US Bank 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. Bancorp 2009 Annual Report

Quality

Strength

Leadership

U.

S.

B

anco

rp

20

09

A

nn

ua

l

Repo

rt

Table of contents

-

Page 1

Quality Strength Leadership U.S. Bancorp 2 0 00 0 9 Annual Report -

Page 2

... Ranking Asset size Deposits Loans Customers Payment services and merchant processing Wholesale banking and trust services Consumer and business banking and wealth management Bank branches ATMs NYSE symbol At year-end December 31, 2009 U.S. Bank is 5th largest U.S. commercial bank $281 billion... -

Page 3

...organization operating on sound and prudent principles. During a devastating economic downturn, U.S. Bancorp demonstrated leadership with sound management, financial performance, customer relationships and commitment to our communities. Please see explanation on Page 17 regarding the risks and... -

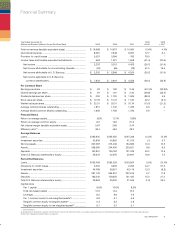

Page 4

... Ratio (a) (In Percents) Tier 1 Capital (In Percents) 49.2 45.4 46.9 4.50 3.97 3.66 3.67 3.65 3.47 50 44.4 48.4 12 10.6 8.8 9.6 2.25 25 6 0 05 06 07 08 09 0 05 06 07 08 09 0 05 06 07 08 09 Average Assets (Dollars in Millions) Average Shareholders' Equity (Dollars in Millions) Total... -

Page 5

...Average Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ...Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ...Capital ratios... -

Page 6

... theme of this year's Annual Report to Shareholders is Quality, Strength, Leadership. These attributes reï¬,ect the manner in which U.S. Bancorp has endeavored to manage through this time of unparalleled turmoil on behalf of our shareholders, customers, employees and the communities we serve. Long... -

Page 7

... of our company. We achieved record total net revenue for both the quarter and the year; a record $4.4 billion for the fourth quarter and a record $16.7 billion for the full year 2009. The strong growth in net revenue, the result of our expanding balance sheet and fee-based businesses, as well... -

Page 8

...heartening that U.S. Bancorp remained consistently proï¬table in 2009, while helping our customers manage through these unprecedented times. We are aligned to make the most of an economic recovery and we have positioned the bank to emerge as an even stronger competitor. This annual report will also... -

Page 9

... maintained. We greatly appreciate the impact that this lower dividend rate has on our shareholders, and we are grateful for your support of our prudent approach to capital preservation at this critical time. Leadership New rules governing the operations of ï¬nancial institutions should be expected... -

Page 10

... individual and group mentoring programs. These are just a few of the many options available to all employees. Leaders provide guidance, help develop direction Our new Leadership Council members were selected to represent the diverse voice of our leaders across the company. These 14 leaders shape... -

Page 11

... helps develop a trained and ready workforce. The Step Up program in Minneapolis recruits, trains and places youth in paid summer jobs. U.S. Bank has been a corporate champion of the program since its inception in 2004 and has hosted more than 125 Step Up interns. All of US create the customer... -

Page 12

..., technological world. Our four major lines of business serve a wide range of customers while maintaining our low-risk proï¬le. We will continue to grow our bank through the organic growth of our established lines of business - Payments, Consumer Banking, Wholesale Banking and Wealth Management... -

Page 13

... and start banking right away. Our Mobile Wallet downloadable "app" puts U.S. Bank at customers' ï¬ngertips to check balances, contact us, transfer funds and see special offers and rewards. Look for mobile bill pay in the future. We look for innovations that make our products and services simpler... -

Page 14

... mutual fund administration business of Fiduciary Management, Inc. with more than $8 billion in assets under administration. We also acquired KeyCorp's and Associated Bank's credit card issuing programs; Diner's Club merchant processing portfolio in Europe; and Citizens National merchant processing... -

Page 15

... Rewards Visa Card when savings balances build to $1,000, and if they maintain that balance for one year, they earn another $50 Rewards Visa Card from U.S. Bank. In May we opened a new Corporate Banking and Capital Markets ofï¬ce in Charlotte, North Carolina, creating excitement and 30 new jobs... -

Page 16

... Moves Making the Most of a Turbulent Year Payment Services 2009 Revenue 26% Offers payments and processing services for individual and corporate credit, prepaid and electronic checks throughout North America and Europe; issues debit, credit and prepaid cards; provides a wide range of ï¬nancial... -

