US Bank 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report

Building on...

Innovating more...

Expanding further...

Table of contents

-

Page 1

Building on...Innovating more...Expanding further... 2008 Annual Report -

Page 2

...The U.S. Bancorp mission statement is our employee's clear, strong commitment to our customers, communities, and shareholders. National Wholesale Banking & Trust Services Mission Statement U.S. Bancorp business scope Regional Consumer & Business Banking & Wealth Management Global Payments Table... -

Page 3

... at usbank.com Payment services and merchant processing Wholesale banking and trust services Consumer and business banking and wealth management Employees Bank branches ATMs NYSE symbol At year-end December 31, 2008 2008 Revenue 27% 40% 20% 13% Payment Services U.S Bancorp delivers an expansive... -

Page 4

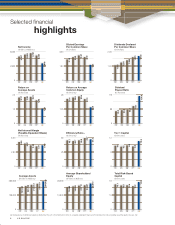

... 2.00 1.625 1.700 2.18 2,946 1.61 2,500 1.50 1.00 0 04 05 06 07 08 0 04 05 06 07 08 0 1.020 1.230 1.390 04 05 06 07 08 8 Return on Average Assets (In Percents) Return on Average Common Equity (In Percents) Dividend Payout Ratio (In Percents) 2.17 22.5 1.93 21.4 21... -

Page 5

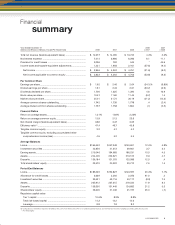

... Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total shareholders' equity ...Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Shareholders' equity ...Regulatory capital ratios Tier 1 capital ...Total risk... -

Page 6

... the value of our shareholders' investment in our Company declined during 2008, I am proud that our business model and disciplined risk management allowed U.S. Bancorp to fare better than many others in the industry. Our company continued to make a proï¬t, to generate capital, to increase lending... -

Page 7

... markets On November 21, 2008, we announced that our Company's lead bank, U.S. Bank National Association, acquired the banking operations of two separate California ï¬nancial institutions from the Federal Deposit Insurance Corporation; Downey Savings & Loan Association, F.A., and PFF Bank & Trust... -

Page 8

...." Baker joins board of directors the ï¬nancial sector reï¬,ect the very historic nature of this time. I believe that now, more than ever, the conservative policies, essential values and integrity of this Company will beneï¬t our shareholders, customers, communities and employees. I am extremely... -

Page 9

... ever, U.S. Bancorp is focusing on customer service, customer relationships, customer convenience, and each customer's experience with U.S. Bank. On the following pages, you will read about the steps we are taking to ensure that every customer in every line of business, in every market, is provided... -

Page 10

... credit products. The bundles were developed with customer input, and nearly half of new checking customers are selecting a Consumer Package. "The Future Looks Brighter With US" U.S. Bank launched its ï¬rst national media advertising campaign in August 2008. The national television and print media... -

Page 11

... cross-functional team, customers in Commercial Banking, Corporate Banking, Community Banking and Commercial Real Estate are participating in the program with Wealth Management and Payment Services as critical partners in the process. Relationship reviews bring results Great convenience and service... -

Page 12

... Banking allows customers to securely and safely check account balances, view transaction history, transfer money between accounts and locate U.S. Bank branch and ATM locations from their mobile phones. Home equity loans and money market accounts in the 80s...free checking, check cards and Internet... -

Page 13

... payments Convenient, secure and downright cool. A tiny microchip makes it easy for busy on-the-go U.S. Bank customers to pay for purchases with Visa payWave Supporting innovative ideas, U.S. Bancorp Community Development Corporation, in collaboration with other partners, will ï¬nance the building... -

Page 14

... a global era From world-wide credit and debit card processing to electronic check and gift card issuing...to corporate travel, purchasing and ï¬,eet and aviation fuel payment systems...to new healthcare payment solutions, our Payment Services division sets new standards in convenience, reliability... -

