TomTom 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

TOMTOM ANNUAL REPORT 2007

Under TomTom’s business model, all our core activities

remain in-house, including our software and hardware

technology expertise, our relationship with our customers, and

our branding activities. All other activities, such as hardware

production, manufacturing logistics and distribution are

outsourced to business partners. This model has given us the

flexibility to expand rapidly and efficiently over the past ten years.

FLEXIBLE BUSINESS MODEL

We aim to consolidate our leading

market sharein Europe and to

increase our market sharein the US

and elsewhere. We will do this by

continuing to increase the depth and

breadth of our products and services,

by expanding our global footprint, and

by deepening and widening our

distribution. At the heart of our

success lies the quality of our

products and services, and we invest

heavilyin development to ensure that

we continue to develop products that

consumers want and that are superior

to those of our competitors. It is also crucial that consumers recognise

and appreciateour technological superiority, and we invest in marketing

and advertising to ensure we retain our market leadership.

We are committed to making strategic acquisitions that will strengthen

our organic growth. These include Datafactory AG in 2005, which gave us

the WEBfleet technology at the heart of the telematics solutions offered

by TomTom WORK; and Applied Generics Ltd in 2006, which gaveus the

technology to develop our ground-breaking Mobility Solutions services.

In line with this approach, our proposed acquisition of digital map maker

Tele Atlas NV (‘Tele Atlas’) is another important step, because it will help

facilitate our key business objective to improve the quality of both

navigation and the user’snavigation experience. The end result will be

far superior maps from which the entire navigation industry and, more

importantly, consumers themselves will benefit.

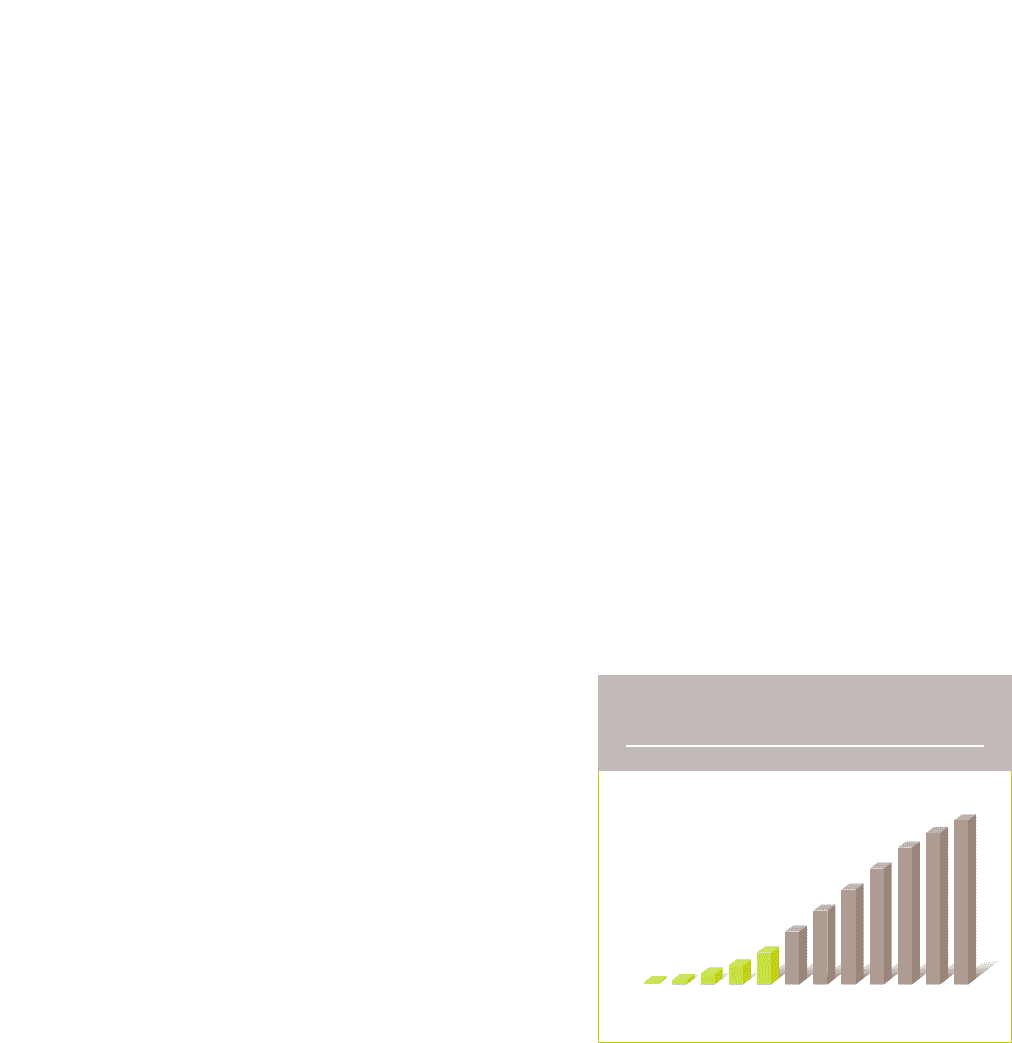

CONTINUED GROWTH

0

40

50

60

70

80

10

20

30

2003 2004 20062005 2007 2008 2009 201120102012 2013 2014

PENETRATION RATE

(EUROPE & US)

(% of cars with some sort of navigation)