Page 17

... Revenue Wealth Management & Securities Services 2009 Revenue 10% Provides a full range of ï¬nancial services via more than 3,000 branch ofï¬ces, by phone and Internet to millions of consumers, small businesses and afï¬,uent clients. Serving individual, business, institutional and municipal... -

Page 18

...nancial services to middle market companies and to specialized industries. Also is very active in Small Business Administration ï¬nancing. Commercial Banking team and Community Banking conducted Building Deeper Relationships comprehensive relationship reviews with more than 8,700 key customers to... -

Page 19

...better understanding of the values that drive our company, the people who manage it, our culture of customer service, our key strategies for prudent growth and our recent accomplishments. The following pages will give you a complete picture of our results, the policies and procedures on which our... -

Page 20

...the Company's fee-based businesses, particularly mortgage banking. Additionally the Company continued its focus on effectively managing its cost structure, with an efficiency ratio (the ratio of noninterest expense to taxable-equivalent net revenue, excluding net securities gains and losses) in 2009... -

Page 21

...-bearing deposits ...Deposits ...Short-term borrowings ...Long-term debt ...Total U.S. Bancorp shareholders' equity ...Period End Balances Loans...Allowance for credit losses...Investment securities ...Assets ...Deposits ...Long-term debt ...Total U.S. Bancorp shareholders' equity ...Capital ratios... -

Page 22

...FDIC deposit insurance expense, costs related to affordable housing and other tax-advantaged investments, and marketing and business development expense, principally related to credit card initiatives. Acquisitions On October 30, 2009, the Company acquired $3.5 billion of losses on those assets and... -

Page 23

... relatively stable with a positive bias. Refer to the "Interest Rate Risk Management" section for further information on the sensitivity of the Company's net interest income to changes in interest rates. Average total loans were $185.8 billion in 2009, compared with $165.6 billion in 2008. Average... -

Page 24

... Income - Changes Due to Rate and Volume (a) 2009 v 2008 (Dollars in Millions) Volume Yield/Rate Total Volume 2008 v 2007 Yield/Rate Total Increase (decrease) in Interest Income Investment securities ...Loans held for sale ...Loans Commercial loans ...Commercial real estate. Residential mortgage... -

Page 25

... economy weakened and unemployment increased. Accruing loans ninety days or more past due increased $558 million (excluding covered assets), primarily due to stress in residential mortgages, commercial loans, construction loans, credit cards and home equity loans. Restructured loans that continue to... -

Page 26

... 2009 v 2008 2008 v 2007 Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking... -

Page 27

..., acquired businesses and other bank initiatives to increase the Company's banking presence and enhance customer relationship management. Employee benefits expense increased as higher payroll taxes and medical costs were partially offset by lower pension costs. Net occupancy and equipment expense... -

Page 28

... information on the Company's pension plan funding practices, investment policies and asset allocation strategies, and accounting policies for pension plans. $ (62) (1.74)% $ 56 1.57% Income Tax Expense The provision for income taxes was $395 million (an effective rate of 15.0 percent) in 2009... -

Page 29

...have limited borrower access to real estate capital markets. Table 8 provides a summary of commercial real estate by property type and geographic location. The collateral for $4.7 billion of commercial real estate loans included in covered assets at December 31, 2009 was in California, compared with... -

Page 30

... 28.2 100.0% Total ...$48,792 Geography California ...Colorado...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah ...$ 6,685... -

Page 31

... 11.7 100.0% Total ...$34,093 Geography California ...Colorado...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah ...$ 7,432... -

Page 32

... 31, 2008 Loans Percent Residential Mortgages California ...Colorado...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah... -

Page 33

... for debt securities. This guidance requires the portion of other-than-temporary impairment related to factors other than anticipated credit losses be recognized in other comprehensive income (loss), rather than earnings. At December 31, 2009, the Company's net unrealized loss on available-for-sale... -

Page 34

... equivalent basis utilizing a tax rate of 35 percent. Yields on available-for-sale and held-to-maturity securities are computed based on historical cost balances. Average yield and maturity calculations exclude equity securities that have no stated yield or maturity. 2009 December 31 (Dollars in... -

Page 35

...December 31, 2009. There is limited market activity for the structured investment and non-agency mortgage-backed securities held by the Company. As a result, the Company estimates the fair value of these securities using estimates of expected cash flows, discount rates and management's assessment of... -

