual and nine small group exchanges. In 2015, we are participating in 23

individual exchanges and in 12 small group exchanges.

Health Reform Legislation also provided for optional expanded Medicaid coverage that became effective in

January 2014. We participate in programs in 24 states and the District of Columbia, and of these, 12 states opted

to expand Medicaid for 2014. For 2015, 13 of our state customers have elected to expand Medicaid. The

Congressional Budget Office forecasts that due to Medicaid expansion, a total of 13 million people will have

obtained coverage through Medicaid by the end of 2016, and we are actively seeking to build market share

serving the needs of these Medicaid expansion beneficiaries and their state sponsors.

39