United Healthcare 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

growth, employment and disposable income. A large number of factors can cause the medical cost trend to vary

from our estimates including: our ability and practices to manage medical costs, changes in level and mix of

services utilized, mix of benefits offered including the impact of co-pays and deductibles, changes in medical

practices, catastrophes and epidemics.

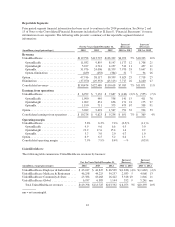

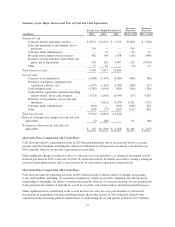

The following table illustrates the sensitivity of these factors and the estimated potential impact on our medical

costs payable estimates for the most recent three months as of December 31, 2014:

Medical Cost PMPM Trend

Increase (Decrease) in Factors

Increase (Decrease)

In Medical Costs Payable

(in millions)

3%..................................................................... $635

2 ...................................................................... 423

1 ...................................................................... 212

(1) ..................................................................... (212)

(2) ..................................................................... (423)

(3) ..................................................................... (635)

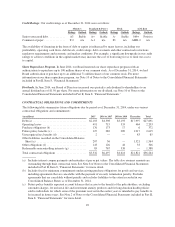

The completion factors and medical costs PMPM trend factors analyses above include outcomes that are

considered reasonably likely based on our historical experience estimating liabilities for incurred but not reported

benefit claims.

Our estimate of medical costs payable represents management’s best estimate of our liability for unpaid medical

costs as of December 31, 2014, developed using consistently applied actuarial methods. Management believes

the amount of medical costs payable is reasonable and adequate to cover our liability for unpaid claims as of

December 31, 2014; however, actual claim payments may differ from established estimates as discussed above.

Assuming a hypothetical 1% difference between our December 31, 2014 estimates of medical costs payable and

actual medical costs payable, excluding AARP Medicare Supplement Insurance and any potential offsetting

impact from premium rebates, 2014 net earnings would have increased or decreased by $67 million.

Revenues

We derive a substantial portion of our revenues from health care insurance premiums. We recognize premium

revenues in the period eligible individuals are entitled to receive health care services. Customers are typically

billed monthly at a contracted rate per eligible person multiplied by the total number of people eligible to receive

services.

Our Medicare Advantage and Medicare Part D premium revenues are subject to periodic adjustment under the

CMS risk adjustment payment methodology. The CMS risk adjustment model provides higher per member

payments for enrollees diagnosed with certain conditions and lower payments for enrollees who are healthier. We

and health care providers collect, capture, and submit available diagnosis data to CMS within prescribed

deadlines. CMS uses submitted diagnosis codes, demographic information, and special statuses to determine the

risk score for most Medicare Advantage beneficiaries. CMS also retroactively adjusts risk scores during the year

based on additional data. We estimate risk adjustment revenues based upon the data submitted and expected to be

submitted to CMS. As a result of the variability of factors that determine such estimations, the actual amount of

CMS’ retroactive payments could be materially more or less than our estimates. This may result in favorable or

unfavorable adjustments to our Medicare premium revenue and, accordingly, our profitability. Risk adjustment

data for certain of our plans is subject to review by the federal and state governments, including audit by

regulators. See Note 12 of Notes to the Consolidated Financial Statements included in Part II, Item 8, “Financial

Statements” for additional information regarding these audits. Our estimates of premiums to be recognized are

reduced by any expected premium minimum MLR rebates payable by us to CMS.

U.S. commercial health plans with MLRs on fully insured products, as calculated under the definitions in Health

Reform Legislation, that fall below certain targets (85% for large employer groups, 80% for small employer

groups and 80% for individuals) are required to rebate ratable portions of their premiums to their customers

52