TomTom 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOMTOM ANNUAL REPORT 2007

The revenue generated by TomTom WORK came

from a strong increase in the number of Webfleet

subscriptions, which more than doubled to 34,000

at the end of 2007 from 14,000 in 2006.

(in €millions) 2007 2006 Change

Revenue

PNDs 1,623 1,268 28%

PDA/smartphone

solutions 25 31 -19%

Other 89 65 37%

Total 1,737 1,364 27%

VOLUMES

The volume of PND units sold doubled in 2007 to

9.6 million units, up from 4.7 million in 2006. In the

second quarter we introduced the TomTom One XL,

which was our first ‘mid-range’ product. We now

havethree product ranges in our PND family: the

entry-level TomTom One, the midrange One XL and

the high-end GO series.

Number of units sold

(in 000s) 2007 2006 Change

PNDs 9,574 4,687 104%

PDA/smartphone

solutions 601 343 75%

Total 10,175 5,030 102%

AVERAGE SELLING PRICE (ASP)

The ASP of our PNDs is the result of a variety of

factors, including the product mix, regional mix

and market dynamics. For 2007, the ASP was €170,

adecrease of 37% compared to 2006. The main

driver behind this decrease was the reduction of

component prices. This allowed for price decreases

without compromising our gross margin. The

increased importance of the North American

market, where ASPs were lower, also had an

impact on our ASP.

Average selling price (in €)2007 2006 Change

PNDs 170 270 -37%

PDA/smartphone

solutions 42 91 -54%

GEOGRAPHY

In 2007, TomTom generated revenue in EMEA

(Europe and South Africa), North America (US and

Canada) and Asia Pacific (Australia, New Zealand

and Taiwan). While all regions showed a strong

increase in sales, the proportion of sales outside

EMEA rose to 20% in 2007, up from 10% in 2006.

In 2007 we saw first sales in Brazil, Japan

(automotive), Latvia and New Zealand.

Sales generated in North America showed the

biggestincrease, and North America revenue more

than doubled to €271 million in 2007, up from €106

million in 2006. Revenue in North America

represented 16% of TomTom revenue, up from 8%

in the previous year.

In EMEA, revenue increased by 14% to €1.4 billion,

up from €1.2 billion in 2006.

Asia Pacific sales wereup 126% to€70 million

from €31 million in 2006. This increase was mainly

driven by a strong performance in Australia.

GROSSPROFIT

The gross profit increased to €764 million, an

increase of €186 million over 2006.

The gross margin for the year was 44% up from

42% in 2006.

17

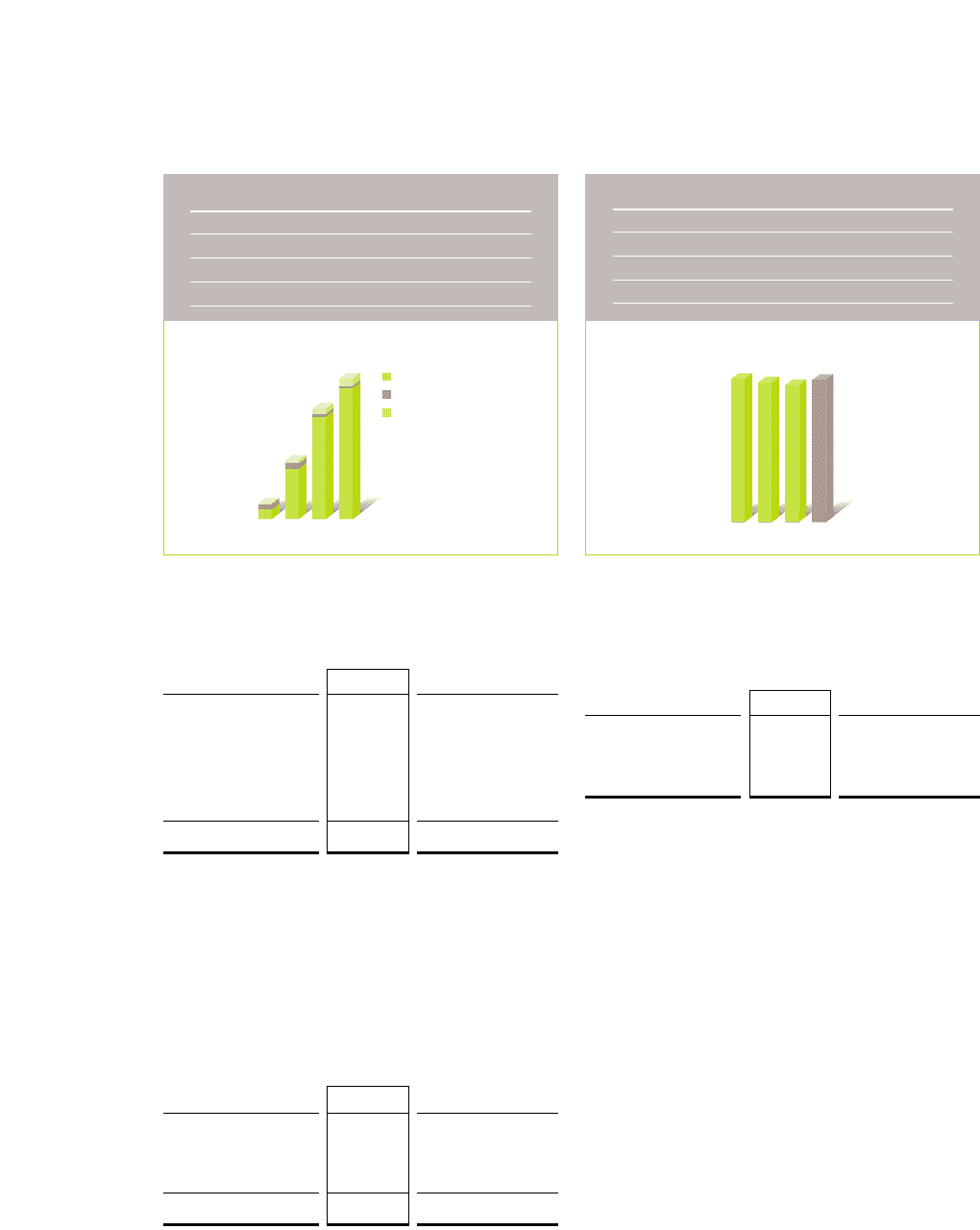

0

500

1,000

1,500

2,000

2004

PNDs

PDA/smartphone solutions

Other

2005 2006 2007

ANNUAL REVENUE (in €millions)

Year to 31 December 2007 1,737

Year to 31 December 2006 1,364

Year to 31 December 2005 720

Year to 31 December 2004 192

2005 2006 20072004

0

10

20

30

40

50

GROSS MARGIN PERCENTAGE

Year to 31 December 2007 44.0%

Year to 31 December 2006 42.4%

Year to 31 December 2005 43.2%

Year to 31 December 2004 44.3%