Unilever 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Disclaimer

Notes to the Annual Report & Accounts and Form 20-F 2003 This PDF version of the

Unilever Annual Report & Accounts and Form 20-F 2003 is an exact copy of the document

provided to Unilever's shareholders.

Certain sections of the Unilever Annual Report & Accounts and Form 20-F 2003 have been

audited. Sections that have been audited are set out on pages 73 to 125, 131 to 147 and

149 to 150. The auditable part of the Directors' Remuneration report as set out on page 68

has also been audited.

The maintenance and integrity of the Unilever website is the responsibility of the Directors;

the work carried out by the auditors does not involve consideration of these matters.

Accordingly, the auditors accept no responsibility for any changes that may have occurred to

the financial statements since they were initially placed on the website.

Legislation in the United Kingdom and the Netherlands governing the preparation and

dissemination of financial statements may differ from legislation in other jurisdictions.

Disclaimer Except where you are a shareholder, this material is provided for information

purposes only and is not, in particular, intended to confer any legal rights on you.

This Annual Report & Accounts and Form 20-F does not constitute an invitation to invest in

Unilever shares. Any decisions you make in reliance on this information are solely your

responsibility.

The information is given as of the dates specified, is not updated, and any forward-looking

statements are made subject to the reservations specified on page 3 of the Report.

Unilever accepts no responsibility for any information on other websites that may be

accessed from this site by hyperlinks.

Table of contents

-

Page 1

... to confer any legal rights on you. This Annual Report & Accounts and Form 20-F does not constitute an invitation to invest in Unilever shares. Any decisions you make in reliance on this information are solely your responsibility. The information is given as of the dates specified, is not updated... -

Page 2

2003 Unilever Annual Report & Accounts and Form 20-F Meeting everyday needs of people everywhere -

Page 3

... competitively with branded products and services which raise the quality of life. Our deep roots in local cultures and markets around the world are our unparalleled inheritance and the foundation for our future growth. We will bring our wealth of knowledge and international expertise to the service... -

Page 4

... Ice cream and frozen foods Operating review by category - Home & Personal Care Home care Personal care Risk management Corporate governance Organisational structure of Unilever Legal structure of the Group Corporate governance developments Directors Advisory Directors Board Committees Requirements... -

Page 5

... has shares listed on the London Stock Exchange and, as American Depositary Receipts, on the New York Stock Exchange. The two parent companies, NV and PLC, together with their group companies, operate as nearly as is practicable as a single entity (the Unilever Group, also referred to as Unilever or... -

Page 6

..., competitive pricing and activities, consumption levels, costs, the ability to maintain and manage key customer relationships and supply chain sources, currency values, interest rates, the ability to integrate acquisitions and complete planned divestitures, physical risks, environmental risks, the... -

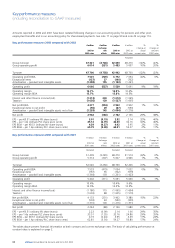

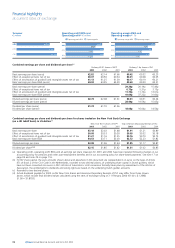

Page 7

... changes in our accounting policy for pensions and other postemployment beneï¬ts and in our accounting policy for share-based payments. See note 17 on page 99 and note 29 on page 116. Key performance measures 2003 compared with 2002 â,¬ million 2003 at 2002 rates â,¬ million Exchange rate effects... -

Page 8

...ï¬xed assets and ï¬xed investments, working capital (stocks, debtors and trade and other creditors due within one year), goodwill and intangible assets at gross book value and cumulative goodwill written off directly to reserves under an earlier accounting policy. â,¬ million 2003 â,¬ million 2002... -

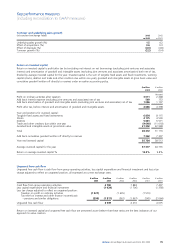

Page 9

... for 2003 on NV New York shares and American Depositary Receipts of PLC may differ from those shown above, which include ï¬nal dividend values calculated using the rates of exchange ruling on 11 February 2004 (â,¬1.00 = $1.2668, £1.00 = $1.8703). 06 Unilever Annual Report & Accounts and Form 20... -

Page 10

... number of businesses and a slow start to the year in North America caused by sharp de-stocking in the retail trade. In Europe consumer conï¬dence dropped to levels not seen in recent years. Nevertheless, we have continued to increase investment in our brands and have maintained our market position... -

Page 11

... review of the forces that will shape Unilever's world, and of what makes us unique as a business. Our roots in hygiene, nutrition and personal care mean that people all over the world choose our brands 150 million times every day for the beneï¬ts they bring in helping them feel good, look good... -

Page 12

... consumer goods across foods, home and personal product categories. Unilever's portfolio includes some of the world's best known and most loved brands. Business structure Our operations are organised into two global divisions - Foods and Home & Personal Care (HPC) - headed by Divisional Directors... -

Page 13

... longer-term growth prospects. It has invested in Physcience, a French natural food supplements business, and Noiro, the leading company in the mass prestige personal care market in Finland. Up to â,¬70 million will be invested over the three years, in two venture funds of our own, Unilever Ventures... -

Page 14

...North America, we deployed a single system from point of order to cash settlement across the Home & Personal Care business, improving operational efï¬ciency and raising customer service levels. Our Latin American business continued to roll out common ï¬nance and supply chain processes, information... -

Page 15

... at www.unilever.com. It is by putting these shared values into everyday working practice that we can operate successfully as a multinational company, and as a trusted corporate citizen in diverse local societies. Our Code Committee oversees compliance with the Code of Business Principles throughout... -

Page 16

... future leaders to share their experiences and discuss future strategies. There are many other examples, such as the HPC Learning Forum and the Knowledge Management Group that provide learning opportunities for managers at all levels. We believe learning that is related to the needs of the business... -

Page 17

... brands and technology. Description of our properties We have interests in properties in most of the countries where there are Unilever operations. However, none is material in the context of the Group as a whole. The properties are used predominantly to house production and distribution activities... -

