Unilever 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

06 Unilever Annual Report & Accounts and Form 20-F 2003

Financial highlights

at current rates of exchange

Combined earnings per share and dividends per share(a)

Ordinary €0.51 shares of NV(b) Ordinary 1.4p shares of PLC

2003 2002 2001 2003 2002 2001

Basic earnings per share (euros) €2.82 €2.14 €1.66 €0.42 €0.32 €0.25

Effect of exceptional items net of tax €0.07 €0.56 €0.34 €0.01 €0.08 €0.05

Effect of amortisation of goodwill and intangible assets net of tax €1.13 €1.25 €1.39 €0.17 €0.19 €0.21

Basic earnings per share BEIA (euros) €4.02 €3.95 €3.39 €0.60 €0.59 €0.51

Basic earnings per share (pence) 29.26p 20.19p 15.46p

Effect of exceptional items net of tax 0.73p 5.31p 3.13p

Effect of amortisation of goodwill and intangible assets net of tax 11.70p 11.72p 13.01p

Basic earnings per share BEIA (pence) 41.69p 37.22p 31.60p

Diluted earnings per share (euros) €2.74 €2.08 €1.61 €0.41 €0.31 €0.24

Diluted earnings per share (pence) 28.40p 19.59p 15.05p

Dividend per share (euros) €1.74 €1.70 €1.56

Dividend per share (pence) 18.08p 16.04p 14.54p

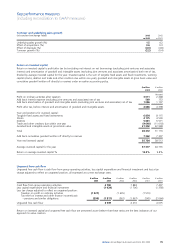

Combined earnings per share and dividends per share for shares traded on the New York Stock Exchange

(on a UK GAAP basis) in US dollars(a)

New York €0.51 shares of NV(b) 5.6p American Depositary Receipts of PLC

2003 2002 2001 2003 2002 2001

Basic earnings per share $3.18 $2.02 $1.48 $1.91 $1.21 $0.89

Effect of exceptional items net of tax $0.08 $0.53 $0.30 $0.05 $0.32 $0.18

Effect of amortisation of goodwill and intangible assets net of tax $1.27 $1.16 $1.25 $0.76 $0.70 $0.75

Basic earnings per share BEIA $4.53 $3.71 $3.03 $2.72 $2.23 $1.82

Diluted earnings per share $3.08 $1.96 $1.44 $1.85 $1.17 $0.87

Dividend per share(c)(d) $2.15 $1.85 $1.42 $1.31 $1.02 $0.85

(a) Operating profit, operating profit BEIA and all earnings per share measures for 2001 and 2002 have been restated following changes in our

accounting policy for pensions and other post-employment benefits and in our accounting policy for share-based payments. See note 17 on

page 99 and note 29 on page 116.

(b) For NV share capital, the euro amounts shown above and elsewhere in this document are representations in euros on the basis of Article

67c of Book 2 of the Civil Code in the Netherlands, rounded to two decimal places, of underlying share capital in Dutch guilders, which

have not been converted into euros in NV’s Articles of Association. Until conversion formally takes place by amendment of the Articles of

Association, the entitlements to dividends and voting rights are based on the underlying Dutch guilder amounts.

(c) Rounded to two decimal places.

(d) Actual dividends payable for 2003 on NV New York shares and American Depositary Receipts of PLC may differ from those shown

above, which include final dividend values calculated using the rates of exchange ruling on 11 February 2004 (€1.00 = $1.2668,

£1.00 = $1.8703).

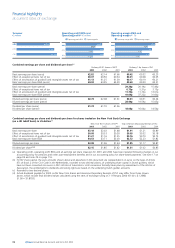

Operating profit BEIA Operating profit Operating margin BEIA Operating margin

Turnover

€ million

2003 42 942 6 772

5 529

7 054

5 091

7 032

5 030

2002 48 760

2001 52 206

Operating profit BEIA and

Operating profit(a) € million

2003

2002

2001

15.8

12.9

14.5

10.4

13.5

9.6

2003

2002

2001

Operating margin BEIA and

Operating margin(a) %