Page 15

... in the housing markets, our Mortgage Banking business ï¬,ourished in 2008, again reï¬,ecting the ï¬,ight to quality. We An important client beneï¬t of Wealth Management's expanded service model is having an entire team of dedicated Personal Trust Specialists available to address any needs or... -

Page 16

...Mellon 1st Business Bank, Downey Savings and Loan, and PFF Bank & Trust, we continue to widen our distribution network and branch offices in the growing California and Arizona markets. 75 branches remain among the largest mortgage lenders in the nation and among the largest mortgage servicers. In... -

Page 17

... Strong The importance of engaged employees to performance, business development and supporting and executing corporate strategies and policies cannot be overstated. The best strategies, products and rates mean little without engaged, motivated, high quality employees. U.S. Bancorp is fortunate to... -

Page 18

...schools. 16 U.S. BANCORP When ï¬,ood waters rose in Iowa in the Summer of 2008, U.S. Bank was there to help with ï¬nancial assistance and provide customers access to their accounts. U.S. Bancorp employees devote tens of thousands of hours of time and effort to their communities and a wide range of... -

Page 19

... of senior leaders in key business lines and includes three members of the Managing Committee. Our board of directors is also engaged in sustainability issues. The Council ensures broad implementation of the policy and provides input to general sustainability issues and long-term environmental... -

Page 20

... Financial Data 120 Company Information 127 Executive Ofï¬cers Forward-Looking Statements The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: This report contains forward-looking statements about U.S. Bancorp. Statements that are not... -

Page 21

... share and industry-leading return on common equity. The Company intends to achieve these financial objectives by providing high-quality customer service, carefully managing costs, and where appropriate, strategically investing in businesses that diversify and generate fee-based revenues, enhance... -

Page 22

...-bearing deposits ...Deposits ...Short-term borrowings ...Long-term debt ...Shareholders' equity ...Period End Balances Loans...Allowance for credit losses...Investment securities ...Assets ...Deposits ...Long-term debt ...Shareholders' equity ...Regulatory capital ratios Tier 1 capital...Total risk... -

Page 23

... managers, branch initiatives and Payment Services' businesses. Growth in expenses from a year ago also included costs related to investments in affordable housing and other tax-advantaged products and an increase in credit-related costs for other real estate owned and collection activities... -

Page 24

... interest checking balances from broker-dealer, institutional trust, government and consumer banking customers, and a $1.0 billion (3.8 percent) increase in money market savings balances driven primarily by higher broker-dealer and consumer banking balances. Average time certificates of deposit less... -

Page 25

... 2006, primarily driven by the migration of money market balances to certificates of deposit within the Consumer Banking and Wealth Management & Securities Services business lines, as customers migrated balances to higher rate deposits. Average time deposits greater than $100,000 were approximately... -

Page 26

... of programs for credit card and sub-prime residential mortgage customers. Net charge-offs increased $248 million (45.6 percent) over 2006, primarily due to an increase in consumer charge-offs principally related to growth in credit 24 U.S. BANCORP card balances, and somewhat higher commercial loan... -

Page 27

... business. Merchant processing services revenue was higher, reflecting an increase in customers and sales volumes on both a domestic and global basis. Trust and investment management fees increased primarily due to core account growth and favorable equity market conditions. Deposit service charges... -

Page 28

... panEuropean payment processing. Marketing and business development expense increased due to higher customer promotion, solicitation and advertising activities. Postage, printing and supplies increased due to increasing customer promotional mailings and changes in postal rates. Other 26 U.S. BANCORP... -

Page 29

...Lease financing...6,859 Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development. . Total commercial real estate...Residential Mortgages Residential mortgages ...Home equity loans, first liens...Total residential mortgages . Retail Credit card ...Retail leasing... -

Page 30

...The growth in commercial real estate loans reflected changing market conditions that have limited borrower access to the capital markets, and loans acquired in 2008 business combinations. Table 8 provides a summary of commercial real estate by property type and geographical locations. The collateral... -