Page 18

...at 31 December 2003, in respect of the four largest Unilever pension funds. Details of all assumptions made are given on page 100. % UK % Netherlands % United States % Germany Discount rate 5.40 Inï¬,ation assumption 2.70 Expected long-term rate of return: Equities 8.30 Bonds 5.30 Others 6.40 5.20... -

Page 19

...planned growth rates of Bestfoods brands and the synergy savings arising from its integration. No impairment loss has been identiï¬ed. Our review of the balances related to Slim•Fast (â,¬1.4 billion) is based upon the assumption that the plans for the business, referred to in the Operating Review... -

Page 20

... market and distribute ready-to-drink tea in several international markets outside North America. In 2002, we increased our holding in the Robertsons business in South Africa and Israel to 59%, and took a one-third equity share in JohnsonDiversey Holdings Inc. Unilever Annual Report & Accounts and... -

Page 21

... of the company. Subsequently on 22 December 2002, Middle East Food and Trade Company SAE made an agreed public tender offer on the Cairo and Alexandria Stock Exchange in Egypt for 6 000 000 shares (100%) of El Rashidi El Mizan Confectionery SAE held by members of the Unilever Group at a price of 15... -

Page 22

... Unilever aims to be in the top third of a reference group for Total Shareholder Return of 21 international consumer goods companies, as explained below. The Group's ï¬nancial strategy supports this objective and provides the ï¬nancial ï¬,exibility to meet its strategic and day-to-day needs... -

Page 23

... time. It combines share price appreciation and dividends paid to show the total return to the shareholder. The absolute level of the TSR will vary with stock markets, but the relative position reï¬,ects the market perception of overall performance relative to a reference group. Unilever calculates... -

Page 24

... of price-competitive markets in laundry. In foods, growth by category in part reï¬,ects the exceptionally hot summer weather, with strong gains in ready-to-drink tea and ice cream, but lower consumption in savoury, frozen meals and cooking products. Highlights of another good year in personal care... -

Page 25

... give an underlying sales growth of 1%, with market share being maintained. Central and Eastern Europe Underlying sales grew by 9% with particular strength in dressings, tea, household care and personal care. We made further good progress in Russia. 22 Unilever Annual Report & Accounts and Form 20... -

Page 26

...funds for future investment behind innovation in the leading brands. Unilever Bestfoods sales grew in a competitive market and in a year in which we successfully introduced a new 'go to market' approach. Particular strengths were Hellmann's, Lipton and Bertolli through pasta sauces and frozen foods... -

Page 27

... growth in the second half of the year. Overall, underlying sales growth in 2002 was held back by promotional price competition in mayonnaise, the exit from Hellmann's pourable dressings and the impact of lower butter prices on the margarine market. In Home & Personal Care, underlying sales growth... -

Page 28

... laundry. In personal care, Dove, Lux and Rexona all grew at over 20%, while Sunsilk has achieved the leading position in hair care in Turkey. In Foods, growth in savoury was led by Knorr, and included the launch into a number of countries in the Middle East. Ice cream and Lipton tea also grew well... -

Page 29

... and laundry brands. South Africa performed particularly well with good underlying sales growth especially in Omo, Sunsilk, Axe and Lux in Home & Personal Care and Knorr, Lipton, Rama and Flora pro•activ in Foods. In Turkey, the weak economy led to consumer downtrading and market contraction and... -

Page 30

... our Home & Personal Care consumer business, growth has been strong and broad-based across categories. Activities behind Lux included the launch of the Lux Spa range in Japan and Lux Super Rich shampoo in a number of markets. Lifebuoy was relaunched in India with new variants and the distribution of... -

Page 31

... in ready-to-drink tea has doubled the market share of Lipton to over 25%. Operating margin increased 2.9% to 14.0% and operating margin BEIA increased to 14.2% in 2002 with gains from our savings programmes partly reinvested in increased advertising and promotions. 28 Unilever Annual Report... -

Page 32

... for the year. Including the impact of disposals, turnover increased 5.0%. The key drivers of growth have been our personal care brands: Lux, which has been relaunched with innovations in both product and packaging; Sunsilk, including the test launch of hair colorants in Argentina, Mexico and Brazil... -

Page 33

... brand to that country. Lipton ready-to-drink tea continued to grow well in Brazil and the soy-based beverage AdeS made very good progress in both Brazil and Mexico. In Argentina, consumer demand was considerably down and volumes were affected as a result. We continued to hold strong market shares... -

Page 34

... of the world's largest food service businesses. It operates in more than 60 countries around the world. The business is focused on delivering innovative, relevant solutions to the professional chef and caterer, leveraging our consumer brands - already 85% of product sales - and technology. In 2003... -

Page 35

... below at constant exchange rates. Unilever's world leadership of both the savoury and dressings foods categories was maintained. The rate of growth in savoury slowed in 2003, partially due to a hot summer in Europe and weakness in food service markets in the ï¬rst half of the year. Brazil had... -

Page 36

... exchange rates. We are world leaders in both the savoury and dressings foods categories. Knorr, Unilever's biggest brand, grew across 100 markets in 2002 with products as diverse as seasonings and meal kits, snacks and frozen food. There was a clear acceleration in the pace of growth as the year... -

Page 37

... difï¬cult start to the year due to severe price pressures mainly in Europe. The launch of dairy cream alternatives in several countries in Europe and Latin America in the fourth quarter is progressing well, with a roll-out to additional markets in 2004. Innovation continues to be the key driver of... -

Page 38

... of several oil businesses, turnover fell 4% in 2002, while underlying sales grew by over 2%. Operating margin increased 0.9% to 12.3% but operating margin BEIA was unchanged from 2001 at 15.3%, after increased advertising and promotions investment. Unilever Annual Report & Accounts and Form... -

Page 39

... expanded our successful North American partnership with Pepsi to include many more countries. We continue to have strong positions in key traditional tea markets. In 2003, we had a very successful relaunch of the Brooke Bond brand in India. 36 Unilever Annual Report & Accounts and Form 20-F 2003 -

