Tesco 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

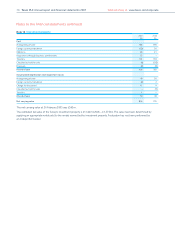

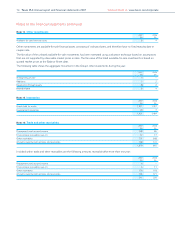

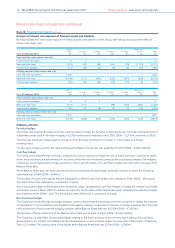

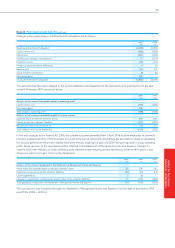

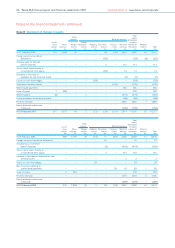

Note 20 Financial instruments continued

The Group has a Chinese Yuan denominated liability relating to the future purchase of the minority shareholding of its subsidiary,

Hymall. This liability has been designated as a net investment hedge of a proportion of the assets of Hymall. The carrying value of

the liability at the Balance Sheet date was £48m (2006 – £nil).

Financial instruments not qualifying for hedge accounting

The Group has a number of financial instruments which do not meet the criteria for hedge accounting.

These instruments include forward foreign exchange contracts, currency options, caps, collars and interest rate swaps. The fair value

of these instruments at the Balance Sheet date was a asset of £11m (2006 – £5m liability).

The Group has a liability relating to the future purchase of the minority shareholding of its subsidiary, dunnhumby Limited. The

carrying value of the liability at the Balance Sheet date was £38m (2006 – £nil).

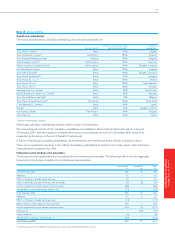

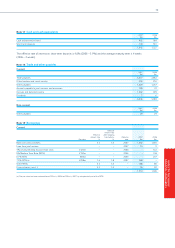

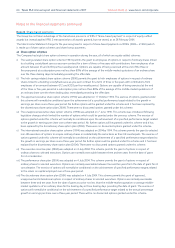

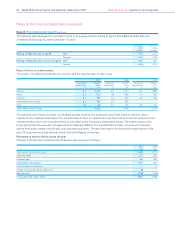

Note 21 Provisions

Property

provisions

£m

At 25 February 2006 7

Additions –

Acquisitions through business combinations 28

Amount credited in the year (6)

At 24 February 2007 29

Property provisions comprise future rents payable net of rents receivable on onerous and vacant property leases, provisions for

terminal dilapidations and provisions for future rents above market value on unprofitable stores. The majority of the provision is

expected to be utilised over the period to 2020.

The balances are analysed as follows:

2007 2006

£m £m

Current 42

Non-current 25 5

29 7

79

NOTES TO THE GROUP

FINANCIAL STATEMENTS