Page 31

... in mortgage banking activity and higher consumer finance originations. Most loans retained in the portfolio are to customers with prime or near-prime credit characteristics at the date of origination. Retail Total retail loans outstanding, which include credit card, retail leasing, home equity and... -

Page 32

...used as collateral for public deposits and wholesale funding sources. While it is the Company's intent to hold its investment securities indefinitely, the Company may take actions in response to structural changes in the balance sheet and related interest rate risk and to meet liquidity requirements... -

Page 33

... reflected the full year impact of holding the structured investment securities the Company purchased in the fourth quarter of 2007 from certain money market funds managed by an affiliate and higher government agency securities, partially offset by sales, maturities and prepayments, as well as... -

Page 34

... cost balances. Average yield and maturity calculations exclude equity securities that have no stated yield or maturity. (e) Primarily includes investments in structured investment vehicles with underlying collateral that includes a mix of various mortgage and other asset-backed securities. 2008... -

Page 35

...banking and institutional trust balances. The $1.8 billion (7.6 percent) increase in money market savings account balances reflected higher broker-dealer balances and the impact of acquisitions, partially offset by lower branch-based and government balances. Average interest-bearing savings deposits... -

Page 36

...incurred loan losses. Commercial banking operations rely on prudent credit policies and procedures and individual lender and business line manager accountability. Lenders are assigned lending authority based on their level of experience and customer service requirements. Credit officers reporting to... -

Page 37

...changes in risk ratings, nonperforming status and potential for loss and the estimated impact on the allowance for credit losses. In the Company's retail banking operations, standard credit scoring systems are used to assess credit risks of consumer, small business and small-ticket leasing customers... -

Page 38

...its loan portfolio. As part of its normal business activities, the Company offers a broad array of traditional commercial lending products and specialized products such as asset-based lending, commercial lease financing, agricultural credit, warehouse mortgage lending, commercial real estate, health... -

Page 39

... and alternative lending markets in residential mortgages, home equity and installment loan financing. The consumer finance division manages loans originated through a broker network, correspondent relationships and U.S. Bank branch offices. Generally, loans managed by the Company's consumer finance... -

Page 40

...Consumer Finance ...$1,179 Table 13 DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN BALANCES At December 31, 90 days or more past due excluding nonperforming loans 2008 2007 2006 2005 2004 Commercial Commercial...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages... -

Page 41

... not have any residential mortgages with payment schedules that would cause balances to increase over time. The retail loan portfolio principally reflects the Company's focus on consumers within its footprint of branches and certain niche lending activities that are nationally focused. Within the... -

Page 42

... at December 31, 2007. The following table provides summary delinquency information for covered assets: As a Percent of Ending Loan Balances 2008 2007 Commercial ...Commercial real estate Residential mortgages . Credit card ...Other retail ... ... ... ... ... $ 35 138 813 450 73 $ 21 - 157 324... -

Page 43

... of foreclosed GNMA loans which continue to accrue interest. Charge-offs exclude actions for certain card products and loan sales that were not classified as nonperforming at the time the charge-off occurred. Residential mortgage information excludes changes related to residential mortgages serviced... -

Page 44

... further detail for residential mortgages and home equity and second mortgage loan balances by geographical location: December 31, (Dollars in Millions) Amount 2008 2007 As a Percent of Ending Loan Balances 2008 2007 Residential Minnesota ...California ...Michigan ...Florida ...Ohio...All other... -

Page 45

...Year Ended December 31 2008 2007 2006 2005 2004 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages ...Retail Credit card ...Retail leasing ...Home equity... -

Page 46

... portfolio. In addition, concentration risks associated with commercial real estate and the mix of loans, including credit cards, loans originated through the consumer finance division and residential mortgages balances, and their relative credit risks were evaluated. Finally, the Company considered... -

Page 47

...development ...Total commercial real estate ...Residential mortgages ...Retail Credit card ...Retail leasing ...Home equity and second mortgages Other retail ... Total retail ...Covered assets ...Total net charge-offs ...Provision for credit losses ...Acquisitions and other changes ...Balance at end... -