Page 40

...brand and to perform strongly in the growing out-of-home sector. As around a third of beverages are consumed outside the home, this sector is important for continued growth. We maintained leadership positions in key traditional tea markets such as the UK and India. Unilever Annual Report & Accounts... -

Page 41

... is discussed below at constant exchange rates. Ice cream Ice cream had a strong year with 4.3% underlying sales growth, assisted by good weather in Europe. In quarter one, the relaunch of the Heart brand strengthened its resonance with contemporary consumers, and innovations such as Magnum 7 Sins... -

Page 42

...the in-home sector with innovations such as mini multi-packs and Cornetto snack-size ice cream, both of which made good progress during the year. We made good progress in Latin America and North America and, in the context of a poor summer, performed well in Europe. Frozen foods Convenience combined... -

Page 43

Operating review by category - Home & Personal Care Financial overview Turnover â,¬ million 2003 2002 2001 At current exchange rates 18 383 20 824 22 777 Operating profit â,¬ million 2003 2002 2001 At current exchange rates 2 766 2 884 2 764 Operating profit BEIA â,¬ million 2003 2002 2001 At ... -

Page 44

... in the second half as innovation around the core business showed signs of a return to growth. Within the portfolio, Cif and Domestos remain leading brands with number one or number two positions in the majority of key markets in which they operate. Unilever Annual Report & Accounts and Form 20... -

Page 45

...a brand for parents and their families. This strategy was driven by the message that getting dirty is all part of the experience children need to learn and develop. It helped to consolidate the leading position of Omo in Brazil and South Africa and to achieve market share gains in such countries as... -

Page 46

... has developed innovative approaches to talking to young men throughout the world. The brand is carving out a strong position in the North American male deodorant market on the basis of this deep consumer understanding. The launch of new fragrances and antiperspirants, along with improved product ef... -

Page 47

... conditioners across more than 30 countries in Europe, Latin America and South East Asia. In 2002, the underlying sales growth of Sunsilk was strong, with good performances in Brazil and Mexico and new market entries in Algeria and Central America. In Ghana and South Africa we launched our new Afro... -

Page 48

...a specialised distribution centre or channel could have an adverse effect on the Group's business and results of operations. Price and supply of raw materials and commodities contracts: Unilever's products are manufactured from a large number of diverse materials. Unilever has experience in managing... -

Page 49

.... As a result of the share option plans for employees, we are exposed to movements in our own share price. In recent years we have hedged this risk through buying Unilever shares in the market when the share option is granted and holding these shares until the share option is exercised or lapses. In... -

Page 50

... of NV and PLC are the principal executive ofï¬cers of Unilever. Our operations are organised into two global divisions - Foods and Home & Personal Care - headed by Division Directors. Reporting to their respective Division Directors are the Foods and the Home & Personal Care Business Presidents... -

Page 51

... Corporate Risk Committee currently comprises the Financial Director, the Foods Director, the Home & Personal Care Director, the Personnel Director, the General Counsel, the Chief Auditor and the Controller. It meets at least four times a year. The objective of the Committee is to assist the Boards... -

Page 52

... retired as a member in 2003. The Committee oversees the Code of Business Principles, advises on external matters of relevance to the business - including issues of corporate social responsibility - and reviews our corporate relations strategy. The Committee is supplied with necessary information... -

Page 53

...at the Annual General Meetings of both NV and PLC. The members attending each meeting will not necessarily include the Chairman of the Committee, since these meetings take place at about the same time in Rotterdam and London respectively. A description of Unilever's compliance with 'Internal Control... -

Page 54

.../. Both NV and PLC communicate with their respective shareholders through the Annual General Meetings. At the Annual General Meetings, each Chairman gives a full account of the progress of the business over the last year and a review of the current issues. A summary of their addresses is published... -

Page 55

...96. Chairman, Unilever Australasia 89/92. Group Treasurer 86/89. External appointments include: Non-Executive Director of Standard Chartered PLC. Charles Strauss President, Home & Personal Care North America and Global Prestige Business. Chairman, North America Committee Nationality: American. Aged... -

Page 56

... & Middle East. Harish Manwani, Latin America Aged 50. Joined Unilever 1976. Appointed Business President 2001. Previous position: Senior Vice-President, Home & Personal Care Category Group. Global Businesses Charles Strauss, Prestige Unilever Director. See page 52. Function Simon Clift, Marketing... -

Page 57

... report and it has been signed on their behalf by the Joint Secretaries of Unilever. It will be presented to shareholders at the Annual General Meetings on 12 May 2004. and effective management of Unilever as a major global company. Rewards based on performance The current Directors' package dates... -

Page 58

...of the Directors' total remuneration to a number of key measures of company performance. This is in line with the 'Path to Growth' strategy. The three main measures are: - Earnings per share growth (BEIA); - Sales growth in the leading brands; and - Total shareholder return generated by Unilever, in... -

Page 59

... of the increase in earnings per share (BEIA) at current rates of exchange and sales growth of the leading brands. A Director can receive a performance bonus of up to 80% of base salary in respect of these corporate targets. • Personal targets: based on agreed key objectives relative to the... -

Page 60

...shareholders (in comparison with that enjoyed by investors in the deï¬ned peer group of companies). Share options Directors may participate in the following share option plans. • Executive Option Plans • All-Employee Share Plans The earnings per share (BEIA) growth at current rates of exchange... -

Page 61

... Directors is one year. If they choose, NV and PLC may pay a Director a sum equal to twelve months' salary in lieu of notice. NV's and PLC's Articles of Association require that all Directors retire from ofï¬ce at every Annual General Meeting. Directors' contracts of service with the Unilever Group... -

Page 62

... indices Under the UK Directors' Remuneration Report Regulations 2002, we are required to show Unilever's relative share performance, based on Total Shareholder Return, against a holding of shares in a broad-based equity index for the last ï¬ve years. The Remuneration Committee has decided to show... -

