TomTom 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2007, we adopted a performance-based share

plan which replaced the 2005 share option plan.

The charges for the performance-based share plan

are determined by an option pricing model that

simulates the expected result of performance

criteria approved by the Supervisory Board. The

performance criteria selected are earnings per

share (EPS) growth, and total shareholder return

(TSR). In 2007 TomTom recorded a charge of €2.1

million in respect of this plan (2006: €0million).

FINANCIAL INCOME AND EXPENSES

We recorded a net gain of €2.8 million in financial

income and expenses in 2007, compared to a net

charge of €24.7 million in 2006. Exchange rate

results resulted in a charge of €16.3 million for

2007 compared to a charge of €32.3 million in 2006.

This charge arose from foreign exchange contracts

put in place in accordance with our foreign

exchange policy which is approved by our

Supervisory Board. Contracts are put in place to

cover our committed and anticipated exposures in

non-functional currencies. The charge is the sum

of positive and negative results on our hedging

portfolio. The weakening trend of the US dollar-

euro exchange rate in 2007 compared to 2006 was

the main driver for the negative effect on our

financial income and expense line.

We revalue all hedging contracts to market value at

the end of each period, whether or not theyhave

matured, as well as cash and other assets and

liabilities denominated in other currencies than our

functional currency. The 2007 result therefore

consisted of both realised and unrealised results.

As a result of the higher average euro interest rates

and our higher average cash balances, net interest

income increased to €19.1 million compared to

€7.6 million in 2006.

TAXATION

The total income tax charged to our income

statement was €114 million and relates to all

jurisdictions in which we have a fiscal presence.

In absolute terms, the tax charge increased 22%

compared to the previous year (2006: 93 million),

mainlyas a result of higher profits. Our effective tax

rate decreased by 3.1 percentage points to 26.5%

compared to 2006 following the decrease in the

Dutch corporate tax rate from 29.6% to 25.5%.

NET PROFIT

The net profit increased by 43% to €317 million in

2007 from €222 million in 2006.

LIQUIDITY AND CAPITAL RESOURCES

In 2007, we generated €535 million of cash from

operations, an increase of €143 million on 2006

(€392 million). Working capital decreased by €29

million, mainly due to increased liabilities and

accruals towards our suppliers in combination with

strong cash collections and tight inventory control.

The inventory value at the balance sheet date was

€131 million, an increase of €8million on the value

at the start of the year (€123 million). As a

percentage of sales, the inventory value at year end

decreased by 1.5 percentage point to 7.5% of

annual sales as we continued to find ways to

operate our inventory more efficiently.

We invested €32 million in technology fixed

assets, including the worldwide patent portfolio

of Horizon Navigation Inc., to support our

worldwide development activities, while

investments in general fixed assets were €17

million, or less than 1% of sales.

In the fourth quarter of 2007 wepurchased a 29.9%

minority stake in Tele Atlas. We spent €816 million,

excluding banking fees, to purchase these shares.

We raised cash in the same period from an equity

issue which delivered €450 million of cash net

of fees.

Overall, our cash balance increased by €26 million

to€463 million at the end of 2007.

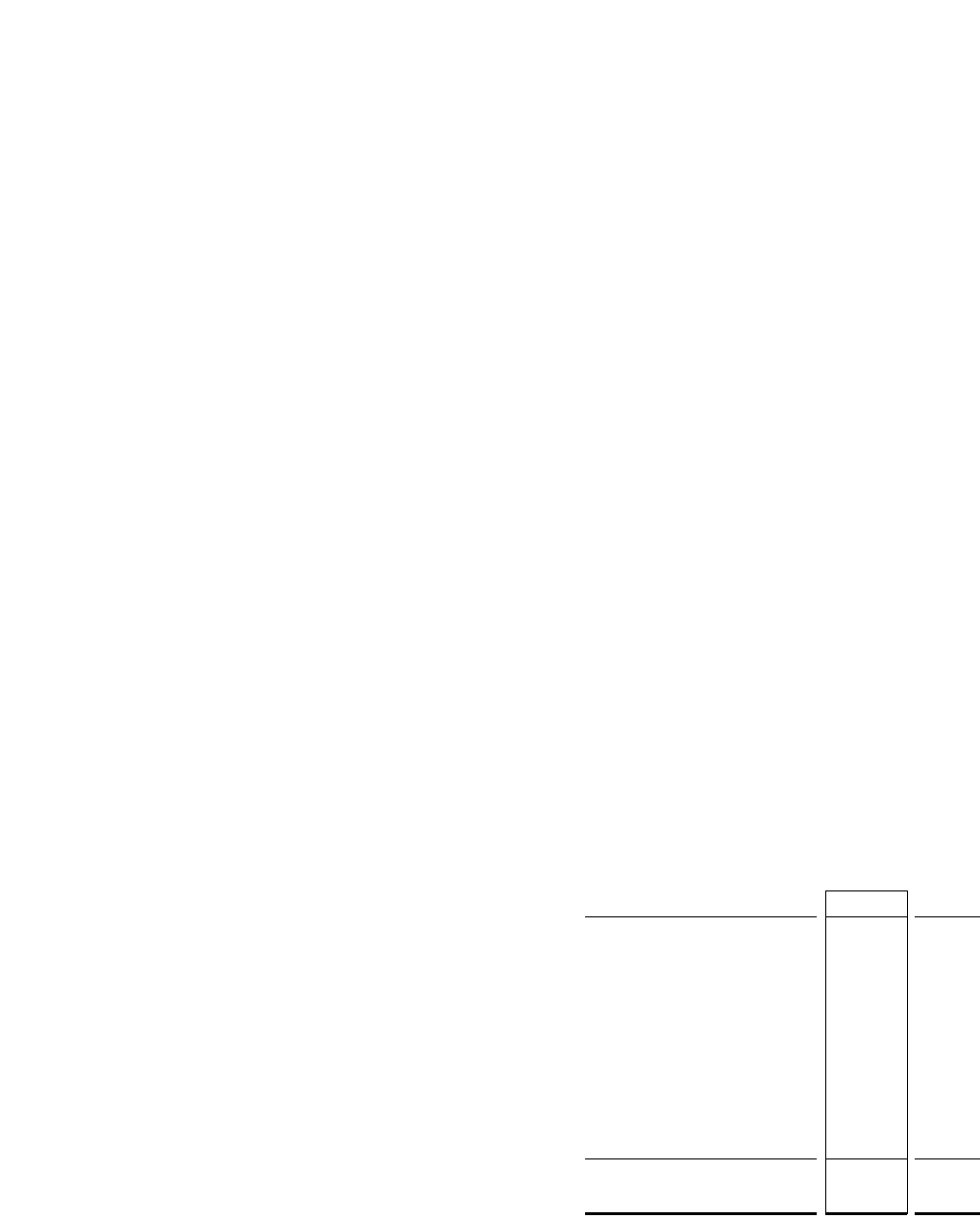

Cash flow (in €thousands) 2007 2006

Net cash from operating

activities 441,113 291,507

of which working capital: 28,957 9,982

Cash flow used in investing

activities -866,567 -28,570

Cash flow from financing

activities 453,417 1,113

Net increase in cash and

cash equivalents 27,963 264,050

Effect of exchange rates -2,425 -4,626

Cash and cash equivalents

at end of period 463,339 437,801

19

TOMTOM ANNUAL REPORT 2007