Page 48

... Percent of Loans 2007 2006 2005 2004 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgage ...Retail Credit card ...Retail leasing ...Home equity and second... -

Page 49

... Company operates in many different businesses in diverse markets and relies on the ability of its employees and systems to process a high number of transactions. Operational risk is inherent in all business activities, and the management of this risk is important to the achievement of the Company... -

Page 50

... audit procedures and reports on the effectiveness of internal controls to executive management and the Audit Committee of the Board of Directors. Management also provides various operational risk related reporting to the Risk Committee of the Board of Directors. Customer-related business conditions... -

Page 51

... and foreign exchange rate contracts on behalf of customers. The Company minimizes its market and liquidity risks by taking similar offsetting positions. All interest rate derivatives that qualify for hedge accounting are recorded at fair value as other assets or liabilities on the balance sheet... -

Page 52

...-average Receive rate ...Pay rate...Futures and forwards Buy ...Sell ...Options Purchased ...Written ...Foreign Exchange Contract Cross-currency swaps Notional amount ...Weighted-average Receive rate ...Pay rate...Forwards ...Equity Contracts ...Credit Default Swaps ...CUSTOMER-RELATED POSITIONS... -

Page 53

... trading activities principally support the risk management processes of the Company's customers including their management of foreign currency and interest rate risks. The Company also manages market risk of non-trading business activities, including its MSRs and loans held-for-sale. Value at Risk... -

Page 54

... time deposits. The Company also issues commercial paper through its Canadian branch. In addition, the Company establishes relationships with dealers to issue national market retail and institutional savings certificates and short-term and medium-term bank notes. The Company's subsidiary banks... -

Page 55

... cash inflows from interest-bearing assets. (c) Amounts only include obligations related to the unfunded non-qualified pension plans and post-retirement medical plan. stable, regionally-based certificates of deposit and commercial paper. The Company's ability to raise negotiated funding... -

Page 56

... business risks and capital position. The Company also manages its capital to exceed regulatory capital requirements for well-capitalized bank holding companies. To achieve these capital goals, the Company employs a variety of capital management tools, including dividends, common share repurchases... -

Page 57

... ago, as payment services, trust and investment management fees and deposit service charges were affected by the impact of the slowing economy on equity valuations and customer behavior. In addition, noninterest income was adversely impacted by securities impairments, market-related valuation losses... -

Page 58

...to structured investment securities and other market valuation losses and higher retail lease residual losses from a year ago, partially offset by a $59 million Visa Gain in the fourth quarter of 2008. Credit and debit card revenue, corporate payment products revenue and merchant processing services... -

Page 59

... that directly support another business line's operations are charged to the applicable business line based on its utilization of those services primarily measured by the volume of customer activities, number of employees or other relevant factors. These allocated expenses are reported as net shared... -

Page 60

... equipment finance and small-ticket leasing, depository, treasury management, capital markets, foreign exchange, international trade services and other financial services to middle market, large corporate, commercial real estate and public sector clients. Wholesale Banking contributed Table 23 LINE... -

Page 61

... equity investments, including an investment in a commercial real estate business, partially offset by higher commercial lending-related and capital markets fees and increases in treasury management and foreign exchange revenue. Total noninterest expense increased $102 million (10.7 percent) in 2008... -

Page 62

... products and services through banking offices, telephone servicing and sales, on-line services, direct mail and ATM processing. It encompasses community banking, metropolitan banking, instore banking, small business banking, consumer lending, mortgage banking, consumer finance, workplace banking... -

Page 63

...and business credit cards, stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit and merchant processing. Payment Services' offerings are highly inter-related with banking products and services of the other lines of business and rely on access to the bank... -

Page 64

... estimated business cycle of a loan, may not change to the same degree as net charge-offs. Because risk ratings and inherent loss ratios primarily drive the allowance specifically allocated to commercial loans, the amount of the allowance for commercial and commercial real estate loans might decline... -

