Tesco 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6Tesco PLC Annual report and financial statements 2007 Find out more at www.tesco.com/corporate

Operating and financial review continued

Increased productivity and good expense controls have

enabled us to absorb significant external cost increases in

the year, arising mainly from higher oil-related costs and

increases in local business taxes. Start-up costs totalling £42m

for Tesco Direct and establishing our operations in the United

States were charged to the UK. Although the combined

start-up losses were a little below our previous guidance of

£50m, we expect these to increase during the current year,

particularly in the US, as we recruit store and depot staff

ahead of our planned launch later this year (see page 12).

Despite absorbing these additional costs, UK trading profit

rose 9.2%, with trading margins at 5.9%, similar to last year.

2006/7 Growth

UK sales (inc. VAT) £35,580m 9.0%

UK trading profit £1,914m 9.2%

Trading margin 5.9% –

Joint Ventures and Associates Our share of profit (net of tax

and interest) for the year was £106m compared to £82m last

year. Tesco Personal Finance (TPF) profit was £130m, of which

our share was £65m, down on last year after absorbing higher

provisions for bad and doubtful debts. Profits from property

joint ventures rose significantly, due to the sale of two stores

(in which we remain tenants) to third parties, realising £47m

of property profits from two of our joint venture companies

during the year.

In September, we sold our 38.5% equity stake in GroceryWorks,

an internet grocery retailing business in the United States (US),

to Safeway Inc., which resulted in a profit of £22m.

Exceptional items Pensions adjustment (Pensions A-Day):

In April 2006, a Finance Act revision was agreed. This change,

known as Pensions A-Day, enabled members of our UK defined

benefit scheme to gain additional pension flexibility, altering

our pension scheme assumptions and resulting in a reduction

of the future liability by £250 million pre-tax. Changes in

pension assumptions for the Republic of Ireland pension

scheme produced a smaller gain of £8m, bringing the total

exceptional gain to £258m, recognised in the Income

Statement. Gerrards Cross: we are facing continuing

uncertainty in respect of our Gerrards Cross site as a result

of the complex legal situation following the tunnel collapse.

No decision has yet been taken about the future for this site.

However, at year end we have written off the carrying value of

our existing asset there (an impairment charge of £35m). We

are not yet in a position to assess any recoveries or liabilities

in respect of ongoing claims.

Finance costs and tax Net finance costs were £126m

(last year £127m), giving interest cover of 21 times (last year

18 times). Total Group tax has been charged at an effective

rate of 29.1% (last year 29.0%).

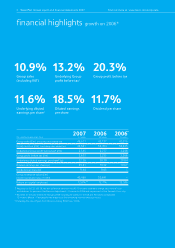

Underlying diluted earnings per share increased by 11.6%

on a comparable basis, to 22.36p (last year – 20.04p).

Dividend The Board has proposed a final dividend of 6.83p

per share (last year 6.10p). This represents an increase of

12.0%. As announced with our Preliminary Results last year,

we have now built dividend cover to comfortable levels and this

increase in dividend is again in line with growth in underlying

diluted earnings per share, which includes net property profits.

We intend to continue to grow future dividends broadly in line

with underlying diluted earnings per share growth.

The final dividend will be paid on 6 July 2007 to shareholders

on the Register of Members as at the close of business on

27 April 2007 (the dividend record date). Shareholders now

have the opportunity to elect to reinvest their cash dividend

and purchase existing Tesco shares in the Company through a

Dividend Reinvestment Plan. This scheme replaced the scrip

dividend at the last Interim Results and was introduced to

reduce dilution of issued shares and improve earnings per share.

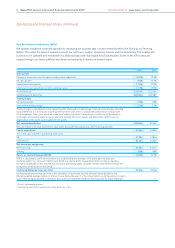

Cash flow and Balance Sheet Group capital expenditure

(excluding acquisitions) rose as planned, to £3.0bn during

the year (last year £2.8bn). UK capital expenditure was £1.9bn

(last year £1.8bn), including £687m on new stores and £295m

on extensions and refits. Total international capital expenditure

rose slightly to £1.1bn (last year £1.0bn); comprising £0.4bn

in Asia and £0.7bn in Europe.

The UK total includes £89m of capital invested in establishing

our operations in the United States. We expect US investment

to move to around the £250m level this year, in line with the

guidance we issued when we announced our entry to the

market last year. We expect Group capital expenditure this

year to be around £3.5bn.

Cash flow from operating activities, including an improvement

of £11m within working capital, totalled £3.5bn. Overall, the

Group had a net cash outflow of £265m during the year,

leaving net borrowings of £5.0bn at the year-end, £0.5bn

higher than last year. Gearing was 48%.

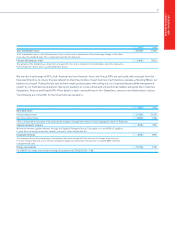

Return on capital employed In April last year, we renewed

our commitment to increasing our post-tax return on capital

employed (ROCE), having exceeded our 2004 aspiration two

years early. We set a new target to improve ROCE by a further

200 basis points. The strong performance of the business

delivered slightly higher ROCE in 2006/07 – at 12.6% (last

year 12.5%), (Including the one-off benefit from Pensions

A-Day, ROCE was 13.6%). This represents good progress

and was achieved despite carrying the extra start-up costs

and investment in the US and Tesco Direct as well as the

integration costs and capital employed in our International

acquisitions and increased stake in Hymall. This means that

ROCE is on track to meet our new target.