Tesco 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

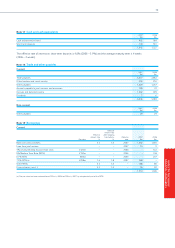

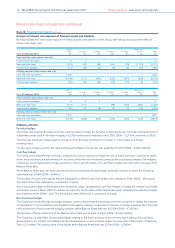

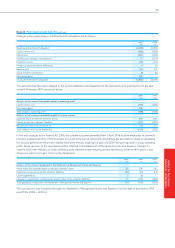

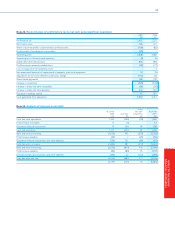

Note 23 Post-employment benefits continued

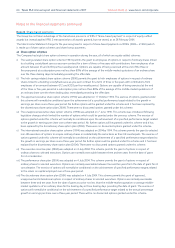

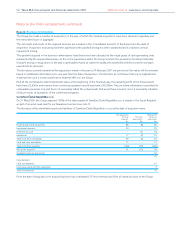

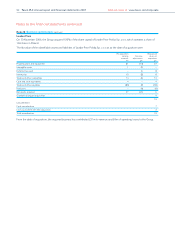

Changes in the present value of defined benefit obligations are as follows:

2007 2006

£m £m

Opening defined benefit obligation (4,659) (3,453)

Current service cost (466) (328)

Interest cost (221) (184)

Gain/(loss) on change of assumptions 71 (727)

Experience losses (41) (24)

Foreign currency translation differences 4 (1)

Benefits paid 104 64

Actual member contributions (7) (6)

Past service gains 258 –

Closing defined benefit obligation (4,957) (4,659)

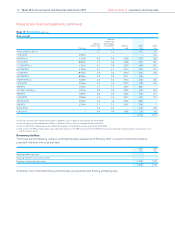

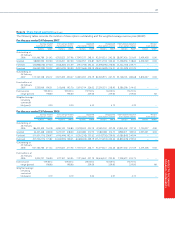

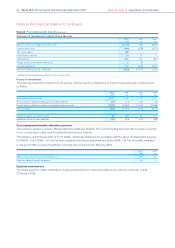

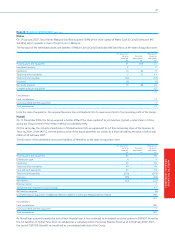

The amounts that have been charged to the Income Statement and Statement of Recognised Income and Expense for the year

ended 24 February 2007 are set out below:

2007 2006

£m £m

Analysis of the amount (charged)/credited to operating profit:

Current service cost (466) (328)

Past service gains 258 –

Total charge to operating profit (208) (328)

Analysis of the amount credited/(charged) to finance income:

Expected return on pension schemes’ assets 255 209

Interest on pension schemes’ liabilities (221) (184)

Net pension finance income (note 5) 34 25

Total charge to the Income Statement (174) (303)

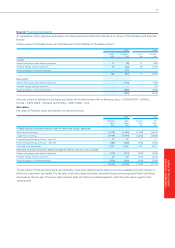

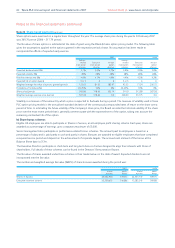

In line with changes to the Finance Act 2006, the scheme rules were amended from 6 April 2006 to allow employees to commute

(convert) a larger proportion of their pension for a cash lump sum at retirement. Accordingly, the assumptions made in calculating

the Group’s defined benefit pension liability have been revised, resulting in a gain of £250m being recognised in Group operating

profit. Future revisions to this assumption will be reflected in the Statement of Recognised Income and Expense. Changes to

scheme rules in the Republic of Ireland affecting early retirement have reduced pension liabilities by a further £8m, which is also

shown as a past service gain in the Income Statement.

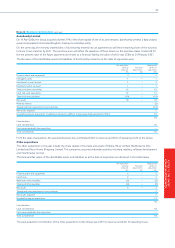

2007 2006 2005

£m £m £m

Analysis of the amount recognised in the Statement of Recognised Income and Expense:

Actual return less expected return on pension schemes’ assets 82 309 66

Experience losses arising on the schemes’ liabilities (41) (24) (14)

Currency gain/(loss) 2 (1) –

Changes in assumptions underlying the present value of the schemes’ liabilities 71 (727) (282)

Total gain/(loss) recognised in the Statement of Recognised Income and Expense 114 (443) (230)

The cumulative losses recognised through the Statement of Recognised Income and Expense since the date of transition to IFRS

are £559m (2006 – £673m).

85

NOTES TO THE GROUP

FINANCIAL STATEMENTS