Page 65

... Balance Sheet, with changes in fair value recorded either through earnings or other comprehensive income (loss) in accordance with applicable accounting principles generally accepted in the United States. These include all of the Company's trading securities, available-for-sale securities... -

Page 66

.... In assessing the fair value of reporting units, the Company may consider the stage of the current business cycle and potential changes in market conditions in estimating the timing and extent of future cash flows. Also, management often utilizes other information to validate the reasonableness of... -

Page 67

...of the Company's management, including its principal executive officer and principal financial officer, the Company has evaluated the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of... -

Page 68

...) 2008 2007 Assets Cash and due from banks ...Investment securities Held-to-maturity (fair value $54 and $78, respectively) ...Available-for-sale ...Loans held for sale (2008 included $2,728 of mortgage loans carried at fair value) Loans Commercial ...Commercial real estate ...Residential mortgages... -

Page 69

... Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services ...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment... -

Page 70

... Treasury Stock Total Shareholders' Equity Balance December 31, 2005 ...Change in accounting principle ...Net income ...Unrealized gain on securities available-forsale ...Unrealized gain on derivative hedges ...Realized loss on derivative hedges ...Foreign currency translation ...Reclassification... -

Page 71

... financing activities ...Change in cash and due from banks ...Cash and due from banks at beginning of year ...Cash and due from banks at end of year ...Supplemental Cash Flow Disclosures Cash paid for income taxes ...Cash paid for interest ...Net noncash transfers to foreclosed property Acquisitions... -

Page 72

... and business credit cards, stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit and merchant processing. Treasury and Corporate Support Treasury and Corporate Support includes the Company's investment portfolios, funding, capital management, asset... -

Page 73

... in connection with mortgage banking activities are considered derivatives and recorded on the balance sheet at fair value with changes in fair value recorded in income. All other unfunded loan commitments are generally related to providing credit facilities to customers of the Company and are not... -

Page 74

.... Revolving consumer lines and credit cards are charged off by 180 days past due and closed-end consumer loans other than loans secured by 1-4 family properties are charged off at 120 days past due and are, therefore, generally not placed on nonaccrual status. Certain retail customers having... -

Page 75

... income is reported net of associated expenses that are directly related to variable volume-based sales or revenue sharing arrangements or when the Company acts on an agency basis for others. Certain specific policies include the following: Credit and Debit Card Revenue Credit and debit card In the... -

Page 76

... Services Merchant processing services revenue consists principally of transaction and account management fees charged to merchants for the electronic processing of transactions, net of interchange fees paid to the credit card issuing bank, card association assessments, and revenue sharing... -

Page 77

... on January 1, 2008. SAB 109 expresses the SEC's view that the expected net future cash flows related to the associated servicing of a loan should be included in the measurement of all written loan commitments that are accounted for at fair value through earnings. Business Combinations In December... -

Page 78

..., the Company entered into loss sharing agreements with the FDIC ("Loss Sharing Agreements") providing for specified credit loss and asset yield protection for all single family residential mortgages and a significant portion of commercial and commercial real estate loans and foreclosed real estate... -

Page 79

...sale securities are carried at fair value with unrealized net gains or losses reported within accumulated other comprehensive income (loss) in shareholders' equity. (c) Primarily includes investments in structured investment vehicles with underlying collateral that includes a mix of various mortgage... -

Page 80

... in available-for-sale investment securities are structured investment vehicle and related securities ("SIVs") purchased in the fourth quarter of 2007 from certain money market funds managed by FAF Advisors, Inc., an affiliate of the Company. During 2008, the Company exchanged its interest in... -

Page 81

...) $(2,184) The Company does not consider these unrealized losses to be other-than-temporary at December 31, 2008. The unrealized losses within each investment category have occurred as a result of changes in interest rates and market credit spreads. The substantial portion of securities that have... -

Page 82

... 2008 2007 Commercial Commercial ...$ 49,759 Lease financing ...6,859 Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential... -