Page 63

Remuneration report - detailed information Detailed Information on Directors' Remuneration 2003 The following section contains detailed information on the Directors' annual remuneration, long-term incentives, pension beneï¬ts and share interests in respect of 2003. Table of aggregate remuneration ... -

Page 64

... of NV. (8) Chairman of PLC. (9) Excluded from the emoluments are payments totalling $582 thousand paid in 2003 which relate to an appointment prior to joining the Boards. (10)Total for 2002 includes the value of the matching shares awarded in respect of the performance period 2002. Unilever Annual... -

Page 65

... closing market prices of ordinary shares at 31 December 2003 were â,¬51.85 (NV shares) and 521p (PLC shares). During 2003 the highest market prices were â,¬59.95 and 628p respectively, and the lowest market prices were â,¬45.81 and 475p respectively. 62 Unilever Annual Report & Accounts and Form... -

Page 66

Remuneration report - detailed information Directors' conditional share awards under the TSR Long-Term Incentive Plan Conditional rights to ordinary shares in NV and PLC were granted in 2003 as shown in the table below. No awards vested or lapsed in 2003: Balance of conditional shares at 1 January ... -

Page 67

... Options outstanding above market price at 31 December 2003 Weighted Number average of exercise shares price Share type 1 January 2003 Number granted Exercised 31 December or expired 2003 First exercisable date Final expiry date A Burgmans Executive Plan Executive Plan NL All-Employee Plan UK... -

Page 68

Remuneration report - detailed information Footnotes for table on preceding page: (1) (2) (3) (4) Grants made under the Executive Plan on 25 March 2003 at an option price of â,¬55.10 (NV shares) and 585p (PLC shares). Premium grants made under the Executive Plan on 8 May 2003 at an option price of ... -

Page 69

... the PLC Executive Option Plans and the UK Employee ShareSave Plan. Further information, including details of the NV and PLC ordinary shares acquired by certain group companies in connection with other share option plans, is given in note 29 on page 116. The voting rights of the Directors who hold... -

Page 70

... Business Group by her and other consultants from that company; and Senator G J Mitchell: US $75 000 paid to him for advice provided to Unilever's North American businesses. As at 28 February 2004 the interests of the Advisory Directors in the share capital of NV and PLC were as follows: NV(1) PLC... -

Page 71

.... By order of the Boards J A A van der Bijl S G Williams Joint Secretaries of Unilever N.V. and Unilever PLC 2 March 2004 Auditable part of remuneration report In compliance with the UK Directors' Remuneration Report Regulation 2002, and under Title 9, Book 2 of the Civil Code in the Netherlands... -

Page 72

... and outcome of the annual audit, and management's response. Their reports included accounting matters, governance and control, and accounting developments. Risk Management and Internal Control Arrangements The Committee reviewed Unilever's overall approach to risk management and control, and its... -

Page 73

... of net funds/(debt) 29 Equity-based compensation plans 30 Summarised accounts of the NV and PLC parts of the Group Five-year record Additional information for US investors Principal group companies and ï¬xed investments Company accounts - Unilever N.V. Notes to the company accounts - Unilever... -

Page 74

... The Group reports to shareholders quarterly. Unilever's system of risk management has been in place throughout 2003 and up to the date of this report, and complies with the recommendations of 'Internal Control - Guidance for Directors on the Combined Code', published by the Internal Control Working... -

Page 75

... accounts of the Unilever Group, and of Unilever N.V. and Unilever PLC respectively, have been properly prepared in accordance with Title 9, Book 2 of the Civil Code in the Netherlands and the United Kingdom Companies Act 1985. In our opinion, the auditable part of the Directors' Remuneration Report... -

Page 76

... their group companies, operate as nearly as is practicable as a single entity (the Unilever Group, also referred to as Unilever or the Group). NV and PLC have the same Directors and are linked by a series of agreements, including an Equalisation Agreement, which are designed so that the position of... -

Page 77

... than the ordinary share capital of NV and PLC, is translated at year-end rates of exchange. In the case of hyper-inï¬,ationary economies, which are those in which inï¬,ation exceeds 100% cumulatively over a three-year period, the accounts are adjusted to reï¬,ect current price levels and remove the... -

Page 78

...Group share of any sales to the joint ventures already included in the Group ï¬gures, but does not include our share of the turnover of associates. Discounts given by Unilever include rebates, price reductions and incentives given to customers in cash or company products. At each balance sheet date... -

Page 79

... loss account Unilever Group for the year ended 31 December â,¬ million 2003 â,¬ million 2002 Restated â,¬ million 2001 Restated Turnover 1 Less: Share of turnover of joint ventures 1 Group turnover 1 Cost of sales 2 Gross proï¬t Distribution, selling and administrative costs 2 Group operating... -

Page 80

... from group operating activities 26 Dividends from joint ventures Returns on investments and servicing of ï¬nance 27 Taxation Capital expenditure and ï¬nancial investment 27 Acquisitions and disposals 27 Dividends paid on ordinary share capital Cash ï¬,ow before management of liquid resources and... -

Page 81

... obligations 17 Net pension asset for funded schemes in surplus 17 Net pension liability for funded schemes in deï¬cit 17 Net pension liability for unfunded schemes 17 Minority interests Capital and reserves 20 Attributable to: NV: Called up share capital 21 Share premium account Other reserves 23... -

Page 82

... accounts Unilever Group 1 Segmental information â,¬ million â,¬ million North America â,¬ million Africa, Middle East & Turkey â,¬ million Asia & Paciï¬c â,¬ million Latin America â,¬ million Analysis by geographical area 2003 Turnover(a) Less: Share of turnover of joint ventures Group turnover... -

Page 83

...consumer brands, we own tea plantations and palm oil plantations, the results of which are reported within this segment. â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care... -

Page 84

... accounts Unilever Group 1 Segmental information continued â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care â,¬ million Personal care â,¬ million Other operations... -

Page 85

...products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care â,¬ million Personal care â,¬ million Other operations â,¬ million Analysis by operation 2003 Turnover At constant 2002 exchange rates Exchange rate adjustments At current 2003 exchange... -