Page 36

...the end-of-term value of leased assets. Operational risk includes risks related to fraud, legal and compliance risk, processing errors, technology, breaches of internal controls and business continuation and disaster recovery risk. Interest rate risk is the potential reduction of net interest income... -

Page 37

...incurred loan losses. Commercial banking operations rely on prudent credit policies and procedures and individual lender and business line manager accountability. Lenders are assigned lending authority based on their level of experience and customer service requirements. Credit officers reporting to... -

Page 38

...69.2 percent of total commercial loans, excluding covered assets, within the 24-state banking region. Credit relationships outside of the Company's banking region are reflected within the corporate banking, mortgage banking, auto dealer and leasing businesses focusing on large national customers and... -

Page 39

... in residential mortgages, home equity and installment loan financing. The consumer finance division manages loans originated through a broker network, correspondent relationships and U.S. Bank branch offices. Generally, loans managed by the Company's consumer finance division exhibit higher credit... -

Page 40

... certain niche lending activities that are nationally focused. Within the Company's retail loan portfolio, approximately 73.4 percent of the credit card balances relate to cards originated through the bank branches or co-branded and affinity programs that generally experience better credit quality... -

Page 41

... Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ... Residential Mortgages ...Retail Credit card ...Retail leasing...Other retail ...Total retail ...Total loans, excluding covered assets ... Covered Assets ...Total loans ...At December 31, 90 days... -

Page 42

... for residential mortgages and retail loans, excluding covered assets: As a Percent of Ending Loan Balances 2008 2009 2008 The following table provides information on delinquent and nonperforming loans as a percent of ending loan balances by channel: Consumer Finance (a) December 31, 2009 2008... -

Page 43

... loans not performing in accordance with modified terms, other real estate and other nonperforming assets owned by the Company. Interest payments collected from assets on nonaccrual status are typically applied against the principal balance and not recorded as income. At December 31, 2009, total... -

Page 44

... covered assets, as a percent of their related loan balances, including geographical location detail for residential (residential mortgage, home equity and second mortgage) and commercial (commercial and commercial real estate) loan balances: December 31, (Dollars in Millions) Amount 2009 2008... -

Page 45

... loans ...Changes in Nonperforming Assets (Dollars in Millions) ... $ Commercial and Commercial Real Estate Retail and Residential Mortgages (d) Total Balance December 31, 2008 ...Additions to nonperforming assets New nonaccrual loans and foreclosed properties ...Advances on loans ...Acquired... -

Page 46

...and related industries, commercial real estate properties and credit costs associated with credit card and other consumer and commercial loans as the economy weakened and unemployment increased. Given current economic conditions and the weakness in home prices and the economy in general, the Company... -

Page 47

... risks associated with commercial real estate and the mix of loans, including credit cards, loans originated through the consumer finance division and residential mortgages balances, and their relative credit risks, were evaluated. Finally, the Company considered current economic conditions... -

Page 48

...Covered assets ...Total recoveries ... Net Charge-Offs Commercial Commercial ...Lease financing ...Total commercial ...Commercial real estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential mortgages ...Retail Credit card ...Retail leasing ...Home... -

Page 49

... Loans 2008 2007 2006 2005 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages ...Retail Credit card ...Retail leasing ...Home equity and second mortgages... -

Page 50

... on customers, as rising unemployment levels have increased losses in prime-based residential portfolios and credit cards. The evaluation of the adequacy of the allowance for credit losses for purchased non-impaired loans acquired on or after January 1, 2009 considers credit discounts recorded... -

Page 51

... is required to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions, including technology, networks and data centers supporting customer applications and business operations. While the Company believes that it... -

Page 52

... interest income over the next 12 months of various potential interest rate changes. The Company manages its interest rate risk position by holding assets on the balance sheet with desired interest rate risk characteristics, implementing certain pricing strategies for loans and deposits and through... -

Page 53

... payments to floating-rate payments; • To convert the cash flows associated with floating-rate debt, issued to finance the Company, from floating-rate payments to fixed-rate payments; and • To mitigate changes in value of the Company's mortgage origination pipeline, mortgage loans held for sale... -

Page 54

...Dominion Bond Rating Service U.S. Bancorp Short-term borrowings ...Senior debt and medium-term notes . Subordinated debt ...Preferred stock ...Commercial paper ...U.S. Bank National Association Short-term time deposits...Long-term time deposits ...Bank notes ...Subordinated debt ...Commercial paper... -