Page 83

...of the Company's nonperforming assets as of December 31, 2008 and 2007, see Table 14 included in Management's Discussion and Analysis which is incorporated by reference into these Notes to Consolidated Financial Statements. The following table lists information related to nonperforming loans as of... -

Page 84

... mortgage banking revenue. The Company has equity interests in several joint ventures that are accounted for utilizing the equity method. The principal activities of these entities are to: • develop land, construct and sell residential homes. • provide commercial real estate financing for loans... -

Page 85

... support its activities. The Company's investments in VIEs primarily represent private investment funds that make equity investments, provide debt financing or partnerships to support community-based investments in affordable housing, development entities that provide capital for communities located... -

Page 86

... MSR value changes included in mortgage banking revenue and net interest income was a loss of $122 million, $35 million and $37 million for the years ended December 31, 2008, 2007 and 2006, respectively. Loan servicing fees, not including valuation changes, included in mortgage banking revenue were... -

Page 87

...methods generally based on cash flows (c) Mortgage servicing rights are recorded at fair value, and are not amortized. Aggregate amortization expense consisted of the following: Year Ended December 31 (Dollars in Millions) 2008 2007 2006 Merchant processing contracts Core deposit benefits ...Trust... -

Page 88

The following table reflects the changes in the carrying value of goodwill for the years ended December 31, 2008 and 2007: (Dollars in Millions) Wholesale Banking Consumer Banking Wealth Management Payment Services Consolidated Company Balance at December 31, 2006 ...Goodwill acquired ...Other (a) ... -

Page 89

...) Rate Type Rate (a) Maturity Date 2008 2007 U.S. Bancorp (Parent Company) Subordinated notes...Fixed Convertible senior debentures ...Floating Floating Floating Floating Medium-term notes ...Fixed Floating Junior subordinated debentures ...Fixed Capitalized lease obligations, mortgage indebtedness... -

Page 90

... were no such issuances or redemptions in 2008. The Company has an arrangement with the Federal Home Loan Bank whereby the Company could have borrowed an additional $6.6 billion at December 31, 2008, based on collateral available (residential and commercial mortgages). Maturities of long-term debt... -

Page 91

...31, 2008, the Company sponsored, and wholly owned 100 percent of the common equity of, nine trusts that were formed for the purpose of issuing Companyobligated mandatorily redeemable preferred securities ("Trust Preferred Securities") to third-party investors and investing the proceeds from the sale... -

Page 92

... of business solely to the extent permitted under the Capital Purchase Program of the Emergency Economic Stabilization Act of 2008. The following table summarizes the Company's common stock repurchased in each of the last three years: (Dollars and Shares in Millions) Shares Value 2008 ...2007... -

Page 93

... in shareholders' equity for the years ended December 31, is as follows: Transactions (Dollars in Millions) Pre-tax Tax-effect Net-of-tax Balances Net-of-Tax 2008 Unrealized loss on securities available-for-sale Unrealized loss on derivative hedges ...Foreign currency translation ...Realized... -

Page 94

... Rate Exchangeable Noncumulative Perpetual Series A Preferred Stock with a liquidation preference of $100,000 per share ("Series A Preferred Securities") to third party investors, and investing the proceeds in certain assets, consisting predominately of mortgage-backed securities from the Company... -

Page 95

... average pay. Employees become vested upon completing five years of vesting service. In addition, two cash balance pension benefit plans exist and only investment or interest credits continue to be credited to participants' accounts. Plan assets consist of various equities, equity mutual funds and... -

Page 96

... Typical Asset Mix (b) December 2008 Actual Target December 2007 Actual Target Compound 2009 Expected Returns Standard Deviation Asset Class Domestic Equity Securities Large Cap ...Mid Cap ...Small Cap ...International Equity Securities . Debt Securities ...Real Estate ...Alternative Investments... -

Page 97

... of eliminating early measurement date . . Actual return on plan assets ...Employer contributions ...Plan participants' contributions ...Benefit payments ...Fair value at end of measurement period ...Funded Status Funded status at end of measurement period Fourth quarter contribution...Recognized... -