Page 86

...Additional segmental information as required by US GAAP continued â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care â,¬ million Personal care â,¬ million Other operations... -

Page 87

... the United Kingdom and the Netherlands, the combined operating proï¬t was â,¬918 million (2002: â,¬750 million; 2001: â,¬1 473 million). The 2002 and 2001 amounts have been restated for the change in accounting policy for pensions and the restatement discussed in footnote (h). 84 Unilever Annual... -

Page 88

... on page 68. The average number of employees during the year was: '000 2003 '000 2002 '000 2001 Europe North America Africa, Middle East and Turkey Asia and Paciï¬c Latin America Total 57 20 53 79 31 240 65 22 52 84 35 258 75 30 49 84 41 279 Unilever Annual Report & Accounts and Form 20-F 2003... -

Page 89

... provisions were originally recorded on the acquisition of the Bestfoods business. In 2001, exceptional items included â,¬1.4 billion of Path to Growth net costs and â,¬811 million gain on the sale of brands to secure regulatory approval for the acquisition of Bestfoods. Information relating to the... -

Page 90

... 2001 Restated Parent and group companies(a)(b) Joint ventures Associates Total Of which: Adjustments to previous years United Kingdom taxes Other taxes (a) United Kingdom Corporation Tax at 30.0% less: double tax relief United Kingdom taxes plus: non-United Kingdom taxes (1 529) (5) 7 (1 527... -

Page 91

Notes to the consolidated accounts Unilever Group 6 Taxation on proï¬t on ordinary activities continued The total charge in future periods will be affected by any changes to the corporate tax rates in force in the countries in which the Group operates. The current tax charges will also be affected... -

Page 92

... NV and PLC in issue during the year, after deducting shares held to meet Unilever employee share options which are not yet exercised. For the calculation of combined ordinary capital, the exchange rate of £1 = Fl. 12 = â,¬5.445 has been used, in accordance with the Equalisation Agreement. Earnings... -

Page 93

... Unilever Group 8 Dividends on ordinary capital â,¬ million 2003 â,¬ million 2002 â,¬ million 2001 Dividends on ordinary capital Interim Final Total Per â,¬0.51 share of NV ordinary capital 2003 2002 2001 (574) (1 108) (1 682) (537) (1 122) (1 659) (491) (1 039) (1 530) Per 1.4p share of PLC... -

Page 94

... than 40 years 40 years Life of lease *40 years 2-20 years 3-6 years Tangible ï¬xed assets are subject to review for impairment in accordance with United Kingdom FRS 11 and United States SFAS 144. Any impairment in the value of such ï¬xed assets is charged to the proï¬t and loss account as it... -

Page 95

Notes to the consolidated accounts Unilever Group 11 Fixed investments Joint ventures are undertakings in which the Group has a long-term participating interest and which are jointly controlled by the Group and one or more other parties. Associated companies are undertakings in which the Group has ... -

Page 96

Notes to the consolidated accounts Unilever Group 11 Fixed investments continued Analysis of listed and unlisted investments Investments listed on a recognised stock exchange Unlisted investments Total ï¬xed investments Market value of listed investments â,¬ million 2003 â,¬ million 2003 â,¬ ... -

Page 97

...854 Borrowings Bank loans and overdrafts Bonds and other loans (1 834) (14 066) (15 900) Total net funds/(debt) Current investments include government securities and A- or higher rated money and capital market instruments. (12 555) An amount of â,¬20 million (2002: â,¬13 million) is included in... -

Page 98

...) Other Total NV PLC 5.375% Notes 2003 (â,¬) Commercial paper (â,¬) Commercial paper (£) Total PLC Other group companies: United States: ... 3.300% Bonds 2007 (Thai Baht) South Africa: 10.200% Bonds 2008 (South African Rand) Other countries Total other group companies Total bonds and other loans - ... -

Page 99

...xing period â,¬ million Floating rate â,¬ million Total Liabilities - 2003 Euro Sterling US Dollar Thai Baht Other Total Liabilities - 2002(d) Euro Sterling US Dollar Thai Baht Other Total (d) Amounts for 2002 have been restated. See page 94. 96 Unilever Annual Report & Accounts and Form 20-F 2003... -

Page 100

...to the exclusion of short-term items, as permitted by United Kingdom Financial Reporting Standard 13, or because the amounts are not material. Unilever's interest rate management policy is described on page 46. The Group's ï¬nancial position is mainly ï¬xed by ï¬xed rate long-term debt issues and... -

Page 101

... accounts Unilever Group 15 Financial instruments continued Under the Group's foreign exchange policy, transaction exposures, which usually have a maturity of less than one year, are generally hedged; this is primarily achieved through the use of forward foreign exchange contracts. The market value... -

Page 102

... Plans In most countries the Group operates deï¬ned beneï¬t pension plans based on employee pensionable remuneration and length of service. The majority of these plans are externally funded. The Group also provides other post-employment beneï¬ts, mainly post-employment medical plans in the United... -

Page 103

... 2003 2002 2003 Netherlands 2002 2003 United States 2002 2003 Germany 2002 Discount rate Inï¬,ation assumption Rate of increase in salaries Rate of increase for pensions in payment Rate of increase for pensions in deferment (where provided) Expected long-term rates of return: Equities Bonds Others... -

Page 104

... to the consolidated accounts Unilever Group 17 Pensions and similar obligations continued Balance Sheet The assets, liabilities and surplus/deï¬cit position of the pension and other post-employment beneï¬t plans and the expected rates of return on the plan assets, at the balance sheet date, were... -

Page 105

...million (2002: â,¬260 million; 2001: â,¬352 million). Company contributions to funded plans have been at a reduced level for a number of years resulting from the generally strong stock market performance of the 1990s. Following the falls in stock markets in 2000, 2001 and 2002, contribution holidays... -

Page 106

...the consolidated accounts Unilever Group 17 Pensions and similar obligations continued History of experience gains and losses 2003 2002 2001 Actual return less expected return on plan assets (â,¬m) As % of plan assets at beginning of year (%) Experience gains/(losses) on plan liabilities (â,¬m) As... -