Page 55

.... These debt obligations may be met through medium-term note and capital security issuances and dividends from subsidiaries, as well as from parent company cash and cash equivalents. During 2009, the Company raised $2.7 billion through the sale of its common stock. Federal banking laws regulate... -

Page 56

... for well-capitalized bank holding companies. To achieve these capital goals, the Company employs a variety of capital management tools, including dividends, common share repurchases, and the issuance of subordinated debt, common stock and other capital instruments. On May 7, 2009, the Federal... -

Page 57

... Department of Housing and Urban Development, Government National Mortgage Association, Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. At December 31, 2009, U.S. Bank National Association met these requirements. Table 20 provides a summary of capital ratios... -

Page 58

... income was also due to higher fee-based payments-related income of $70 million (10.3 percent) and an increase in commercial products revenue of $54 million (41.2 percent) due to stronger capital markets, standby letters of credit and other commercial loan fees. Trust and investment management fees... -

Page 59

...the marginal impact of higher pre-tax earnings year-over-year. Line of Business Financial Review The Company's major lines of business are Wholesale Banking, Consumer Banking, Wealth Management & Securities Services, Payment Services, and Treasury and Corporate Support. These operating segments are... -

Page 60

...treasury management, capital markets, foreign exchange, international trade services and other financial services to middle market, large corporate, commercial real estate, financial institution and public sector clients. Wholesale Banking contributed $240 million of the Company's net income in 2009... -

Page 61

... for further information on factors impacting the credit quality of the loan portfolios. Wealth Management & Securities Services 2009 2008 Percent Change 2009 Payment Services 2008 Percent Change Treasury and Corporate Support 2009 2008 Percent Change 2009 Consolidated Company 2008 Percent... -

Page 62

... five businesses: Wealth Management, Corporate Trust, FAF Advisors, Institutional Trust & Custody and Fund Services. Wealth Management & Securities Services contributed $373 million of the Company's net income in 2009, a decrease of $111 million (22.9 percent), compared with 2008. Total net revenue... -

Page 63

.... Support includes the Company's investment portfolios, funding, recently acquired assets and assumed liabilities prior to assignment to business lines, capital management, asset securitization, interest rate risk management, the net effect of transfer pricing related to average balances and... -

Page 64

... table shows the Company's calculation of the non-regulatory capital ratios: December 31, (Dollars in Millions) 2009 2008 2007 2006 2005 Total equity ...Preferred stock ...Noncontrolling interests ...Goodwill (net of deferred tax liability)...Intangible assets, other than mortgage servicing rights... -

Page 65

... determined for commercial and commercial real estate would increase by approximately $153 million at December 31, 2009. The Company's determination of the allowance for residential and retail loans is sensitive to changes in estimated loss rates. In the event that estimated loss rates increased by... -

Page 66

... income (loss) in accordance with applicable accounting principles generally accepted in the United States. These include all of the Company's available-for-sale securities, derivatives and other trading instruments, MSRs and certain mortgage loans held-for-sale. The estimation of fair value... -

Page 67

..., customer behaviors and attrition, changes in revenue growth trends, cost structures, technology, changes in discount rates and specific industry and market conditions. In determining the reasonableness of cash flow estimates, the Company reviews historical performance of the underlying assets or... -

Page 68

...-15(e) under the Securities Exchange Act of 1934 (the "Exchange Act")). Based upon this evaluation, the principal executive officer and principal financial officer have concluded that, as of the end of the period covered by this report, the Company's disclosure controls and procedures were effective... -

Page 69

... with the policies or procedures may deteriorate. The Board of Directors of the Company has an Audit Committee composed of directors who are independent of U.S. Bancorp. The committee meets periodically with management, the internal auditors and the independent accountants to consider audit results... -

Page 70

... and Shareholders of U.S. Bancorp: We have audited the accompanying consolidated balance sheets of U.S. Bancorp as of December 31, 2009 and 2008, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2009... -

Page 71

... We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of U.S. Bancorp as of December 31, 2009 and 2008, and the related consolidated statements of income, shareholders' equity, and cash flows for each... -

Page 72

...) 2009 2008 Assets Cash and due from banks ...Investment securities Held-to-maturity (fair value $48 and $54, respectively)...Available-for-sale ...Loans held for sale (included $4,327 and $2,728 of mortgage loans carried Loans Commercial ...Commercial real estate ...Residential mortgages ...Retail... -

