Tesco 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

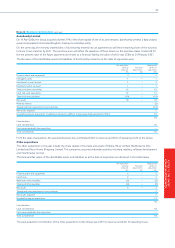

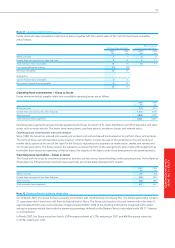

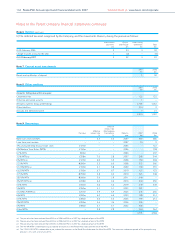

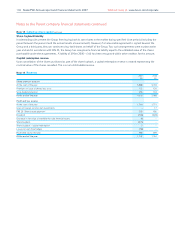

Note 2 Auditor remuneration

2007 2006

£m £m

Fees payable to the Company’s auditor for the audit of the Parent Company and consolidated annual accounts 0.6 0.4

Note 3 Employment costs

2007 2006

£m £m

Wages and salaries 13 10

Social security costs 10 8

Pension costs 12

Share-based payment expense – equity settled 19 15

43 35

The average number of employees (all Directors of the Company) during the year was: 15 (2006 – 15).

The Schedule VI requirements for Directors’ Remuneration are included within the Directors’ Remuneration Report

on pages 27 to 40.

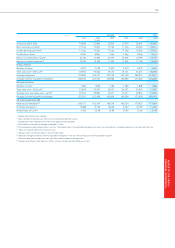

Note 4 Dividends

For details of equity dividends see note 8 in the consolidated Group financial statements.

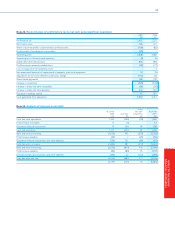

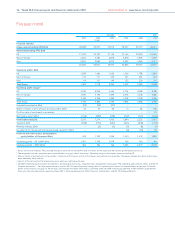

Note 5 Fixed asset investments

Shares in Group Shares in

undertakings joint ventures Total

£m £m £m

As at 25 February 2006 7,220 162 7,382

Additions 1,032 – 1,032

Disposals (41) – (41)

As at 24 February 2007 8,211 162 8,373

For a list of the Company’s principal operating subsidiary undertakings and joint ventures see note 13 in the Group financial

statements.

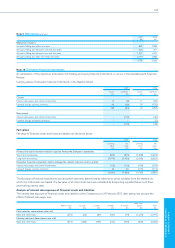

Note 6 Debtors

2007 2006

£m £m

Amounts owed by Group undertakings 5,337 4,710

Amounts owed by joint ventures and associates (a) 135 97

Other debtors 13 20

Deferred tax asset (b) 29 30

To t a l 5,514 4,857

(a) The amounts due from joint ventures and associates of £135m (2006 – £97m) are due after more than one year.

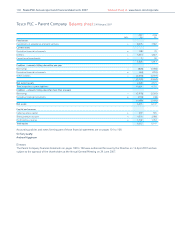

PARENT COMPANY

FINANCIAL STATEMENTS

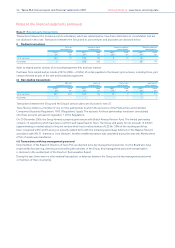

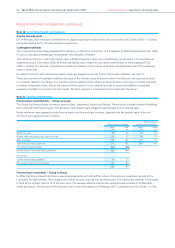

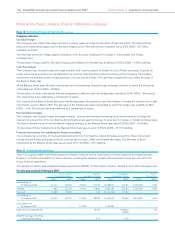

Taxation

Corporation tax payable is provided on the taxable profit for

the year, using tax rates enacted or substantively enacted by the

Balance Sheet date.

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the Balance Sheet

date and would give rise to an obligation to pay more or less

taxation in the future.

Deferred tax assets are recognised to the extent that they are

recoverable. They are regarded as recoverable to the extent that

on the basis of all available evidence, it is regarded as more

likely than not that there will be suitable taxable profits from

which the future reversal of the underlying timing differences

can be deducted.

Deferred tax is measured on a non-discounted basis at the tax

rates that are expected to apply in the periods in which the

timing differences reverse, based on tax rates and laws that

have been substantively enacted by the Balance Sheet date.

Note 1 Accounting policies continued