Page 107

... requirements of the territories where the plans are based. The Group has developed policy guidelines for the allocation of assets to different classes with the objective of controlling risk and maintaining the right balance between risk and long-term returns in order to limit the cost to the... -

Page 108

... 2002, from 76% in 2001. In 2002 and previous years the Group did not calculate pension costs and balances under SFAS 87 for a number of small deï¬ned beneï¬t plans. The amounts originally recognised for these plans in the group accounts under SSAP 24 would not have been materially different under... -

Page 109

... expected rate of return on plan assets was determined, based on actuarial advice, by a process that takes the current long-term rates of return available on government bonds and applies to these rates suitable risk premiums that take account of available historic market returns and current market... -

Page 110

... depreciation Stock reliefs Short-term and other timing differences Less: asset balances reclassiï¬ed as debtors due after more than one year 13 859 31 (780) 110 637 747 877 41 (1 015) (97) 472 375 Movements in deferred taxation: 1 January Currency retranslation Acquisition of group companies... -

Page 111

...Dec 2000 Capital and reserves as reported in the 2002 Annual Report & Accounts Accounting policy change - pensions Accounting policy change - share options Capital and reserves as restated 5 867 (1 238) 73 4 702 6 993 1 444 - 8 437 7 974 3 237 - 11 211 108 Unilever Annual Report & Accounts and... -

Page 112

... each of NV and PLC is given in notes 21, 22 and 23 on pages 110 and 111. â,¬ million Called up share capital â,¬ million Share premium account â,¬ million Other reserves(b) â,¬ million Proï¬t retained â,¬ million Total 2003 1 January 2003 Result for the year retained Goodwill movements Actuarial... -

Page 113

.... For information on the rights of shareholders of NV and PLC and the operation of the Equalisation Agreement, see 'Control of Unilever' on pages 152 to 155. Internal holdings The ordinary shares numbered 1 to 2 400 (inclusive) in NV and deferred stock of PLC are held as to one half of each class by... -

Page 114

...million PLC 2002 Restated â,¬ million PLC 2001 Restated Net proï¬t Preference dividends Dividends on ordinary capital Result for the year retained Goodwill movements Actuarial gains/(losses) on pension schemes net of tax Share option credit(a) Unrealised gain on partial disposal of a group company... -

Page 115

.... In exchange, Unilever received a 9% equity interest in Unilever Bestfoods Robertsons thereby obtaining control. â,¬ million â,¬ million Provisional adjustments to align accounting policies â,¬ million â,¬ million Provisional fair values at date of acquisition Balance sheets of acquired businesses... -

Page 116

... Pamol oil business in Malaysia. Various trademarks were also sold as part of our Path to Growth strategy, including Brut in the US and Latin America and a number of oral care brands in the US. In 2002 the principal sale was that of the DiverseyLever business to JohnsonDiversey Inc. in exchange for... -

Page 117

... consolidated accounts Unilever Group 26 Reconciliation of group operating proï¬t to operating cash ï¬,ows â,¬ million 2003 â,¬ million 2002 Restated â,¬ million 2001 Restated Group operating proï¬t Depreciation and amortisation Changes in working capital: Stocks Debtors Creditors Pensions and... -

Page 118

... made in previous years Total Management of liquid resources Purchase of current investments Sale of current investments (Increase)/decrease in cash on deposit Total Financing Issue/purchase of shares by group companies to/(from) minority shareholders Debt due within one year: Increases Repayments... -

Page 119

...that time. (vi) The North American Performance Share Plan A long-term incentive plan for North American managers, awarding Unilever shares if company and personal performance targets are met over a three-year period. Unilever will not grant share options in total in respect of Executive Option Plans... -

Page 120

... by a Group company until the vesting date. Group (b): The UK and South Africa plans annually offer options over PLC shares, combined with a compulsory (UK) or optional (South Africa) savings plan. The exercise price is the market price at date of grant. In 2003, Unilever UK introduced 'ShareBuy... -

Page 121

... Expected dividend yield Risk-free interest rate PLC option value information(b) Fair value per option(c) Valuation assumptions Expected option term Expected volatility Expected dividend yield Risk-free interest rate NV New York shares option value information(b) Fair value per option(c) Valuation... -

Page 122

...shares of Unilever PLC, at a price not lower than the market value on the day the options are granted. These options become exercisable over a three-year period from the date of grant and have a maximum term of ten years. Managers working in India can participate in an Executive Option Plan relating... -

Page 123

... PLC shares. 2003 2002 2001 NV option value information(b) Fair value per option(c) NV Executive Option Plan PLC Executive Option Plan NA Executive Option Plan Valuation assumptions Expected option term Expected volatility Expected dividend yield Risk-free interest rate PLC option value information... -

Page 124

... that the manager has not resigned from Unilever at the end of this period. The North American managers participate in the North American Share Bonus Plan, the others in the Variable Pay in Shares Plan. The numbers below include the numbers for the Directors shown in the Remuneration report on page... -

Page 125

... The TSR Long-Term Incentive Plan Under this plan, introduced in 2001, grants are made to Board members and some senior executives. The level of share award which will vest three years later will vary in accordance with the Total Shareholder Return in comparison with a peer group (see description on... -

Page 126

... using option pricing models taking account of peer group TSR volatilities and correlations. â,¬43.57 £4.63 â,¬26.94 £2.41 â,¬57.33 £5.11 (v) The Restricted Share Plan In speciï¬c one-off cases a number of executives are awarded the right to receive NV and PLC shares at a speciï¬ed date in... -

Page 127

... 163 031) NV options and of 79 751 021 (2002: 13 156 190) PLC options was above the market price of the shares. Shares held to satisfy options are accounted for in accordance with Netherlands law and United Kingdom UITF 37 and UITF 38. All differences between the purchase price of the shares held to... -