Page 98

... benefit cost: Pension Plans (Dollars in Millions) 2008 2007 2006 Postretirement Welfare Plan 2008 2007 2006 Discount rate ...Expected return on plan assets ...Rate of compensation increase ...Health care cost trend rate (a) Prior to age 65...After age 65 ...Effect on total of service cost and... -

Page 99

... outstanding and exercised under various stock options plans of the Company: WeightedAverage Exercise Price WeightedAverage Remaining Contractual Term Aggregate Intrinsic Value (in millions) Year Ended December 31 Stock Options/Shares 2008 Number outstanding at beginning of period . Granted... -

Page 100

... compensation expense may vary from their actual fair value. The following table includes the weighted average estimated fair value and assumptions utilized by the Company for newly issued grants: 2008 2007 2006 Estimated fair value...Risk-free interest rates...Dividend yield ...Stock volatility... -

Page 101

...) (91) (83) (76) $2,112 Applicable income taxes ... The tax effects of fair value adjustments on securities available-for-sale, derivative instruments in cash flow hedges and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive... -

Page 102

... into derivative transactions to manage its interest rate, prepayment and foreign currency risks and to accommodate the business requirements of its customers. The Company does not enter into derivative transactions for speculative purposes. Refer to Note 1 "Significant Accounting Policies" in the... -

Page 103

... billion of foreign exchange rate contracts. Gains or losses on customer-related transactions were not significant for the year ended December 31, 2008. Note 21 FAIR VALUES OF ASSETS AND LIABILITIES derivatives to protect its net investment in certain foreign operations. The Company uses forward... -

Page 104

... by the Company are executed over-the-counter and are valued using standard cash flow, Black-Scholes and Monte Carlo valuation techniques. The models incorporate various inputs, depending on the type of derivative, including interest rate curves, foreign exchange rates and volatility. In addition... -

Page 105

... Statements for further information on the methodology used by the Company in determining the fair value of its MSRs. Deposit Liabilities The fair value of demand deposits, savings accounts and certain money market deposits is equal to the amount payable on demand at year-end. The fair value... -

Page 106

...-related investments, certain non-agency mortgage-backed securities, certain trust-preferred securities investments, MSRs and derivatives: Investment Securities Available-for-Sale Mortgage Servicing Rights Net Other Assets and Liabilities Year Ended December 31, 2008 (Dollars in Millions) Balance... -

Page 107

.... The guarantees frequently support public and private borrowing arrangements, including commercial paper issuances, bond financings and other similar transactions. The Company issues commercial letters of credit on behalf of customers to ensure payment or collection in connection U.S. BANCORP 105 -

Page 108

...2008: (Dollars in Millions) Capitalized Leases Operating Leases participates in securities lending activities by acting as the customer's agent involving the loan of securities. The Company indemnifies customers for the difference between the market value of the securities lent and the market value... -

Page 109

... business partners who generate customer referrals or provide marketing or other services related to the generation of revenue. In certain of these agreements, the Company may guarantee that a minimum amount of revenue share payments will be made to the third party over a specified period of time... -

Page 110

... Company's payment services business issues and acquires credit and debit card transactions through the Visa U.S.A. Inc. card association or its affiliates (collectively "Visa"). In 2007, Visa completed a restructuring and issued shares of Visa Inc. common stock to its financial institution members... -

Page 111

Note 23 U.S. BANCORP (PARENT COMPANY) CONDENSED BALANCE SHEET December 31 (Dollars in Millions) 2008 2007 Assets Deposits with subsidiary banks, principally interest-bearing . Available-for-sale securities ...Investments in bank subsidiaries ...Investments in nonbank subsidiaries ...Advances to ... -

Page 112

...9,903 ... Net cash provided by (used in) financing activities ...Change in cash and cash equivalents ...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year ... Transfer of funds (dividends, loans or advances) from bank subsidiaries to the Company is restricted... -