Page 73

...losses...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking... -

Page 74

...in earnings on securities available-for-sale ...Unrealized gain on derivative hedges ...Foreign currency translation ...Reclassification for realized losses...Change in retirement obligation ...Income taxes ...Total comprehensive income (loss) ...Redemption of preferred stock ...Repurchase of common... -

Page 75

... net income to net cash provided by operating activities Provision for credit losses ...Depreciation and amortization of premises and equipment...Amortization of intangibles ...Provision for deferred income taxes ...Gain on sales of securities and other assets, net ...Loans originated for sale in... -

Page 76

... and sales, on-line services, direct mail and ATM processing. It encompasses community banking, metropolitan banking, instore banking, small business banking, consumer lending, mortgage banking, consumer finance, workplace banking, student banking and 24-hour banking. Wealth Management & Securities... -

Page 77

... loans. Covered Assets Loans and foreclosed real estate covered under loss sharing or similar credit protection agreements with the FDIC are reported in loans along with the related indemnification asset. In accordance with applicable authoritative accounting guidance effective for the U.S. BANCORP... -

Page 78

... in connection with mortgage banking activities are considered derivatives and recorded on the balance sheet at fair value with changes in fair value recorded in income. All other unfunded loan commitments are generally related to providing credit facilities to customers of the Company and are not... -

Page 79

...of business, the Company enters into derivative transactions to manage its interest rate, prepayment, credit, price and foreign currency risk and to accommodate the business requirements of its customers. Derivative instruments are reported in other assets or other liabilities at fair value. Changes... -

Page 80

...within credit and debit card revenue. Payments to partners and expenses related to rewards programs are recorded when earned by the partner or customer. Merchant Processing Services Merchant processing services acquired businesses ("goodwill") is not amortized. Other intangible assets are amortized... -

Page 81

...benefit payments as of the measurement date. Periodic pension expense (or income) includes service costs, interest costs based on the assumed discount rate, the expected return on plan assets based on an actuarially derived market-related value and amortization of actuarial gains and losses. Pension... -

Page 82

... Assets In June 2009, the FASB issued accounting guidance, effective for the Company January 1, 2010, related to the transfer of financial assets. This guidance removes the exception for qualifying special-purpose entities from consolidation guidance and the exception for guaranteed mortgage... -

Page 83

...accounting guidance applicable in 2008, the Company recorded all other loans at the predecessors' carrying amount, net of fair value adjustments for any interest rate related discount or premium, and an allowance for credit losses. Included in loans at December 31, 2009, were $22.5 billion of assets... -

Page 84

......Mortgage-backed securities Residential Agency ...Non-agency Prime (c) ...Non-prime ...Commercial ...Asset-backed securities Collateralized debt obligations/ Collateralized loan obligations Other...Obligations of state and political subdivisions ...Obligations of foreign governments Corporate debt... -

Page 85

... the applicable restructuring agreements. The SIVs and the investment securities received are collectively referred to as "SIV-related securities." Some of these securities evidenced credit deterioration at the time of acquisition by the Company. Changes in the amortized cost and accretable balance... -

Page 86

... 31, 2009 (Dollars in Millions) Total Available-for-sale Mortgage-backed securities Non-agency residential Prime (a)...Non-prime ...Commercial ...Asset-backed securities Collateralized debt obligations/Collateralized loan obligations . Other ...Corporate debt securities ...Perpetual preferred... -

Page 87

...) Total available-for-sale... The Company does not consider these unrealized losses to be credit-related. These unrealized losses relate to changes in interest rates and market spreads subsequent to purchase. A substantial portion of securities that have unrealized losses are either corporate debt... -

Page 88

...) 2009 2008 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages... -

Page 89

... payments receivable were $12.7 billion, the contractual cash flows not expected to be collected were $2.8 billion, and the estimated fair value of the loans was $8.2 billion. Because of the short time period between the closing of the FBOP transaction and December 31, 2009, certain amounts related... -

Page 90

...to Consolidated Financial Statements. The following table lists information related to nonperforming loans as of December 31: (Dollars in Millions) 2009 2008 Loans on nonaccrual status ...Restructured loans ...Total nonperforming loans ...Interest income that would have been recognized at original... -