Page 128

... and loss account for the year ended 31 December â,¬ million NV 2003 â,¬ million NV 2002 Restated â,¬ million NV 2001 Restated â,¬ million PLC 2003 â,¬ million PLC 2002 Restated â,¬ million PLC 2001 Restated Group turnover Group operating proï¬t Total income from ï¬xed investments Interest Other... -

Page 129

..., working capital (stocks, debtors and trade and other creditors due within one year), goodwill and intangible assets at gross book value and cumulative goodwill written off directly to reserves under an earlier accounting policy. Ungeared free cash ï¬,ow is cash ï¬,ow from group operating... -

Page 130

... taxation Net proï¬t Preference dividends Dividends on ordinary capital Result for the year retained Combined earnings per share(c) Euros per â,¬0.51 of ordinary capital Euro cents per 1.4p of ordinary capital Ordinary dividends NV - euros per â,¬0.51 of ordinary capital(d) PLC - pence per 1.4p of... -

Page 131

... Group turnover Net proï¬t Capital and reserves Total assets Combined earnings per share(c) Euros per â,¬0.51 of ordinary capital Euro cents per 1.4p of ordinary capital Diluted earnings per share Euros per â,¬0.51 of ordinary capital Euro cents per 1.4p of ordinary capital Return on invested... -

Page 132

... 9 264 690 577 37 1 304 Net operating assets Foods Home & Personal Care Other operations 22 469 2 180 272 24 921 25 156 2 625 406 28 187 805 466 27 1 298 Capital expenditure Foods Home & Personal Care Other operations 602 416 20 1 038 Unilever Annual Report & Accounts and Form 20-F 2003 129 -

Page 133

... Noon Buying Rates in New York for cable transfers in foreign currencies as certiï¬ed for customs purposes by the Federal Reserve Bank of New York were as follows: 2003 2002 2001 2000 1999 Year end â,¬1 = $ Annual average â,¬1 = $ High â,¬1 = $ Low â,¬1 = $ High and low exchange rate values for... -

Page 134

... determining the expected return on plan assets for US purposes, Unilever changed the method of valuing its pension plan assets from a market-related value calculated by smoothing gains and losses over a ï¬ve-year period to an actual fair value at the balance sheet date. Management believe that the... -

Page 135

... account. Goodwill and intangible assets Under UK and Netherlands GAAP, goodwill (being the difference between the fair value of consideration paid for new interests in group companies, joint ventures and associated companies and the fair value of the Group's share of their net assets at the date... -

Page 136

... for the year ended 31 December 2003. Goodwill An analysis of goodwill of group companies by reporting segment is given below: â,¬ million Savoury and dressings Spreads and cooking products Health & wellness and Ice cream and beverages frozen foods Home care Personal care Other operations Total As... -

Page 137

... determining the expected return on plan assets for US purposes, Unilever changed the method of valuing its pension plan assets from a market-related value calculated by smoothing gains and losses over a ï¬ve-year period to an actual fair value at the balance sheet date. Management believe that the... -

Page 138

... the accounting policy from the initial adoption of SFAS 87 by Unilever. The cumulative effect adjustment net of tax was â,¬522 million in 2002. Investments Unilever accounts for current investments, which are liquid funds temporarily invested, at their market value, which is consistent with UK GAAP... -

Page 139

... companies in preparing the changes in its corporate governance arrangements that will be effective from the NV and PLC Annual General Meetings on 12 May 2004. Further information will be placed on Unilever's website www.unilever.com/investorcentre/ following those meetings, and will be reported... -

Page 140

... account for the year ended 31 December 2003 Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Share of operating proï¬t of associates Dividends Other income from ï¬xed investments Interest Other ï¬nance income/(cost) - pensions... -

Page 141

... interests Equity earnings of subsidiaries Net proï¬t Proï¬t and loss account for the year ended 31 December 2001 (restated) Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Dividends Other income from ï¬xed investments Interest... -

Page 142

...guarantor Unilever United States Inc. subsidiary guarantor Unilever PLC parent guarantor Nonguarantor subsidiaries Eliminations Unilever Group Cash ï¬,ow statement for the year ended 31 December 2003 Cash ï¬,ow from group operating activities Dividends from joint ventures Returns on investments... -

Page 143

... year Provisions for liabilities and charges (excluding pensions and similar obligations) Net liabilities for pensions and similar obligations Minority interests Capital and reserves attributable to: PLC NV Called up share capital Share premium account Other reserves Proï¬t retained Total capital... -

Page 144

... year Provisions for liabilities and charges (excluding pensions and similar obligations) Net liabilities for pensions and similar obligations Minority interests Capital and reserves attributable to: PLC NV Called up share capital Share premium account Other reserves Proï¬t retained Total capital... -

Page 145

... following key: Holding companies Foods Home & Personal Care Other Operations Unless otherwise indicated, the companies are incorporated and principally operate in the countries under which they are shown. The aggregate percentage of equity capital directly or indirectly held by NV or PLC is shown... -

Page 146

.... Unilever PLC(2) Unilever UK Central Resources Ltd. Unilever UK Holdings Ltd. Unilever UK & CN Holdings Ltd. % North America Canada Unilever Canada Inc. United States of America Ben & Jerry's Homemade Inc. Good Humor-Breyers Ice Cream(3) Slim•Fast Foods Company(3) Unilever Bestfoods(3) Unilever... -

Page 147

...xed investments Unilever Group as at 31 December 2003 Principal group companies continued % Asia and Paciï¬c Australia Unilever Australia Ltd. 61 Bangladesh Lever Brothers Bangladesh Ltd. Cambodia Unilever (Cambodia) Limited 80 77 China Bestfoods Guangzhou Foods Ltd. Unilever (China) Ltd. Unilever... -

Page 148

...Lda. North America United States of America The Pepsi/Lipton Partnership c F Ownership Activity a F Associated companies % 33 % 33 Europe United Kingdom Langholm Capital Partners North America United States of America JohnsonDiversey Holdings Inc a P Ownership b Activity O Unilever Annual Report... -

