Tesco 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89Tesco plc

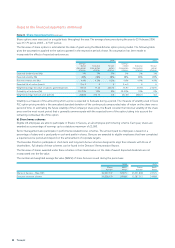

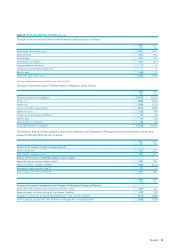

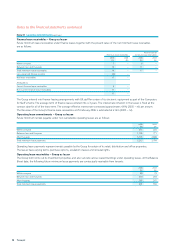

Note 30 Commitments and contingencies

Capital commitments

On 25 February 2006 there were commitments for capital expenditure contracted for, but not provided, of £1,578m

(2005 – £416m), principally relating to the store development programme.

Contingent liabilities

The Company has irrevocably guaranteed the liabilities as defined in section 5(c) of the Republic of Ireland (Amendment Act) 1986,

of various subsidiary undertakings incorporated in the Republic of Ireland.

Tesco Personal Finance, in which the Group owns a 50% joint venture share, has commitments, described in its own financial

statements as at 31 December 2005, of formal standby facilities, credit lines and other commitments to lend, totalling £6.0bn

(2005 – £5.2bn). The amount is intended to provide an indication of the volume of business transacted and not of the underlying

credit or other risks.

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see note 11.

There are a number of contingent liabilities that arise in the normal course of business which if realised are not expected to result

in a material liability to the Group. In connection with the railway tunnel collapse at Gerrards Cross, the Group is currently assessing

anumber of potential claims. Due to the nature of those claims it is not currently possible to assess their potential impact, therefore

no provision has been made. The final outcome is not expected to be material to the Group.

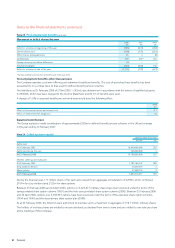

Note 31 Leasing commitments

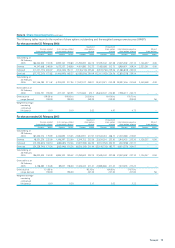

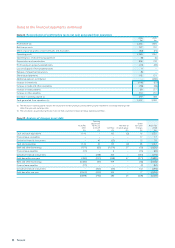

Finance lease commitments – Group as lessee

Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net

minimum leasepayments are as follows:

Present value of

Minimum lease payments minimum lease payments

2006 2005 2006 2005

£m £m £m £m

Within one year 23 12 20 11

Between twoand five years 37 32 27 23

After five years 132 126 57 54

Total minimum lease payments 192 170 104 88

Less future finance charges (88) (82)

Present value of minimum lease payments 104 88

Analysed as:

Current finance lease payables 20 11

Non-current finance lease payables 84 77

104 88

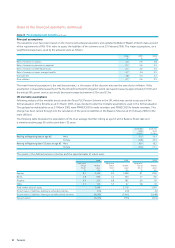

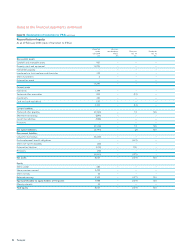

The Group has finance leases for various items of plant, equipment, fixtures and fittings. There are also a small number of buildings

which are held under finance leases. The fair value of the Group’s lease obligations approximate to their carrying value.