Page 91

...are to develop land, and construct and sell residential homes. The Company provides a warehousing line to this joint venture. Warehousing advances to the joint venture are repaid when the sale of loans is completed or the real estate is permanently refinanced by others. At December 31, 2009 and 2008... -

Page 92

... of $147 million, for the year ended December 31, 2009, compared with net losses of $122 million and $35 million the years ended December 31, 2008 and 2007, respectively. Loan servicing fees, not including valuation changes included in mortgage banking revenue, were $512 million, $404 million and... -

Page 93

... subsidy, down payment and/or closing cost assistance. Mortgage loans originated as part of government agency and state loans programs tend to experience slower prepayment rates and better cash flows than conventional mortgage loans. A summary of the Company's MSRs and related characteristics by... -

Page 94

... the changes in the carrying value of goodwill for the years ended December 31, 2009 and 2008: (Dollars in Millions) Wholesale Banking Consumer Banking Wealth Management Payment Services Treasury and Corporate Support Consolidated Company Balance at December 31, 2007 ...Goodwill acquired ...Other... -

Page 95

...457 . 8,915 . 10,924 . 6,853 Total...$29,149 Maximum month-end balance Federal funds purchased...Securities sold under agreements to Commercial paper ...Other short-term borrowings ...repurchase ...$ 6,352 . 9,154 . 14,608 . 9,550 (a) Interest and rates are presented on a fully taxable-equivalent... -

Page 96

... in 2009 or 2008. The Company has an arrangement with the Federal Home Loan Bank whereby the Company could have borrowed an additional $17.3 billion and $6.6 billion at December 31, 2009 and 2008, respectively, based on collateral available (residential and commercial mortgages). 94 U.S. BANCORP -

Page 97

... from the sales of the Debentures for general corporate purposes. In connection with the formation of USB Capital IX, the trust issued redeemable Income Trust Securities ("ITS") to third party investors, investing the proceeds in Debentures issued by the Company and entered into stock purchase... -

Page 98

... diluted common share for the year ended December 31, 2009 the impact of a deemed dividend of $154 million, representing the unaccreted preferred stock discount remaining on the redemption date. On July 15, 2009, the Company repurchased the warrant from the U.S. Department of the Treasury for $139... -

Page 99

... other comprehensive income (loss) included in shareholders' equity for the years ended December 31, was as follows: Transactions (Dollars in Millions) Pre-tax Tax-effect Net-of-tax Balances Net-of-Tax 2009 Changes in unrealized gains and losses on securities available-for-sale ...Other-than... -

Page 100

... Office of the Comptroller of the Currency. Note 16 Earnings Per Share The components of earnings per share were: (Dollars and Shares in Millions, Except Per Share Data) 2009 2008 2007 Net income attributable to U.S. Bancorp ...Preferred dividends...Accretion of preferred stock discount ...Deemed... -

Page 101

...age and years of service. Participants will also receive an annual interest credit. This new plan formula resulted in a $35 million reduction of the 2009 projected benefit obligation. In general, the Company's qualified pension plans' objectives include maintaining a funded status sufficient to meet... -

Page 102

.... Actual return on plan assets ...Employer contributions ...Plan participants' contributions ...Benefit payments ... Fair value at end of measurement period ...Funded (Unfunded) Status ...Components Of The Consolidated Balance Sheet Noncurrent benefit asset ...Current benefit liability ...Noncurrent... -

Page 103

......Other Changes In Plan Assets And Benefit Obligations Recognized In Other Comprehensive Income (Loss) Current year actuarial gain (loss) ...Actuarial loss (gain) amortization ...Current year prior service credit (cost) ...Prior service cost (credit) and transition obligation (asset) amortization... -

Page 104

... an affiliate of the Company, certain plan assets are lent to qualified borrowers on a short-term basis in exchange for investment fee income. These borrowers collateralize the loaned securities with either cash or non-cash securities. Cash collateral held at December 31, 2009 and 2008 totaled $121... -

Page 105

... 31: Other (Dollars in Millions) 2009 2008 Balance at beginning of period ...Unrealized gains (losses) relating to assets still held at end of year ...Balance at end of period ... $9 (3) $6 $8 1 $9 Expected Future Benefit Payments The following benefit payments are expected to be paid from the... -

Page 106

... Company's expected dividend yield over the life of the options. The following summarizes certain stock option activity of the Company: (Dollars in Millions) 2009 2008 2007 Fair value of options vested ...Intrinsic value of options exercised ...Cash received from options exercised ...Tax benefit... -

