Unilever 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Unilever Annual Report & Accounts and Form 20-F 2003

Financial review

invoiced based on our knowledge of customer, consumer and

promotional activity.

Goodwill, intangible and tangible fixed assets

Impairment reviews in respect of goodwill and intangible fixed

assets are performed at least annually. More regular reviews, and

impairment reviews in respect of tangible fixed assets, are

performed if events indicate that this is necessary. Examples of

such triggering events would include a significant planned

restructuring, a major change in market conditions or technology,

expectations of future operating losses or negative cash flows.

Impairment reviews are performed following the guidance in UK

Financial Reporting Standard 11, United States SFAS 142 and

SFAS 144. Such reviews are performed by comparing the carrying

value of the asset concerned to a valuation derived from

discounted future cash flows. Significant assumptions, such as

long-term growth rates and discount rates, are made in preparing

these forecast cash flows; although these are believed to be

appropriate, changes in these assumptions could change the

outcomes of the impairment reviews.

The most significant balances of goodwill and intangible assets

are those arising from the purchases of Bestfoods and Slim•Fast.

We have reviewed the balances related to the Bestfoods

acquisition (€14.8 billion), by considering actual and planned

growth rates of Bestfoods brands and the synergy savings arising

from its integration. No impairment loss has been identified.

Our review of the balances related to Slim•Fast (€1.4 billion)

is based upon the assumption that the plans for the business,

referred to in the Operating Review on pages 23 and 36, achieve

a stabilisation of revenues during 2004 and a return to growth

thereafter. We conclude, on this basis, that there is no

impairment but the position will be monitored.

Deferred tax

Full provision is made for deferred taxation, as required under UK

Financial Reporting Standard 19, at the rates of tax prevailing at

the year-end unless future rates have been enacted, as detailed

on page 75. Deferred tax assets are regularly reviewed for

recoverability, and a valuation allowance is established to the

extent that recoverability is not considered likely.

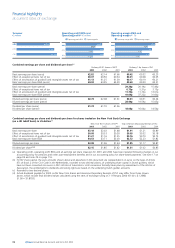

Results – 2003 compared with 2002

2003 6 772

2002 7 054

2001 7 032

Operating profit BEIA

€ million

2003 5 529

2002 5 091

2001 5 030

Operating profit

€ million

2003 42 942

2002 48 760

2001 52 206

Turnover

€ million

As noted in the preceding section, with effect from 1 January

2003 we have adopted FRS 17 in respect of pensions accounting

and have implemented a new accounting policy for share options.

Amounts for prior years have been restated in the financial

statements and in the following commentary.

Turnover fell by 12% to €42 942 million. This decrease was

primarily due to a 10% strengthening of the average exchange

rate for the euro against the basket of Unilever currencies. At

constant rates of exchange, underlying sales grew by 1.5% in the

year, but the net effect of this and our continued programme of

disposals under Path to Growth, partly offset by the increase in

our holding in Unilever Bestfoods businesses across Asia, was a

2% reduction in turnover. The main disposal impact came from

the sale of DiverseyLever, Mazola and Loders Croklaan.

Group turnover was €42 693 million (2002: €48 270 million). Our

share of turnover from joint ventures continued to fall in 2003 to

€249 million (2002: €490 million) as a result of increases in our

holding in former Bestfoods joint ventures in Asia and South

Africa and their consequent inclusion as subsidiaries.

Operating profit was up 9% at €5 529 million for the year (2002:

€5 091 million) and the operating margin increased to 12.9%

(2002: 10.4%), with a significant contribution from lower net

exceptional charges. Operating profit BEIA was 4% lower at

€6 772 million, compared with €7 054 million in 2002. Operating

margin BEIA improved strongly from 14.5% in 2002 to 15.8%

despite an increase in brand investment; this was achieved

through improved gross margins and lower overheads as a result

of the Path to Growth savings programmes. These improvements

were more than offset by the strengthening of the euro. Group

operating profit BEIA was €6 719 million (2002: €6 959 million).

Amortisation of goodwill and intangible assets was €1 143 million

compared with €1 261 million in 2002. The decrease is mainly

due to the strengthening of the euro in 2003.

Net exceptional charges included in operating profit for the

year were €100 million (2002: €702 million), which included

€470 million of restructuring investment costs and a net credit

for the profit and losses on disposals of €370 million. The

restructuring costs primarily relate to Path to Growth initiatives,

and the continued integration of Bestfoods. Associated costs of

€121 million were included within operating profit BEIA for the

year (2002: €191 million).

Group operating profit increased by 10% to €5 483 million.

An overview of operating performance by region and product

category is included in the regional and category texts on pages

21 to 30 and 31 to 44 respectively.

Net interest cost, excluding pensions interest, fell to €847 million

from €1 173 million in 2002 as a result of the lower overall level

of net debt and the positive impact of currency movement on the

cost of our US dollar-based debt. The net interest cover for the

year was 6.7 times compared with 4.5 times in 2002. The net

interest cover on the basis of EBITDA was 9.5 times (2002:

7.0 times). The pension net interest charge for the year was

€166 million compared with a net interest credit of €108 million

in 2002. This change reflected a lower expected return on

pension assets for 2003 as a result of lower asset values following

the weak stock market performance in 2002.