Page 113

...information presented throughout this Annual Report rests with the management of U.S. Bancorp. The Company believes that the consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States and present the substance of transactions... -

Page 114

... Board of Directors and Shareholders of U.S. Bancorp: We have audited the accompanying consolidated balance sheets of U.S. Bancorp as of December 31, 2008 and 2007, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended... -

Page 115

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of U.S. Bancorp as of December 31, 2008 and 2007, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2008 and... -

Page 116

U.S. Bancorp Consolidated Balance Sheet - Five Year Summary (Unaudited) December 31 (Dollars in Millions) 2008 2007 2006 2005 2004 % Change 2008 v 2007 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance ... -

Page 117

... Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services ...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment... -

Page 118

...Income Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment... -

Page 119

... chart compares the cumulative total shareholder return on the Company's common stock during the five years ended December 31, 2008, with the cumulative total return on the Standard & Poor's 500 Commercial Bank Index and the Standard & Poor's 500 Index. The comparison assumes $100 was invested... -

Page 120

... Bancorp Consolidated Daily Average Balance Sheet and Year Ended December 31 Average Balances 2008 Yields and Rates Average Balances 2007 Yields and Rates (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate... -

Page 121

Related Yields and Rates (a) (Unaudited) 2006 Average Balances Yields and Rates Average Balances 2005 Yields and Rates Average Balances 2004 Yields and Rates 2008 v 2007 % Change Average Balances...% $ 7,088 3.56% 3.54 5.93% 1.96 3.97% 3.95% $7,140 3.95% 3.93 5.48% 1.23 4.25% 4.23% U.S. BANCORP 119 -

Page 122

..., foreign exchange and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage and leasing. U.S. Bancorp's banking subsidiaries are engaged in the general banking business, principally in domestic markets... -

Page 123

..., investments, loans, mergers, issuance of securities, payment of dividends, establishment of branches and other aspects of operations. Website Access to SEC Reports U.S. Bancorp's internet website can be found at usbank.com. U.S. Bancorp makes available free of charge on its website its annual... -

Page 124

... of funds for lending and investing and the return that can be earned on those loans and investments, both of which affect the Company's net interest margin. Federal Reserve Board policies can also materially affect the value of financial instruments that the Company holds, such as debt securities... -

Page 125

... of legislative, regulatory and technological changes and continued consolidation. The Company competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions and investment companies. In addition, technology has... -

Page 126

... market volatility due to the uncertainty of the credit ratings, deterioration in credit losses occurring within certain types of residential mortgages, changes in prepayments and the lack of transparency related to the structures and the collateral underlying the structured investment vehicles... -

Page 127

... asset balances; or significantly increase its accrued taxes liability. For more information, refer to "Critical Accounting Policies" in this Annual Report. Changes in accounting standards could materially impact the Company's financial statements From time to time, the required by regulatory... -

Page 128

... of other companies that investors deem comparable to the Company; new technology used or services offered by the Company's competitors; news reports relating to trends, concerns and other issues in the financial services industry; and changes in government regulations. General market fluctuations... -

Page 129

... Wealth Management & Securities Services Joseph C. Hoesley, Vice Chairman, Commercial Real Estate William L. Chenevich, Vice Chairman, Technology and Operations Services Richard K. Davis, Chairman, President and Chief Executive Officer Richard J. Hidy, Executive Vice President and Chief Risk Officer... -

Page 130

...-Busch Companies, Inc. St. Louis, Missouri Business Consultant Louisville, Kentucky 1. Executive Committee 2. Compensation and Human Resources Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Risk Management Committee 128 U.S. BANCORP -

Page 131

.../Shareholder Information. Mail At your request, we will mail to you our quarterly earnings, news releases, quarterly ï¬nancial data reported on Form 10-Q, Form 10-K, and additional copies of our annual reports. Please contact: U.S. Bancorp Investor Relations 800 Nicollet Mall Minneapolis, MN 55402... -

Page 132

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com