TomTom 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

TOMTOM ANNUAL REPORT 2007

Total bad debts currently represent 0.3% of sales

revenue.

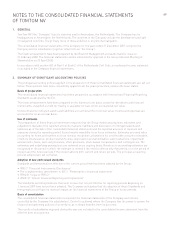

Certain financial assets, such as trade receivables,

are individually assessed for impairment. When

assets are considered not to be individually

impaired, these assets are subsequently assessed

for impairment on a collective basis. Evidence of

impairment could include our past experience of

debt collecting and/or changes in economic

conditions that have an effect on receivables.

LIQUIDITY

Our approach to managing liquidity is to ensure, so

far as possible, that we will always have sufficient

liquidity to meet our liabilities when they fall due,

under both normal and stressed conditions, without

incurring unacceptable losses or risking damage to

our reputation.

We consistently monitor future cash flow

requirements to ensure we have sufficient cash on

demand to meet expected operational expenses,

including the servicing of financial obligations.

Management ensures adequate reserves, banking

facilities and reserve borrowing facilities are

maintained by continuously monitoring forecast and

actual cash flows, and by matching the maturity

profiles of financial assets and liabilities. The

potential impact of extreme circumstances that

cannot reasonably be predicted, such as natural

disasters, have been excluded. There were no lines

of credit at balance sheet date. The contractual

maturity of our trade and other liabilities is less

than one year.

CURRENCIES

The objective of market risk management is to

manage and control foreign exchange risk arising

from various currency exposures and price risk

arising from the holding of investments classified

as at fair value through profit or loss.

Foreign exchange risk is managed through the

buying and selling of derivatives and option

contracts for forecast commitments and forward

contracts for actual commitments. All such

transactions are carried out within the guidelines

set by the financial risk management policy, which

is approved by the Supervisory Board.

We are exposed to currency risk on our estimated

purchases and sales transactions that are

denominated in a currency other than the reporting

currency of the Company – the euro (€). Foreign

currency exposures are based on invoices, orders

and the outcome of monthly forecast meetings. We

aim to cover our currency exposure for 9 months

for both purchases and sales.

Wedo not makeuse of natural hedges for

anticipated exposures, as these can prove

ineffective in the event of sharp increases or

decreases in currency rates and therefore are not

considered best practice from a risk management

point of view. Foreign currency exposures are

grouped per currency to allow for more efficient

hedging. We hedge at least 80% to 85% of our

anticipated and committed foreign currency

exposure, in respect of forecast sales and

purchases over the next nine months. We use

foreign exchange (FX) plain vanilla options and

foreign exchange (FX) forward contracts to hedge

our currency risk, all with a maturity of less than

one year from the reporting date.

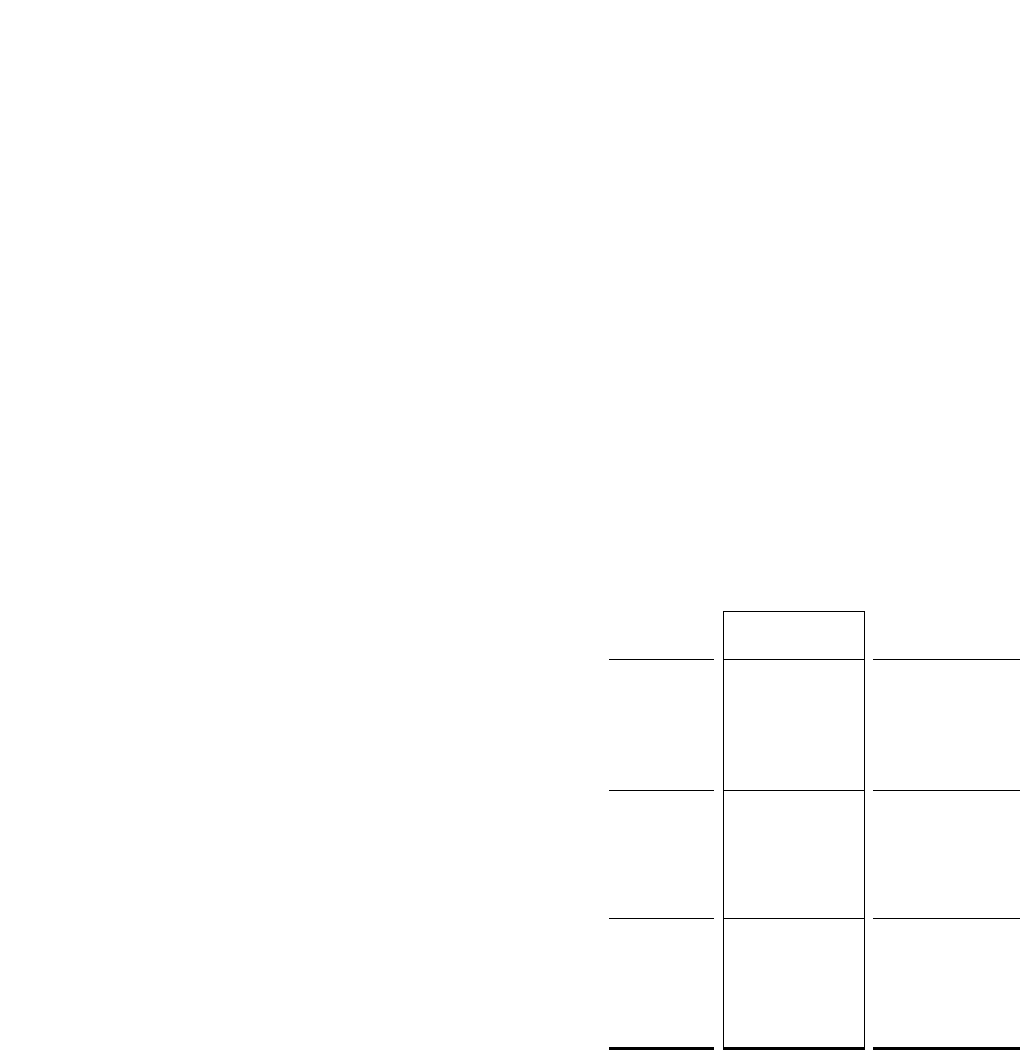

A2.5% strengthening or weakening of the euro

against the currencies listed below at 31 December

would have increased (decreased) equity, and profit

or loss, by the amounts shown below. This analysis

assumes that all other variables remain constant.

The analysis is performed on the same basis

for 2006.

2007 2006

(€in thousands) 2.50% -2.50% 2.50% -2.50%

AUD

Net profit

after taxation -247 247 66 -66

Total capital

and reserves -146 149 66 -66

GBP

Net profit

after taxation -933 933 2,912 -2,912

Total capital

and reserves -779 783 3,247 -3,245

USD

Net profit

after taxation 542 -542 -3,312 3,331

Total capital

and reserves 1,013 -1,011 -3,389 3,408

INTEREST RATES

Wehavelimited exposureto interest rate risk, as

we have not drawn under any loan facility. The term

loan that we secured for the proposed Tele Atlas

acquisition has a floating interest coupon linked to

Euribor developments.

Market related interest rates are received on the

cash balances. Cash balances areonlyheld with

counterparties that have a credit risk rating of at

least AA- as rated by an acknowledged rating

agency.It is our intention to earn a reasonable

interest rate whilst maintaining a stable

investment. The investment policy is approved

by the Supervisory Board.

Bank borrowing terms have been negotiated with

asyndicateof banks toenableus toacquirethe

shares of Tele Atlas, should the conditions to our

offer be fulfilled.