Page 107

...criteria by the Company. The total fair value of shares vested was $12 million, $29 million, and $45 million for 2009, 2008 and 2007, respectively. Stock-based compensation expense was $89 million, $85 million and $77 million for 2009, 2008 and 2007, respectively. On an after-tax basis, stock-based... -

Page 108

... $1,883 Applicable income taxes ... The tax effects of fair value adjustments on securities available-for-sale, derivative instruments in cash flow hedges and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive income (loss). In... -

Page 109

...(Dollars in Millions) 2009 2008 Deferred Tax Assets Allowance for credit losses ...Securities available-for-sale and financial instruments ...Accrued expenses ...Stock compensation ...Pension and postretirement benefits ...Federal, state and foreign net operating loss carryforwards Other investment... -

Page 110

... forward commitments to buy residential mortgage loans to economically hedge the change in the fair value of the Company's residential MSRs. In addition, the Company acts as a seller and buyer of interest rate derivatives and foreign exchange contracts to accommodate its customers. To mitigate the... -

Page 111

...) Notional Value Fair Value Notional Value Fair Value Asset and Liability Management Positions Fair value hedges Interest rate contracts Receive fixed/pay floating swaps ...Foreign exchange cross-currency swaps ...Cash flow hedges Interest rate contracts Pay fixed/receive floating swaps ...Net... -

Page 112

...Loss) Gains (Losses) Reclassified from Other Comprehensive Income (Loss) into Earnings Year Ended December 31, 2009 (Dollars in Millions) Asset and Liability Management Positions Cash flow hedges Interest rate contracts Pay fixed/receive floating swaps (a) ...Net investment hedges Foreign exchange... -

Page 113

... pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation. This category includes residential MSRs, certain debt securities, including the Company's SIV-related... -

Page 114

... debt securities. In 2009, due to the limited number of trades of non-agency mortgage-backed securities and lack of reliable evidence about transaction prices, the Company determined the fair value of these securities using a cash flow methodology and incorporating observable market information... -

Page 115

...deposit was estimated by discounting the contractual cash flow using current market rates. Short-term Borrowings Federal funds purchased, securities sold under agreements to repurchase, commercial paper and other short-term funds borrowed have floating rates or short-term maturities. The fair value... -

Page 116

...loan obligations ...Other ...Obligations of state and political subdivisions ...Obligations of foreign governments ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale Mortgage loans held for sale ...Mortgage servicing rights ...Other assets... -

Page 117

... in Net Income Transfers into Level 3 End of Period Balance 2009 Available-for-sale securities Mortgage-backed securities Residential non-agency Prime ...Non-prime ...Commercial ...Asset-backed securities Collateralized debt obligations/Collateralized loan obligations ...Other ...Corporate debt... -

Page 118

..., long-term relationships with deposit, credit card, merchant processing and trust customers, other purchased intangibles, premises and equipment, deferred taxes and other liabilities. The estimated fair values of the Company's financial instruments are shown in the table below. 2009 December 31... -

Page 119

... commercial paper issuances, bond financings and other similar transactions. The Company issues commercial letters of credit on behalf of customers to ensure payment or collection in connection with trade transactions. In the event of a customer's nonperformance, the Company's credit loss exposure... -

Page 120

... 31, 2009. Commitments from Securities Lending The Company Merchant Processing The Company, through its participates in securities lending activities by acting as the customer's agent involving the loan of securities. The Company indemnifies customers for the difference between the market value of... -

Page 121

... 31, 2009. Other Contingent Liabilities Visa Restructuring and Card Association Litigation The Company's payment services business issues and acquires credit and debit card transactions through the Visa U.S.A. Inc. card association or its affiliates (collectively "Visa"). In 2007, Visa completed... -

Page 122

..., results of operations or cash flows of the Company. Note 23 U.S. Bancorp (Parent Company) Condensed Balance Sheet December 31 (Dollars in Millions) 2009 2008 Assets Due from banks, principally interest-bearing Available-for-sale securities ...Investments in bank subsidiaries ...Investments in... -

Page 123

... of Income Year Ended December 31 (Dollars in Millions) 2009 2008 2007 Income Dividends from bank subsidiaries ...Dividends from nonbank subsidiaries ...Interest from subsidiaries ...Other income ...Total income ...Expense Interest on short-term funds borrowed ...Interest on long-term debt ...Other... -