Page 149

... the Civil Code in the Netherlands, the company accounts are prepared in accordance with United Kingdom accounting standards. Amounts for 2002 have been restated following changes in our accounting policies for pensions and other post-employment beneï¬ts and for the presentation of securities held... -

Page 150

Notes to the company accounts Unilever N.V. Fixed investments â,¬ million 2003 â,¬ million 2002 Shares in group companies Book value of PLC shares held in connection with share options Less NV shares held by group companies Other unlisted investments 11 008 381 (228) - 11 161 11 008 368 (168) ... -

Page 151

.... The General Meeting can only decide to make distributions from reserves on the basis of a proposal by the Board and in compliance with the law and the Equalisation Agreement. â,¬ million 2003 â,¬ million 2002 Restated Proposed proï¬t appropriation Proï¬t for the year Preference dividends Pro... -

Page 152

... as part of the published company accounts for PLC. Amounts for 2002 have been restated following the implementation of UK UITF 37 and UITF 38. On behalf of the Board of Directors N W A FitzGerald Chairman A Burgmans Vice-Chairman 2 March 2004 Unilever Annual Report & Accounts and Form 20-F 2003... -

Page 153

... of UK UITF 37 'Purchase and sale of own shares' and UITF 38 'Accounting for ESOP Trusts', PLC shares held in an ESOP Trust to meet share options granted to employees have been reclassiï¬ed from 'Fixed investments' to 'Other reserves', which are a deduction from proï¬t retained. Prior years have... -

Page 154

... this page and the information contained in the Report of the Directors on pages 2 to 69, Dividends on page 161 and Principal group companies and ï¬xed investments on pages 142 to 145. Corporate Centre Unilever PLC PO Box 68 Unilever House Blackfriars London EC4P 4BQ Unilever PLC Registered Ofï¬ce... -

Page 155

... NV and PLC have always been able to pay their own dividends, so we have never had to follow this procedure. If we did, the payment from one company to the other would be subject to any United Kingdom and Netherlands tax and exchange control laws applicable at that time. The Equalisation Agreement... -

Page 156

... of both companies. If the Boards fail to enforce the agreement, shareholders can compel them to do so under Netherlands and United Kingdom law. General Meetings and voting rights General Meetings of shareholders of NV and PLC are held at times and places decided by the Boards. NV meetings are held... -

Page 157

... calculate earnings per share is as follows. First, we convert the average capital of NV and PLC into units using the formula contained in the Equalisation Agreement: one unit equals 10.7 NV shares or 71.4 PLC shares. We add these together to ï¬nd the total number of units of combined share capital... -

Page 158

... to vote the NV ordinary and preference shares it holds at shareholders' meetings. Trust companies in the Netherlands will not usually vote to inï¬,uence the operations of companies, and in the past Nedamtrust has always followed this policy. However, if a change to shareholders' rights is proposed... -

Page 159

... of PLC's shares or deferred stock on 28 February 2004. The voting rights of such shareholders are the same as for other holders of the class of share indicated. We take this information from the register we hold under section 211 of the UK Companies Act 1985. Title of class Name of holder Number of... -

Page 160

... in exchange rates. However, over time the prices of NV and PLC shares do stay in close relation to each other, in particular because of our equalisation arrangements. If you are a shareholder of NV, you have an interest in a Netherlands legal entity, your dividends will be paid in euros (converted... -

Page 161

...65 56 65 58 633 562 39 35 Annual high and low prices for 2001, 2000 and 1999: 2001 2000 1999 NV per â,¬0.51 ordinary share in Amsterdam (in â,¬(a)) NV per â,¬0.51 ordinary share in New York (in $) PLC per 1.4p ordinary share in London (in pence) PLC per American Share in New York (in $) High Low... -

Page 162

... organisations that are generally exempt from United States taxes and that are constituted and operated exclusively to administer or provide pension, retirement or other employee beneï¬ts may be exempt at source from withholding tax on dividends received from a Netherlands corporation. An agreement... -

Page 163

... if the shares are part of the business property of a permanent establishment of the individual in the United Kingdom or, in the case of a shareholder who performs independent personal services, pertain to a ï¬xed base situated in the United Kingdom. 160 Unilever Annual Report & Accounts and Form... -

Page 164

... comparison between PLC dividends paid before and after 6 April 1999 because of the abolition of United Kingdom ACT (Advance Corporation Tax) from that date. The ï¬nal sterling dividend for 2003 is payable on 14 June 2004. The dollar dividend will be calculated with reference to the exchange rates... -

Page 165

...n/a Risk factors 45-46 48 50 50-51, 85 n/a n/a 4 Information on the company 4A History and development of the company 4B Business overview 4C Organisational structure 4D Property, plant and equipment 5 5A 5B 5C 2, 17-18, 47, 115, 164 9-14, 21-44, 45 47, 142-145 14 Operating and ï¬nancial review... -

Page 166

...Reserves Share capital Share option Share premium account Shareholders' funds Shares in issue Statement of total recognised gains and losses Stocks Tangible ï¬xed assets Turnover Financial statements A business which is not a subsidiary or a joint venture, but in which the Group has a shareholding... -

Page 167

Financial calendar and addresses Annual General Meetings NV PLC Announcements of results First Quarter First Half Year Dividends on ordinary capital Final for 2003 - announced 12 February 2004 and to be declared 12 May 2004 Ex-dividend date Record date Payment date 10:30 am Wednesday 12 May 2004 ... -

Page 168

... share price, our quarterly and annual results, performance charts, ï¬nancial news and analyst communications. It also includes transcripts of our investor relations speeches and copies of Unilever results presentations. You can also view this year's and prior years' Annual Review and Annual Report... -

Page 169

... PO Box 760 3000 DK Rotterdam The Netherlands T +31 (0)10 217 4000 F +31 (0)10 217 4798 Unilever PLC PO Box 68, Unilever House Blackfriars, London EC4P 4BQ United Kingdom T +44 (0)20 7822 5252 F +44 (0)20 7822 5951 Unilever PLC registered ofï¬ce Unilever PLC Port Sunlight Wirral Merseyside CH62 4ZD...