Page 124

... of the Currency's minimum capital constraints for all national banks. Within these guidelines, all bank subsidiaries have the ability to pay dividends without prior regulatory approval. The amount of dividends available to the parent company from the bank subsidiaries at December 31, 2009, was... -

Page 125

...Consolidated Balance Sheet - Five-Year Summary (Unaudited) December 31 (Dollars in Millions) 2009 2008 2007 2006 2005 % Change 2009 v 2008 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance for loan losses... -

Page 126

...losses...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking... -

Page 127

...losses ...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking... -

Page 128

...Average Balance Sheet and Year Ended December 31 Average Balances 2009 Yields and Rates Average Balances 2008 Yields and Rates (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate Residential mortgages . Retail... -

Page 129

Related Yields And Rates (a) (Unaudited) 2007 Average Balances Yields and Rates Average Balances 2006 Yields and Rates Average Balances 2005 Yields and Rates 2009 v 2008 % Change Average Balances... $ 6,790 3.08% 3.05 6.63% 2.98 3.65% 3.62% $ 7,088 3.56% 3.54 5.93% 1.96 3.97% 3.95% U.S. BANCORP 127 -

Page 130

...Financial Data (Unaudited) Earnings Per Common Share Summary 2009 2008 2007 2006 2005 Earnings per common share ...Diluted earnings per common share ...Dividends declared per common share...Ratios Return on average assets ...Return on average common equity ...Average total U.S. Bancorp shareholders... -

Page 131

... the Bank Holding Company Act of 1956. U.S. Bancorp provides a full range of financial services, including lending and depository services, cash management, foreign exchange and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage... -

Page 132

... include the allowance for credit losses, investments, loans, mergers, issuance of securities, payment of dividends, establishment of branches and other aspects of operations. Website Access to SEC Reports U.S. Bancorp's internet and, in some cases, to fail. Market developments may further erode... -

Page 133

... loss of fee income, as well as the loss of customer deposits and income generated from those deposits. In addition, changes in consumer spending and saving habits could adversely affect the Company's operations, and the Company may be unable to timely develop competitive new products and services... -

Page 134

... larger concentrations of residential or commercial real estate could result in significantly higher credit costs. Changes in interest rates can reduce the value of the Company's mortgage servicing rights and mortgages held for sale, and can make its mortgage banking revenue volatile from quarter... -

Page 135

... persons outside of the Company, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of the internal control system and compliance requirements and business continuation and disaster recovery. This risk of loss also includes the... -

Page 136

... be reported under different conditions or using different assumptions or estimates. These critical accounting policies include: the allowance for credit losses; estimations of fair value; the valuation of purchased loans and related indemnification assets; the valuation of mortgage servicing rights... -

Page 137

... takes title to properties In the course of the Natural disasters could harm the Company's operations through interference with communications, including the interruption or loss of the Company's websites, which would prevent the Company from obtaining deposits, originating loans and processing and... -

Page 138

... price performance of other companies that investors deem comparable to the Company; new technology used or services offered by the Company's competitors; news reports relating to trends, concerns and other issues in the financial services industry; and changes in government regulations. General... -

Page 139

... 2006. From the time of the merger of Firstar Corporation and U.S. Bancorp in February 2001 until October 2004, Mr. Davis served as Vice Chairman of U.S. Bancorp. From the time of the merger, Mr. Davis was responsible for Consumer Banking, including Retail Payment Solutions (card services), and he... -

Page 140

...assumed responsibility for Wealth Management & Securities Services. From 1999 until April 2007, she served as President of Corporate Trust and Institutional Trust & Custody services of U.S. Bancorp, having previously served as Chief Administrative Officer of Corporate Trust at U.S. Bancorp from 1995... -

Page 141

... Executive Officer Hormel Foods Corporation (Consumer food products) Austin, Minnesota 1. Executive Committee 2. Compensation and Human Resources Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Risk Management Committee U.S. BANCORP... -

Page 142

.../Shareholder Information. Mail At your request, we will mail to you our quarterly earnings, news releases, quarterly ï¬nancial data reported on Form 10-Q, Form 10-K, and additional copies of our annual reports. Please contact: U.S. Bancorp Investor Relations 800 Nicollet Mall Minneapolis, MN 55402... -

Page 143

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com